IEEFA: Virtual power plants are the future of electricity retailing

Key Takeaways:

In the future, ‘virtual power plants’ that harvest distributed renewable electricity and demand response will play a major role.

There is the potential for behind-the-meter resources to provide significant supply and demand response to meet the needs not just of households and businesses, but for the broader electricity system.

Virtual Power Plants are the future of energy retailing. Providers (aggregators and retailers) aiming for future profits will increasingly see the value in investing in VPP software and systems.

21 March 2022 (IEEFA): As Australia surpasses three million rooftop solar installations, households looking to buy a battery storage system or electric vehicle can be part of a new kind of power plant bringing about faster, cheaper decarbonisation. In the future, so-called ‘virtual power plants’ that harvest distributed renewable electricity and demand response will play a major role, says a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

A virtual power plant (VPP) is a network of distributed energy resources – not just rooftop solar, but also batteries, electric vehicles and smart appliances – working as a single power source and aggregated via software to participate in energy markets.

In general, says report author Dr Gabrielle Kuiper, the greatest value in rooftop solar and battery storage is in providing behind-the-meter (BTM) on-site electricity supply, co-locating generation and load, while avoiding network and retail costs.

“As the capacity of rooftop solar systems and batteries increases and the cost decreases – and if electricity demand can be harnessed through smart controllers – there is the potential for behind-the-meter resources to provide significant supply and demand response to meet the needs not just of households and businesses, but for the broader electricity system,” says Kuiper.

The potential of VPPs is yet to be realised

Three years ago, the Australian Energy Market Operator (AEMO) predicted there could be 700 megawatts (MW) of VPPs by 2022 – on IEEFA’s estimate, the figure is nearer 300MW for households in the National Energy Market.

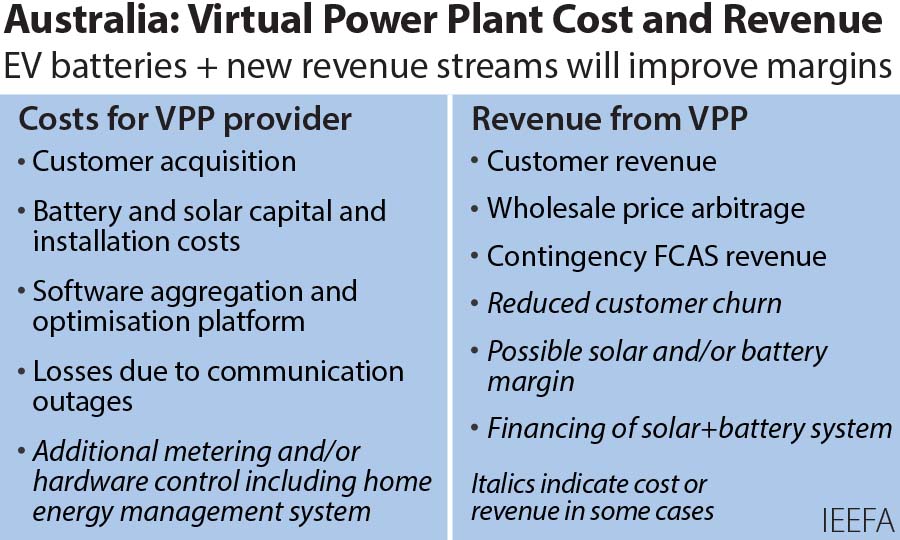

“The potential of VPPs is yet to be realised,” says Kuiper. “There is a lack of significant revenue for distributed energy resource owners or VPP providers.

“Households are currently only being paid around $200/year for the use of their battery by aggregators to participate in energy and ancillary services markets. The margins are thin.”

However, Kuiper maintains, VPPs are the future of energy retailing. VPP providers (aggregators and retailers) aiming for future profits will increasingly see the value in investing in VPP software and systems.

In March 2022, Origin Energy announced plans to expand its in-house VPP ten-fold from 205MW to 2,000MW within four years, aiming to fulfill customers’ expectations for lower costs, decarbonisation and energy autonomy, with less churn an advantage for Origin.

“Origin clearly understands the value of distributed energy resources,” says Kuiper. “To secure their future, retailers should offer the combination of rooftop solar, batteries, managed EV charging while being a VPP-tailer for both residential and commercial customers.”

VPPs have relatively low set-up costs

Kuiper says VPPs have relatively low set-up costs in comparison with large generators and transmission and they are fast to establish.

“Origin realises that they can leverage billions of dollars of household and business investment in smart energy to quickly provide clean capacity to the national electricity market. Another twenty retail and aggregation businesses are looking to scale to do the same.”

Whereas previously the largest retailers owned large generators, with profitability tied to “gentailing”, IEEFA sees the future of retail being in “VPP-tailing”.

“Inevitably at least two-thirds of Australian households will purchase rooftop solar and either a stationary battery or an EV or two, or both. That will mean that most of the supply to these households will be behind-the-meter and they will have spare capacity available to sell directly and via a battery to the rest of the grid,” says Kuiper.

“Unless a retailer has a relationship with households that enables access to these behind-the-meter resources, they will be left with only a small proportion of households to retail to, as well as no access to these valuable distributed energy resources.

“VPPs have the potential to benefit both utilities and consumers.

“Unfortunately, Australia’s energy market institutions are not treating distributed energy resources or VPPs with the same seriousness as companies like Origin are doing.

“Consumers and the industry need national policy and regulation which prioritises equitable treatment for distributed energy resources with large-scale generation and storage.”

Read the report: What Is the State of Virtual Power Plants in Australia? From Thin Margins to a Future of VPP-tailers

Media Contact: Kate Finlayson ([email protected]) +61 418 254 237

Author Contact: Gabrielle Kuiper ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)