Green steel taxonomy key to kickstart decarbonisation of India’s steel sector

With the decarbonisation of the steel industry in a nascent stage, the government needs to create the right policies to meet the net-zero by 2070 target

Key Takeaways:

A legal definition for green steel can help guide the industry in making the right investments for decarbonisation.

The government needs to take policy measures to create demand for green steel, which is nearly twice the cost of traditionally produced steel. A penalty on carbon emissions will also help bridge the cost gap.

Mandating the use of green steel in public infrastructure and green steel certificates, tradable in the national carbon market, to offer the private sector a new revenue stream can help stimulate demand for green steel.

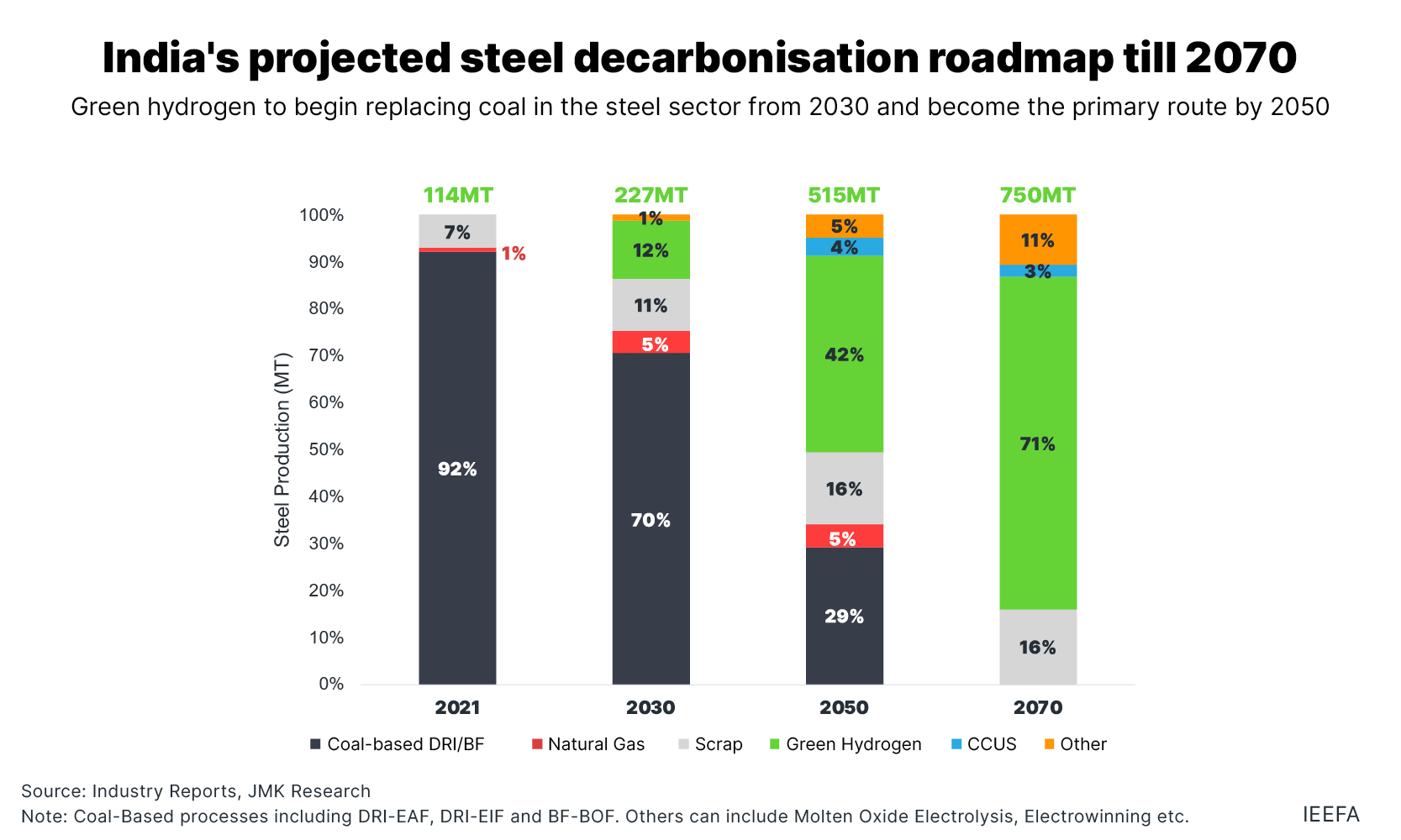

Given all the challenges, we expect green hydrogen to dethrone coal as the primary route for steelmaking in the latter part of the 2030 to 2050 period.

