Future role of gas in the NEM is likely overstated

Integrated System Plan points to a declining role for gas power generation, as investment risks loom

Key Takeaways:

Despite featuring prominently in the narrative surrounding AEMO’s 2024 Integrated System Plan, gas is forecast to play a reduced role in power generation for the National Electricity Market, and there are risks and uncertainties surrounding increased investment in gas.

The need for gas power generation is expected to be below historic levels, and very small compared with the expansion of renewable generation and storage. As the role of gas narrows to focus on ‘peaking’ services, generators are expected to operate only 7% of the time on average.

Gas is an expensive form of generation, and low utilisation rates will likely require gas generators to increase their prices even further. Meanwhile, batteries are seeing rapid cost reductions and are outcompeting gas in many jurisdictions.

AEMO’s forecasts are based on rapidly evolving assumptions, and carry inherent uncertainties, including the future frequency of ‘low VRE’ [variable renewable energy] events. This could further erode the profitability of gas generators.

3 October 2024 (IEEFA AUSTRALIA) | An independent think tank has observed that gas is unlikely to play a major role in Australia’s future energy system, contrary to narratives that are emerging from market bodies and industry groups.

In the narrative surrounding its 2024 Integrated System Plan (ISP), the Australian Energy Market Operator (AEMO) devotes significantly more attention to the role of gas in power generation than it has in previous releases.

The ISP is a key planning document for the future of Australia’s National Electricity Market (NEM). It identifies renewable energy as the least-cost form of new generation, while forecasting that ‘firming’ technologies will be necessary at times when wind and solar power output is low.

Gas power generation is one of several technologies that can fulfill this ’firming’ role. However, the disproportionate focus on gas power generation has led some stakeholders to interpret the 2024 ISP as signalling an urgent need to invest in new supplies of gas and supporting infrastructure.

A new briefing note from the Institute for Energy Economics and Financial Analysis (IEEFA) has examined the analysis underlying the ISP, finding that this interpretation is not supported.

