Boosting Pakistan’s renewable investments through auctions would require an enhanced benchmark tariff and financial guarantees

Government commitments towards optimizing risk sharing could help restore investor confidence

June 16 (IEEFA Asia): Innovating Pakistan’s power purchase agreements (PPA) for renewable projects, and offering price stability to de-risk the market, are crucial to restore investor confidence. This is according to a new report by Haneea Isaad, an Energy Finance Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA).

Isaad’s new report analysed the efficacy of incentives available to the country’s solar and wind projects in recent years and outlined recommendations to address market inefficiencies and project risks before moving onto auctions.

“The debate on the right incentives depends on the local market context,” says Isaad. “The United Kingdom and Vietnam are great examples of countries where a Feed-in Tariff (FIT) has worked out well for renewable energy to take off. On the other hand, countries like South Africa and India have had remarkable success with reverse auctions.”

“For Pakistan to emulate the success of these countries, risk mitigation will be necessary before any such scheme is introduced.”

In October 2022, the Government of Pakistan launched ‘Fast Track Solar PV Initiatives 2022’, a program designed to replace fossil-fuel based power capacity with approximately 10,000 Megawatt (MW) of solar power in a first attempt to introduce reverse auctions to the renewable energy market in the country.

However, under the scheme, no bids have yet to be received despite multiple deadline extensions for the flagship 600 MW solar power project at Muzaffargarh. This suggests a lack of interest from project developers, due to a high-risk environment and a low benchmark tariff.

“Policy uncertainty, created by an abrupt removal of the upfront tariff scheme and the delay in initiating auctions, has led to a loss of investor confidence in the stability of renewable energy markets in Pakistan,” says Isaad.

As the government moves towards competitive bidding for upcoming solar and wind power projects, an honest assessment and addressal of the country’s risk premium will be required to encapsulate the high-policy lending environment and financial instability the country is experiencing right now.