A clear definition of green steel is crucial for steelmakers to start investing in the right technologies, a new joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics finds.

The report also provides various policy recommendations for the government to lay a strong foundation for decarbonising India’s steel sector.

“Decarbonising steel production in India requires a vision by policymakers whereby they can encourage the production of green steel,” says the report’s co-author, Vibhuti Garg, Director, South Asia, IEEFA.

“The first step is a definition for green steel, without which the technology track that the industry should follow remains unclear. India needs to clarify that green steel will mean eliminating the use of fossil fuels in the production process,” she adds.

Given that green steel production technologies are yet to go mainstream anywhere in the world, the report finds that green steel costs nearly twice that of traditionally produced steel.

“Since steel is a highly competitive commodity, the market is unlikely to absorb the premium of green steel without a strong impact on its dynamics. Therefore, the government needs to formulate policies that create demand for green steel and penalise carbon emissions from traditionally produced steel,” says co-author Jyoti Gulia, Founder, JMK Research.

“Initially, in all government and public sector purchases, a certain quantity of green steel should be mandatory. Going forward, the government can also extend the percentage of green steel procurement to private consumers,” says co-author Kapil Gupta, Manager, JMK Research.

“Green Steel Certificates can be another way to create demand. The government can link green steel purchases with incentives through green steel certificates, which are tradable in the national carbon market for financial gain. This action will support the creation of a green steel market for domestic steelmakers,” says Gupta.

The report also recommends viability gap funding (VGF) to help bridge the gap due to the high initial capital cost of low-carbon steelmaking technology. It notes that the government can provide this VGF to urge steelmakers to commit part of their capacity to green steel manufacturing.

Analysing the various technology solutions currently available to cut emissions from steelmaking, the report finds that green hydrogen is the cleanest option. Producing steel using scrap in renewables-powered electric arc furnaces (EAFs) is another option. Still, it cannot fully substitute other forms of production as there are challenges of high-quality scrap availability.

The report finds the key challenge with green hydrogen is its high cost. To address this, the government has launched an ambitious National Green Hydrogen Mission to encourage the domestic production of the fuel.

“To make hydrogen technology viable for expansion, the required price should be around US$1-2/kg and a carbon penalty of at least US$50 per tonne of emissions should be applicable on steel manufactured through traditional methods. This can make green steel competitive and catalyse a 150 million tonne shift from coal-based to hydrogen-based steelmaking, mainly the direct reduced iron (DRI)-EAF route,” says Gupta.

The report forecasts that green hydrogen will dethrone coal as the primary steelmaking route by 2050, with its use increasing from 2030.

“Between 2030 and 2050, green hydrogen projects will be deployed on a large scale across India due to high demand. This is likely to phase out coal-based routes of steelmaking at a faster pace. We estimate that the steel industry will replace around 25-30% of its grey hydrogen requirements with green hydrogen in the early part of 2030-2050. This will increase to 80% by 2050,” says co-author Nagoor Shaik, Senior Research Associate at JMK Research.

“Global sustainable finance markets hold much promise to provide capital at scale for decarbonising large corporates. Sustainability-linked bonds and loans have been regarded as apt for financing industrial decarbonisation globally,” says co-author Shantanu Srivastava, Sustainable Finance and Climate Risk Lead, IEEFA.

“Innovative financing products, such as blended finance mechanisms, will play an important role in the initial growth of low-carbon solutions for the steel sector in the country. Support in the form of technical assistance grants, guarantees and risk insurance, and concessional capital will be needed at different stages of the technological lifecycle,” he adds.

Read the report: Steel Decarbonisation in India

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contacts: Vibhuti Garg ([email protected]); Jyoti Gulia ([email protected]); Kapil Gupta ([email protected]); Nagoor Shaik ([email protected]) and Shantanu Srivastava ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. (www.jmkresearch.com)