Gas power generation forecasts in AEMO’s 2024 ISP

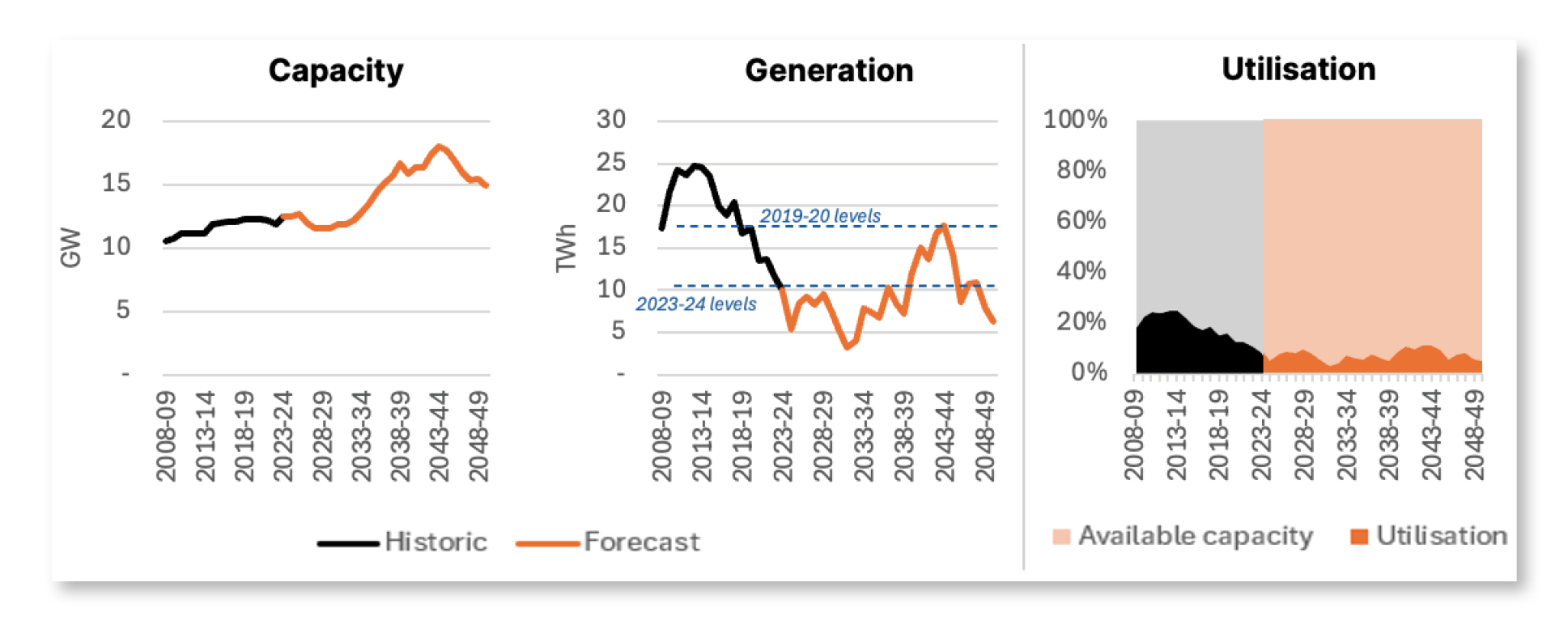

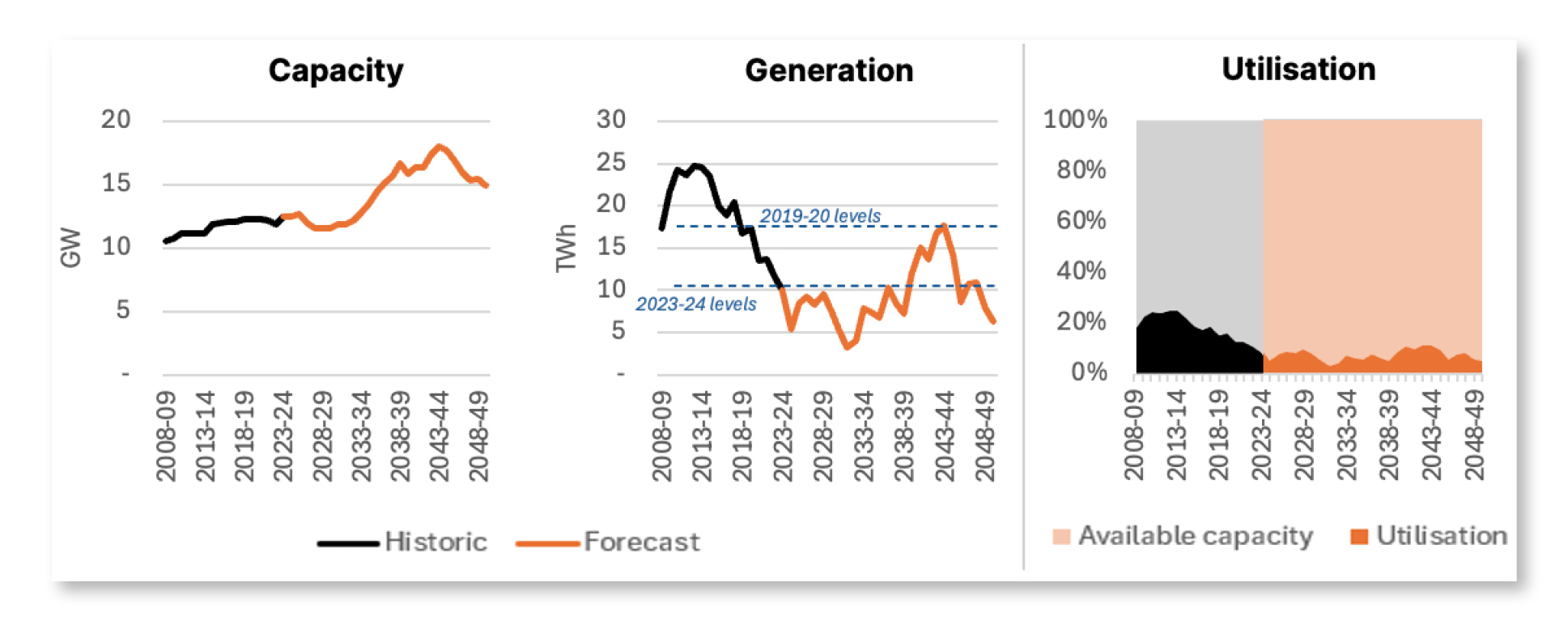

“Gas power generation in Australia has been in steady decline, and is at record low levels. AEMO’s forecasts do not see gas generation increase above these levels until at least the mid-2030s, and do not see gas generation ever return to pre-pandemic levels,” says Jay Gordon, Energy Finance Analyst – Australian Electricity.

“In reality, the amount of gas generation in AEMO’s forecasts is small compared to recent historic levels, and tiny compared to the increase in renewable generation and storage expected. It is far from being a clear signal for greater investments in gas,” Gordon adds.

Furthermore, the briefing note identifies a considerable range of risks and uncertainties surrounding AEMO’s forecasts. As the niche for gas power generation steadily narrows to focus on ‘peaking’ services, its utilisation is expected to fall and become increasingly weather-dependent. A key driver of utilisation of gas generation is the frequency and severity of periods with low wind and solar output. However, AEMO has acknowledged that these events are highly uncertain and difficult to forecast.

Gordon adds: “AEMO’s gas generation forecasts have varied considerably between different versions of the ISP, and are sensitive to input assumptions that are rapidly evolving. Perhaps most notably, the ongoing decline in costs for competing storage technologies, such as batteries, is already impacting the market share of gas in some jurisdictions. This is likely to impact the profitability of gas generators, which are already set to become fragile as they increasingly find themselves operating at low utilisation rates.”

The briefing note also identifies broader risks around over-investment in new gas supplies in the east coast market, if overall demand were to fall faster than AEMO’s forecasts. On winter days infrastructure limits may occasionally constrain the amount of gas available to gas generators in southern regions, but AEMO’s analysis shows that the use of back-up liquid fuel – or in the longer term, alternatives such as biofuels – is likely to be a more economical option than expanding pipeline capacity.

Gordon says: “Investors will need to look beyond the narrative of gas in AEMO’s ISP, and be mindful that AEMO’s forecasts in fact point to a declining role for gas generation. Investment opportunities in gas power generation may not be as significant as some industry groups have suggested, and carry significant new risks for investors to manage.”

Read the report: How much gas does the future grid need? Analysing AEMO’s Integrated System Plan

Media contact: Amy Leiper [email protected] +61 (0) 414 643 446

Author contacts: Jay Gordon [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)