Blended Finance: A viable mechanism for financing energy transition in developing countries

Practical model bringing together private and public capital in a risk-adjusted return structure, to scale up renewable energy projects in developing countries that may otherwise struggle to raise finance from conventional sources

Key Takeaways:

The gap between commercial imperatives and environmental objectives is one of the biggest obstacles to the transition to renewable energy in developing countries, especially in case of smaller-sized projects targeting new technologies or low-income demography.

Blended Finance provides a roadmap for interventions in renewable energy segments, such as solar mini-grids, which struggle to secure conventional finance.

As India’s energy transition accelerates, Blended Finance could also serve as a blueprint for other emerging economies that face similar issues finding capital.

As the transition to a low-carbon economy gathers pace across emerging economies and new technologies and untapped demographic segments come to the fore, Blended Finance offers a solution that can help alleviate the technological and market risks allowing such projects to access affordable capital, a new joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and auctusESG finds.

The report highlights that in developing and emerging economies, commercial financiers are mostly backing utility-scale wind and solar projects at the expense of smaller-scale projects, such as mini-grid solar, which offer economic, social and environmental benefits for all, especially in those economies that still face energy poverty.

“Blended Finance is typically for projects with combined developmental objectives, which otherwise do not get funded via conventional financing channels, or for those sectors where the risk-return profile of a project is yet to be established but they need to scale,” says the report’s co-author Vibhuti Garg, Director, South Asia, IEEFA.

“Its primary role is to bridge the gap between the level and direction of finance flows required from a social perspective and the flows determined by prevailing market conditions,” she adds.

