IEEFA: Pakistan’s hydropower projects could benefit from timely reassessment due to energy security and financial risks

Poor governance, institutional credit downgrade and extreme weather add strain to project reliability

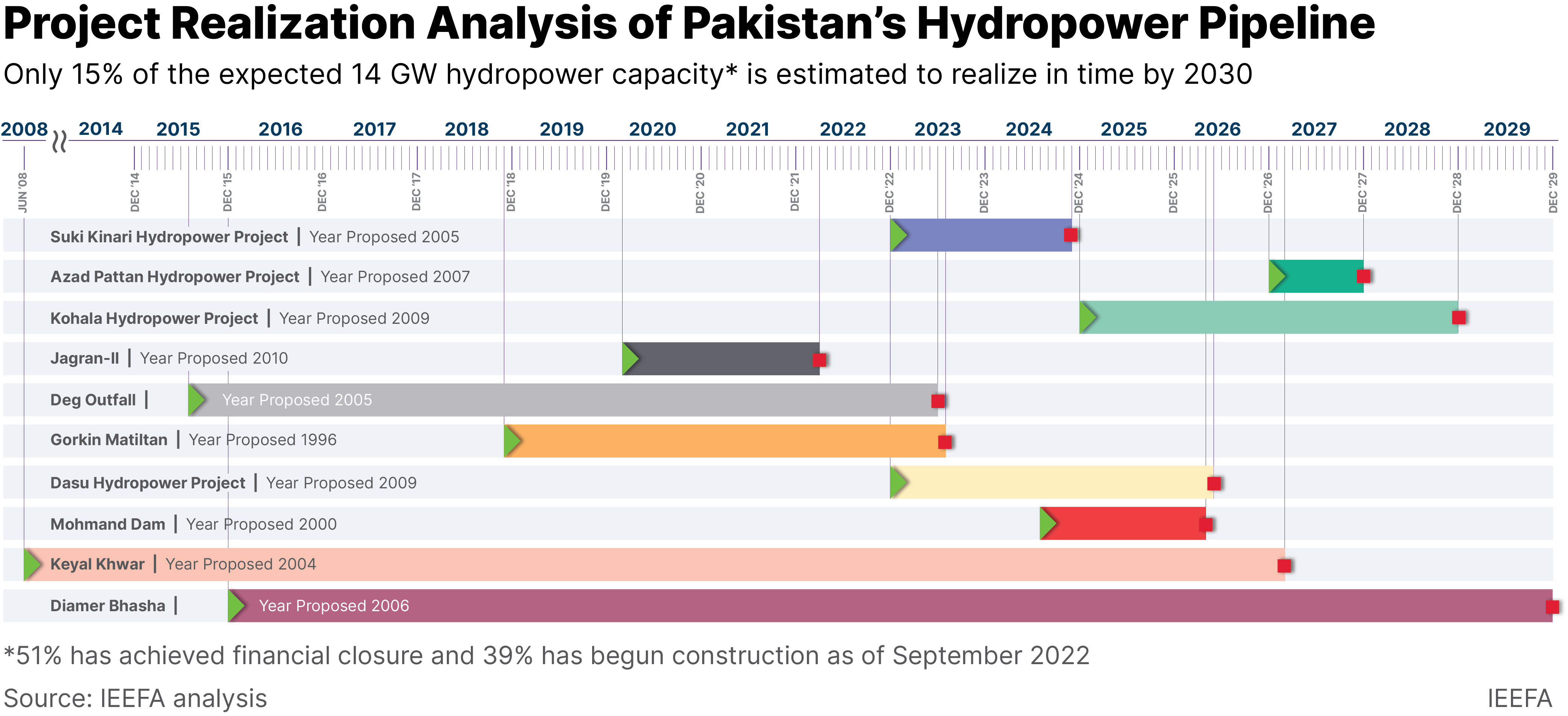

20 September (IEEFA Asia): Hydropower has served almost 30% of the power generated in Pakistan over the years, but the country’s long-term goal to meet 46% of the country’s power generation needs by 2030 could be risky, according to a new report by Haneea Isaad, an Energy Finance Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA).

Hydropower has been favoured in Pakistan’s renewable energy planning as a symbol of nationalist pride and a fundamental resource for water security. However, achieving its targeted production appears increasingly unlikely, due to more frequent extreme weather events, significant cost overruns and schedule delays.

“As of September 2022, only 51% of planned hydropower capacity has achieved financial closure and only 39% has begun physical construction,” says Isaad. “We estimate that only 15% of the hydropower pipeline will come online in time.”

The recent floods in Pakistan have further increased economic stress and shifted the government’s focus toward disaster recovery.

“Capital for large-scale hydropower projects may become even harder to come by, further jeopardizing their realization,” explains Isaad.

Pakistan’s total 14 gigawatts (GW) hydropower pipeline has previously been valued at USD 31.2 billion, but IEEFA’s latest cost estimate goes up to USD 49-61 billion.

5.2 GW (37%) out of the 14 GW will be financed through the support of multilateral development banks (MDBs), which will also require funds to be matched by the government.