Optimizing tariff regimes

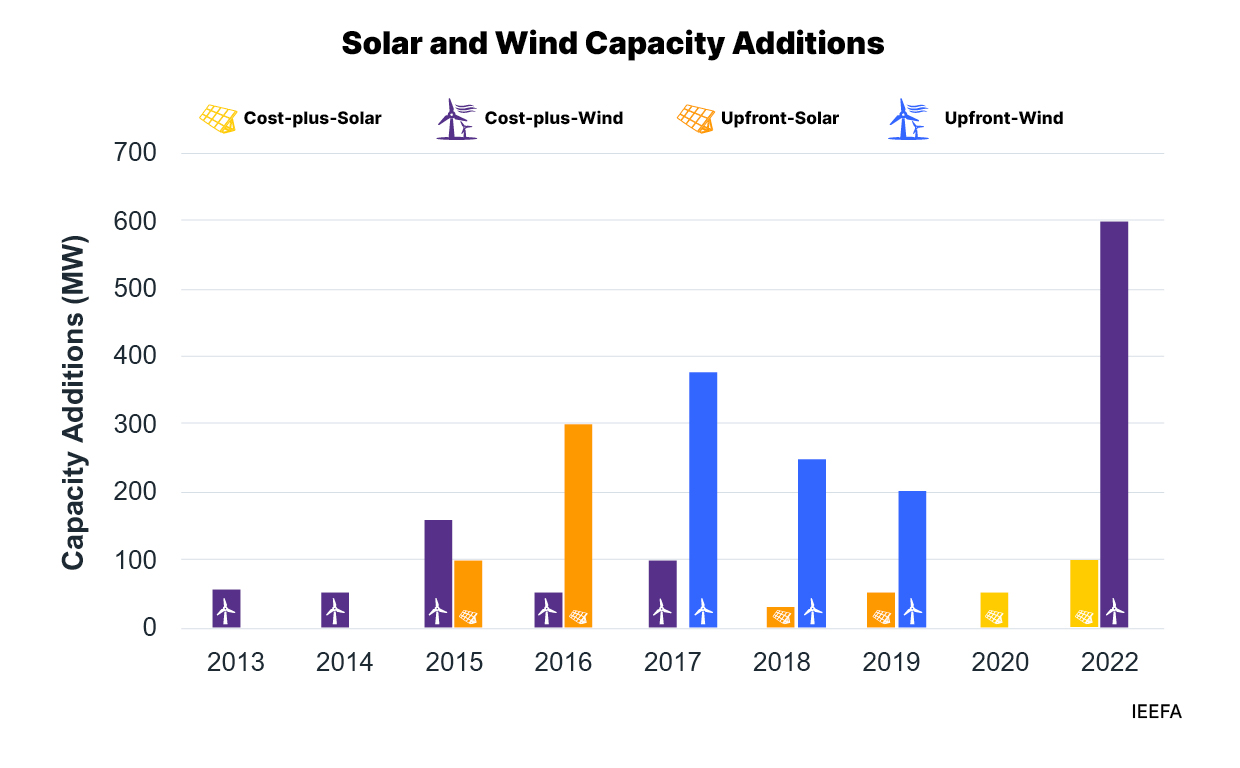

Solar and wind power in Pakistan has traditionally been added through two tariff regimes. A FIT guarantees a fixed price signal over the lifetime of the project or the stipulated duration of the power purchase contract (25 years in Pakistan’s case).

“Pakistan’s solar power projects have generally followed the upfront tariff introduced in 2014. The tariff was lowered over the years until discontinuation of the scheme in 2016, as the National Electric Power Regulatory Authority (NEPRA) mandated that renewable energy addition shifts to competitive bidding,” says Isaad.

In parallel, a cost-plus tariff regime has allowed developers to recoup their original project costs, plus a mutually negotiated rate of return between the developer and the off-taker.

“Most of the present wind power capacity in the country has been installed under a cost-plus tariff regime. Since 2016, however, the government has also decided not to extend the cost-plus scheme as it moves towards competition instead,” says Isaad.

The abrupt shift towards auctions left a policy vacuum in renewable energy markets, severely dampening investor confidence and stagnating the development of almost 7 GW of solar and wind energy.

Although the government did categorize these projects as a transitionary mechanism, it happened after a delay of nearly three years (projects at an advanced stage of development could still proceed under a cost-plus tariff).

While some of these pending projects recently became operational, others still await their fate through auctions that are expected to be carried out in a couple of months.

IEEFA’s report aims to assess what a realistic tariff could look like for such projects.

