Canada’s major banks continue funding oil and gas companies despite growing concerns over decommissioning liabilities

Unregulated Liabilities and Opaque Financial Reporting Last Seen in Mortgage-backed Securities During the 2008 Financial Crisis

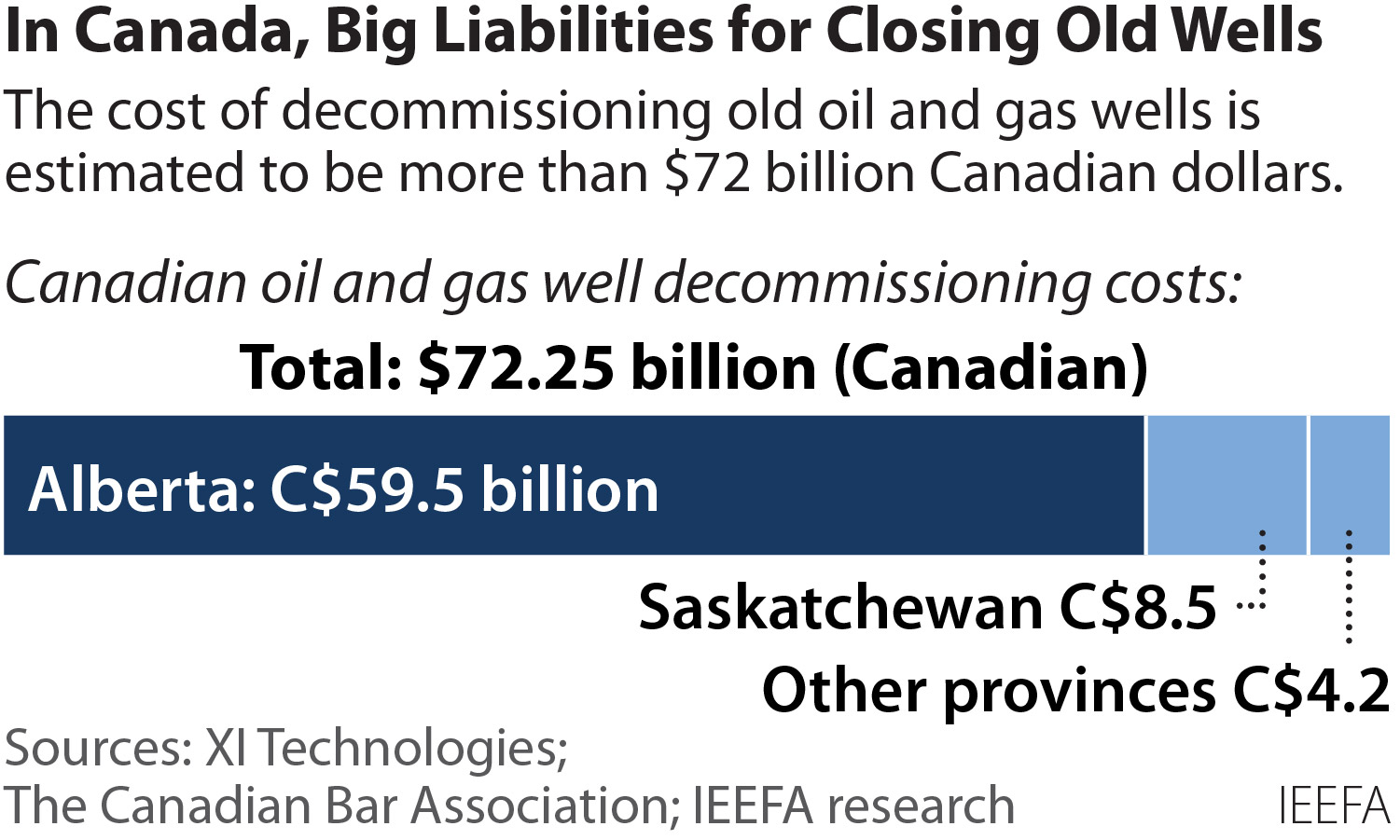

May 25, 2022 (IEEFA)—Oil and gas companies across western Canada are unable to meet their share of the total $72 billion in future decommissioning obligations even if oil prices stay above $85 per barrel, according to a new analysis by the Institute for Energy Economics and Financial Analysis.

The $72 billion in future decommissioning liabilities includes wells, pipelines, and facilities in Alberta, Saskatchewan, British Columbia and Manitoba. Without a plan or more financial capacity, the research shows banks may face additional write-downs and the Canadian taxpayers will likely foot the bill.

The IEEFA analysis shows:

- Five of the 10 companies that could be on the hook for $3.5 billion indicate decommissioning liabilities will increase by more than 30% from current financial reporting over the next two decades, even in an $85 oil price environment.

- With limited equity issuance and dwindling cash flow due to natural production declines, bank credit facilities may be the main source of funding for Asset Retirement Obligations (AROs) for at least 20 years.

- Consistency around companies’ financial reporting of decommissioning liabilities is not standardized.

- Companies are at high risk of defaulting on future ARO obligations—even if they operate in a long-term $80- to $90-per-barrel West Texas Intermediate (WTI) oil price environment.

- Future revolving credit facilities will likely face major impairments.

- It is not clear if companies are inadequately reporting AROs to the Alberta Energy Regulator because of poor accounting or by delaying disclosure of the status of retired or retiring assets.

The IEEFA analysis looked at 10 publicly traded oil and gas producers in Canada. The combined decommissioning liabilities from the 10 companies total $3.5 billion—a snapshot of a much larger problem.

“This is a warning for creditors to reign in credit provided to risky oil and gas companies, and to encourage better risk management of abandoning and reclaiming old wells, pipelines and facilities,” said Omar Mawji, an IEEFA energy finance analyst and author of the report. “Ultimately, the taxpayer will remain the bailout system for mismanaged decommissioning obligations.”

The full extent of the decommissioning liabilities issue is not fully known, given the lack of transparency and reporting of AROs by oil and gas companies. In Alberta, more than 70 percent of the 459,000 wells require costly closure work.

AROs became a major issue after the Redwater case ruling by the Supreme Court of Canada that gave priority to decommissioning liabilities over the most senior secured creditor to oil and gas companies. The ruling added additional risk to the creditors of oil and gas exploration and production companies.

Full Report: Canada’s Oil and Gas Decommissioning Liability Problem

Author Contact:

Omar Mawji ([email protected]), IEEFA energy data analyst.

Media Contact:

Susan Torres ([email protected]), +1 (908) 565-3451

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.