“This could mean additional economic burden for the country and allocation through public funds, as well as a supply-demand mismatch for the country’s projected power generation in the future if the planned capacity fails to materialize on schedule,” says Isaad. “What follows could be a switch back to fossil fuels such as furnace oil or coal.”

Climate and geographical challenges

Despite holding a significant share of Pakistan’s power mix, water stored within hydropower reservoirs and dams also serves its agricultural economy.

Hydropower dams are primarily available for power generation during the summer months, replenished during the monsoon season and drained during the winters for crop production. This hampers their ability to provide year-round power production.

In the report, Isaad analysed recent events in China, France and Norway, citing how lack of timely rainfall and drought conditions could limit water availability in large dams for power generation.

Pakistan itself is no stranger to extreme temperatures and drought conditions. The country has an arid climate and an early onset of summers this year and last year has led to record-low water levels in major reservoirs such as Tarbela, Mangla and Chashma. As a result, competing usages such as agriculture took precedence over power generation, and the country suffered power cuts and blackouts.

Moreover, as Pakistan’s hydropower pipeline becomes increasingly vulnerable to climate change, the reliance on data that overestimates rainfall or underestimates the climate risks could put the financial viability of these projects into question.

Cost and schedule overruns

According to IEEFA’s analysis, almost 81% of the planned hydropower capacity will comprise of large hydropower projects with a capacity over 700 megawatts (MW), while nearly the entire proposed hydropower pipeline is located in the northern belt of the country.

While massive dam projects are fundamental to socio-economic development for their water storage capacity and agricultural sustenance, many of Pakistan’s current pipeline have already been riddled with delays amounting to decades.

Isaad explains that the 969 MW Neelum Jhelum hydropower project proposed in 1987 is a classic demonstration of how the non-availability of funds and engineering challenges can contribute to unprecedented cost escalation and schedule delays.

“The project was finally completed in 2018 with a cost of Rs. 507 billion ($4.1 billion), which is 600% higher than its initial estimate, plus a schedule delay of 21 years,” says Isaad.

Another example is the Diamer Bhasha dam, first envisioned in 1980. Upon completion, the 4500 MW project will become the highest roller compacted dam in the world. However, it has a long history of international financing challenges, and the overall project progress currently remains at 7%.

“The slated completion date by 2029 remains highly unlikely, given that funding is currently available only for the dam site, while a major portion of the land acquisition is yet to take place,” says Isaad.

Cost and schedule overruns are normal for large dams due to poor technical and cost estimates, unexpected geotechnical conditions, underperformance by contractors and supervisors, and economic and regulatory changes.

“Despite government support, inadequate financing could lead to a huge economic burden on the national exchequer, higher costs of debt financing and non-provision of project benefits,” says Isaad.

Credit downgrade

The recent downgrade by three credit rating agencies (Moody’s, Fitch and S&P) of Pakistan and its Water and Power Development Authority (WAPDA) could further dampen the ability to raise capital and delay project implementation cycles.

For example, in the case of the Diamer Bhasha Dam, WAPDA had plans to raise additional funds through green bond issuances. However, this may not be practical, given that the firm’s negative credit rating will force it to pay a higher interest rate on the bond principal, further raising project costs.

Pakistan’s dollar-denominated bonds currently show a mixed performance already. IEEFA predicts that the investor demand for Pakistani bonds will likely stay weak, given that WAPDA’s credit downgrade to negative could defer bond subscription and future financing.

“If the country is unable to raise sufficient debt in time, the 6.6 GW of hydropower capacity that is yet to achieve financial closure could lead to even more project and cost overruns,” says Isaad.

In instances where the government is supposed to match MDB funding, this could even lead to the MDB’s withdrawal from the project. The 1450 MW Ghazi Barotha Hydropower project was stalled in 1997 due to the government’s inability to match funding by the donor agencies. Many of the planned infrastructure for the hydropower project could not materialize.

Timely reassessment

IEEFA recommends that a clear criterion is set for projects within the pipeline that should be allowed to go forward in times of such economic distress. High costs would likely result in a financial burden for the government and end-consumers.

Projects that are yet to achieve their financial closure or begin construction should be put on hold. At the same time the existing hydropower capacity should be complemented with a portfolio of smaller, quicker to build and easy to finance solutions.

In her report, Isaad identifies solutions including diverting funds towards grid infrastructure upgrade, such as smart grids and a higher evacuation capacity for renewables.

Scaling up solar power, such as floating solar on existing hydropower reservoirs and canals, could also suit countries like Pakistan with high population densities and competitive usage of available land. In addition, incentivizing private capital for rooftop solar solutions could also be a great opportunity to scale up renewables, and if appropriate, more workable financing models can be made available to the public.

“Pakistan’s focus instead should be to build agile and modular sources of power generation, such as solar and wind power, or even small hydro for their ability to provide distributed generation and add flexibility to the grid,” says Isaad.

“Their shorter construction timelines and lower costs, as well as battery storage or pumped hydro storage, may be a better use of funds than financing mega-dams prone to cost overruns and implementation risks.”

Read the report: To Build or Not to Build: Keeping Pakistan’s Hydropower Reliance in Check

Report contact: Haneea Isaad ([email protected])

Media contact:

Alex Yu ([email protected]) Ph: +852 9614 1051