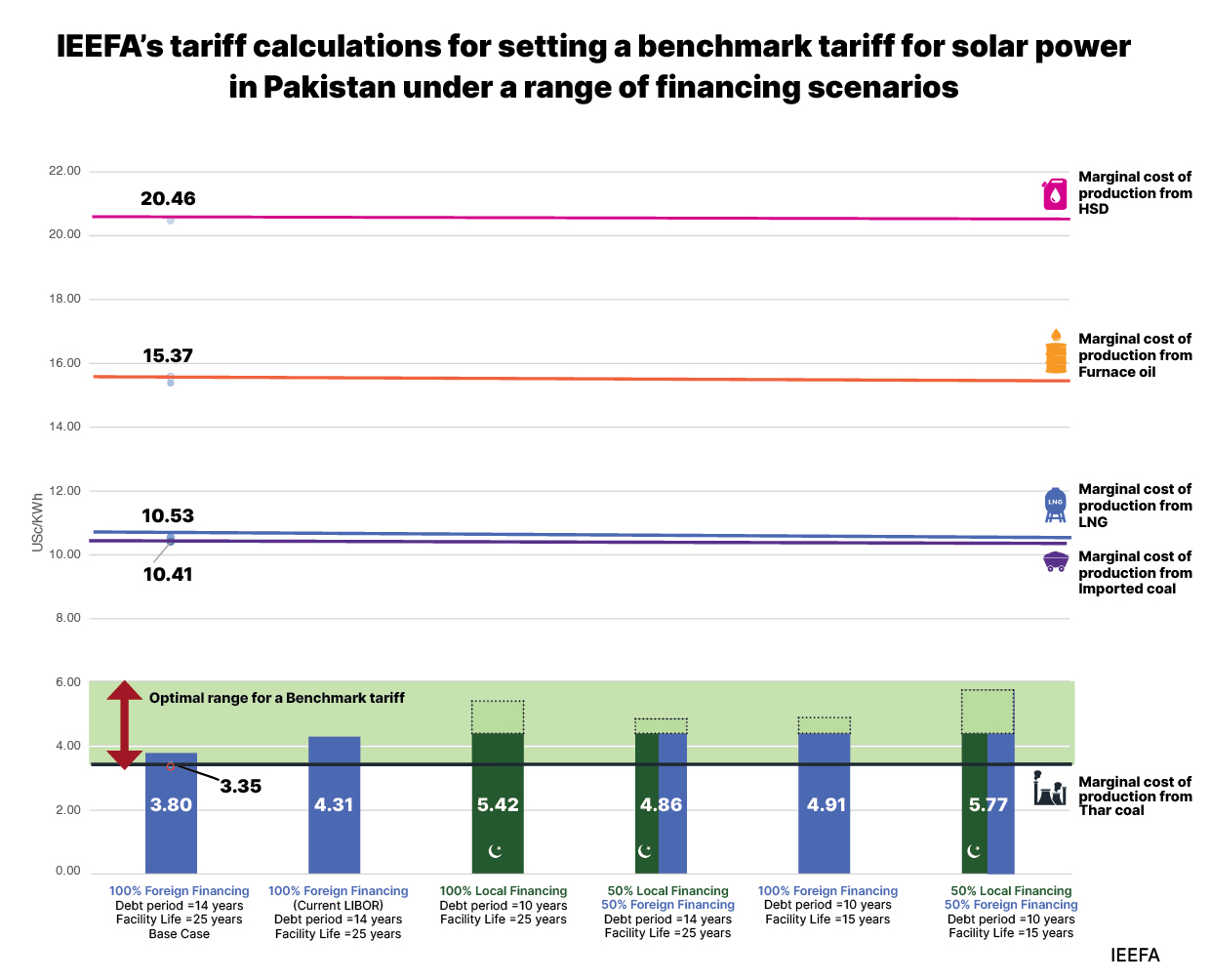

“For solar projects, we model various underlying conditions to assess the optimum tariff. Our calculations reveal a benchmark of 4.3-5.8 USc/KWh (US cents per kilowatt-hour). A shorter PPA may also offer developers more attractive prospects, such as a quicker debt repayment period and higher profits in the short term,” says Isaad.

“From a state-owned off-taker’s point of view, reducing the duration of power purchase agreements by five to ten years may lead to a slightly higher tariff now but would allow the government flexibility to negotiate a lower rate in the future as a new power purchase agreement is signed. In addition, this could also provide mitigation against technological advancements as renewable energy technologies improve in the future, resulting in lower prices.”

Meanwhile, a comparison with the marginal cost of production for various types of fossil fuel-based power plants reveals a difference of 5-15 USc/KWh, even at the highest variation of our calculated tariff range.

“This cements our conclusion that even at a higher tariff offering, the difference between the cost of producing fossil-based power and solar energy would still lead to a net benefit,” says Isaad.

Next steps for reinforcing investor confidence

Isaad emphasizes that the government would have to de-risk the market for renewable energy investors for any future auctions to succeed.

Low participation (in the first attempt) to enforce a competitive regime highlights outstanding issues like the financial health of the Central Power Purchasing Agency (CPPA), and the shortage of foreign exchange, which may outshine any benefits to result from current incentives offered by the Alternative Energy Development Board (AEDB, the government entity responsible for designing and implementing auctions), however generous they might be.

Isaad adds that, instead, a good auction design with a realistic benchmark tariff can deliver both the price stability that project developers desire and introduce healthy competition into the market that the government wants.

“As the market matures and Pakistan’s economic credibility improves, price reductions will automatically get reflected in the bids that developers put forward during auctions — and government support can be phased out,” says Isaad.

“For now, the government will have to show its commitment to seek input from stakeholders and set a tariff that reflects pragmatic thinking yet offers a reasonable margin for returns. In addition, a reasonable balance between the off-taker (CPPA) and the project developer for risk sharing must be incorporated in upcoming PPA designs.”

Read the report: Choosing the right incentive for Pakistan’s renewable energy industry

Report contact: Haneea Isaad ([email protected])

Media contact:

Alex Yu ([email protected]) Ph: +852 9614 1051

About the author:

Haneea Isaad is an energy finance analyst at IEEFA. Based in Pakistan, she covers Asian energy markets with a focus on Pakistan’s energy transition.

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)