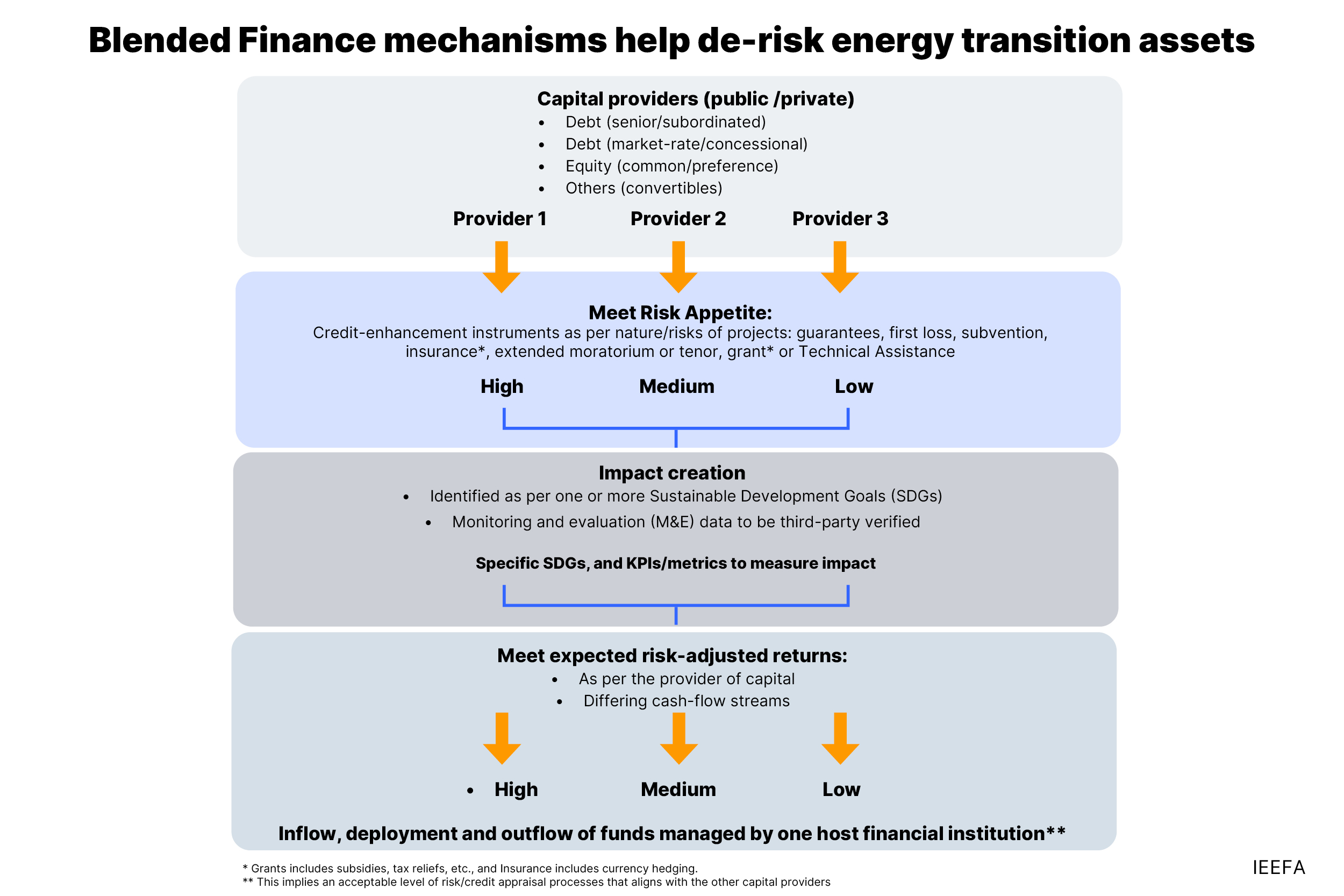

According to the report, Blended Finance fits in as a financing tool for the aforementioned types of projects by pooling public and private capital in a risk-adjusted return structure, while adding an element of concessional capital to the pool.

“Commercial entities focus on risks and returns, and gauge risk based on factors such as proven business models, visibility of cash flows, and credentials of borrowers, which often are not strong in the case of several small scale and emerging interventions in clean energy,” says the report’s co-author, Namita Vikas, Founder & Managing Director, auctusESG.

“Blended Finance’s bespoke structuring approach, involving public and private capital, addresses the perceived financial risks, and thus provides comfort to raise commercial capital at scale. Using Blended Finance judiciously based on contextual factors would not only facilitate finance for energy transition at scale, but would create energy access to millions suffering from energy poverty while enabling a climate-smart planet,” she adds.

Blended Finance incorporates a wide range of stakeholders, such as a nodal implementation agency, commercial capital providers (microfinance institutions, banks and non-banking financial companies), catalytic capital providers (multilateral development banks, philanthropies), project developers, local communities, customers, auditors and consultants.

“Blended Finance can essentially help pay for positive social benefits by combining commercial borrowings with concessional instruments such as grants or subsidised loans from the government, philanthropic resources and multilateral development banks,” says the report’s co-author, Shantanu Srivastava, Lead Analyst, Sustainable Finance & Climate Risk, IEEFA.

“At the same time, Blended Finance is not a grant, and demands reasonable financial returns, even if the desired returns may, at times, vary from market returns,” he adds.

The most exciting aspect of Blended Finance is its potential to transform the lives of millions of people in emerging economies like India, especially those without regular access to grid power.

“This transformative pathway could allow those still living with a degree of energy poverty in emerging economies to leapfrog fossil fuel-generated power and tap into the opportunities provided by renewable energy applications,” says the report’s co-author Sourajit Aiyer, Vice President, auctusESG.

“Blended Finance could also provide a blueprint for other developing economies to ensure no one is left behind in the energy transition,” he adds.

The report focuses on mini-grids as a renewable energy resource that aligns with a just transition in areas where the cost and reliability of central grid power is a bottleneck. Solutions to this problem include:

- Mini-grids scaled up through the use of Blended Finance mechanisms that can derisk specific business models;

- Grant-funded technical assistance and a revenue shortfall guarantee blended with concessional and market rate debt, and developer equity contribution, and;

- Asset aggregation to bring scale, community engagement to establish demand buy-in, demand estimation, and robust measurement, reporting and verification (MRV) to ensure the model can scale up and achieve commercial viability.

This report provides a go-to market strategy for capital providers looking at energy transition as an opportunity. It shows how Blended Finance’s bespoke structure can help aggregate smaller projects at commercially viable scale: a win-win for all and a shining example of trickle-down economics that actually works.

Read the report: Blended Finance: Key to Bridging the Energy Transition Gap in Developing Countries

Media contact: Prionka Jha ([email protected]) +91 9818884854 & Charu Ghadge ([email protected])

Author contacts: Shantanu Srivastava ([email protected]) & Sourajit Aiyer, Vice President, auctusESG ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About auctusESG: auctusESG is a global company providing strategic advisory and enablement on sustainable finance, climate transition, ESG, and climate risk management to the banking and financial sector. It has worked on marquee projects awarded by international governments, UN agencies, and global institutions across multiple emerging markets. (https://auctusesg.com/)