IEEFA: Australia’s climate policies could push New South Wales into a debt spiral

20 October 2021 (IEEFA Australia): Australia’s failure to commit to net zero targets or any credible climate policy is a growing economic threat to New South Wales and other states, argues a new report by the Institute of Energy Economics and Financial Analysis (IEEFA).

Australia must begin planning for the investment needed in the transition to zero carbon

The Reserve Bank of Australia’s deputy governor Guy Debelle last week urged Australia to begin planning for the investment needed in the transition to zero carbon with Deloitte Access Economics determining the economic losses of doing nothing to mitigate the impacts of climate change would shrink Australia’s GDP by 6%, a $3.4 trillion loss in GDP in present value terms.

IEEFA’s report finds that Australia’s climate policies will have an extremely detrimental impact on the NSW economy.

Report author and analyst Trista Rose says increased spending resulting from climate mitigation and damage from extreme weather events will push out debt levels. Couple that with declining coal royalties and continued reliance on high emitting fuels, the state’s net debt is estimated to reach 100% by 2060.

“The combined effect of drought, bushfires, floods and the first round of COVID-19 lockdowns have taken debt in NSW to unprecedented levels,” says Rose.

Debt in NSW is at unprecedented levels

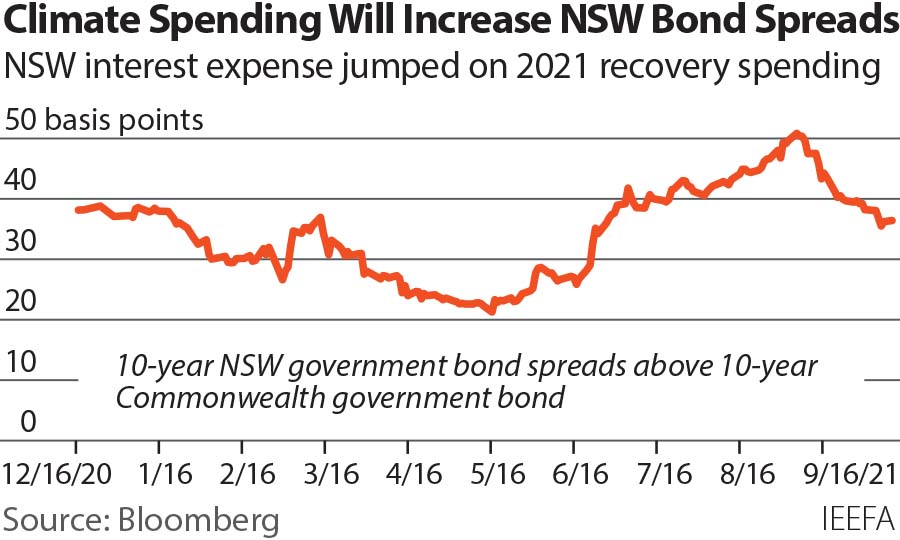

“The bond market has reacted strongly, pushing out the cost NSW pays for its borrowing by 30 basis points representing $300 million per annum.

“Increased expenditure from climate mitigation will push out bond spreads, with the bond market’s reaction to NSW’s recent recovery spending evidence we will see more of the same.

“NSW could wind up in a vicious cycle of spending and debt related to environmental costs and interest expenditure, rather than a virtuous cycle of spending which results in broader economic gain which benefits the residents of NSW.”

IEEFA’s report also notes that Australia’s climate stance will inhibit access to cheap capital, drive the cost of capital higher, and could eventually send NSW (and other sub sovereigns) into a debt spiral.

Australia’s climate stance will inhibit access to cheap capital

NSW has relied heavily on offshore investors for funding requirements and, as foreign investors increasingly shun assets with high carbon exposure as the world commits to net zero, access to foreign capital is likely to become increasingly challenging.

“Australian sovereign and sub-sovereign bonds will not meet the international community’s low carbon goals,” says Rose. “Global investors will look to proactively divest bonds in high emitting markets, particularly in relatively insignificant global markets such as NSW.”

Sovereign rating agencies have also signalled their impatience for regions and states not calculating in climate risk and the cost of transition.

“Considering the huge sums that credit ratings agencies have recently invested to ramp up their ESG offerings and the increased global focus on climate disclosures, climate risk will have a more considerable role in determining sovereign ratings in the future,” says Rose.

Sovereign downgrades are coming and inevitable

“The ratings agencies have issued strong warnings that sovereign downgrades are coming and inevitable.

“Decarbonising portfolios inevitably means shifting money away from assets with a high climate risk profile, materially impacting in this case the economic and fiscal outlook for NSW, and Australia in general.

“The Federal government’s failure to commit to net zero targets or any credible climate policy is a growing economic threat, federally and to the States.”

Report’s key findings:

- NSW Treasury expects the economic cost of natural disasters to NSW to treble to $15-$17 billion per year by 2061.

- Deloitte Access Economics estimates that the economic losses of Australia doing nothing to mitigate climate will shrink Australia’s GDP by 6%.

- The combined loss of coal revenue and population growth will tip net debt to 100% by 2060.

- If climate mitigation efforts are not introduced until 2030, debt-to-GDP will increase to 156% by 2040, and Australia will default.

- Australia will see at least a 4-notch credit ratings downgrade by 2100 if it continues to ignore climate warnings; NSW ratings will be concurrently lowered.

- The bond market has reacted strongly to the NSW government’s recent economic recovery spending, with interest costs rising 30bps since June 2021. Increased debt resulting from the rising costs of environmental damage and climate mitigation will come at a greater cost to taxpayers in the form of interest expense.

“Aside from these tangible costs, international investors’ perceptions of Australia and climate matter, and will inevitably have a material flow-on effect on the demand and liquidity of NSW Government bonds,” says Rose.

Read the report: Climate Risk and the Cost of Capital in NSW – Australia’s Climate Policies Will Materially Impact NSW’s Long Term Economic Outlook

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Trista Rose ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)