AIA lagging global insurers in coal investment, divestment and exclusion

Key Takeaways:

AIA holds up to $6bn in coal and coal-fired power assets

AIA lags peers and must address exposure to coal

21 December 2020 (IEEFA Asia): Major insurer AIA still holds anywhere between US $4 – 6 billion in coal and coal-fired power assets that if stranded will massively reduce wealth for investors and despite pledging its commitment to three significant global climate accords according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Author of the report Norman Waite says at 2-3% of its overall portfolio, even a small percent write-off of those assets as they become stranded could have substantial share price and brand value implications.

“AIA is one of the largest financial stocks in the world, and definitely in Asia,” says Waite. “It has written insurance covering 1% of the Australasian markets in which it operates.”

“For its size, AIA is too important to be lagging its global peers on coal exit commitments. It needs a policy on its coal investments, divestment and exclusion to assure investors that it is keeping pace with the current energy transition disrupting global markets.”

AIA is too important to be lagging its global peers on coal exit commitments

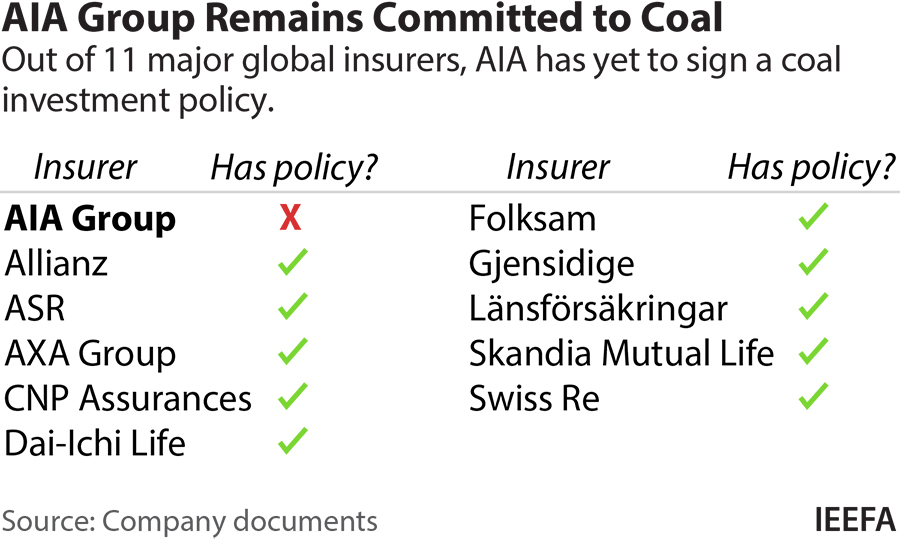

Of 11 global insurers that have signed on to significant climate pledges for reducing carbon footprints, AIA is the only one yet to produce a coal investment policy that responds to accelerating announcements away from coal power lending in the global financial market.

To its credit, AIA calculated the weighted average of issuer carbon intensity of its equity portfolio in 2019.

“Unfortunately however, the results weren’t great and scored AIA equities pretty high, with high being bad. In fact they showed a portfolio that was barely meeting the MSCI score for emerging markets broadly,” says Waite.

“This is despite AIA’s support for the UN’s Principles of Responsible Investment, the Task Force on Climate-related Financial Disclosures, and Climate Action 100+, as well as AIA’s substantial exposure to USD assets. AIA’s high score shows there is a problem.”

Waite says with little detail available concerning its sprawling USD 200 billion plus investment portfolio, AIA’s continued investment in coal and coal-fired power assets is troubling.

Over 150 significant global financial institutions including insurers of similar size to AIA have already announced coal exit policies.

“AIA’s CIO Mark Konyn has voiced concern about the performance impact from stranded assets, so AIA’s CEO Lee Yuan Siong may just need to formalize some of the firm’s best investment practices into a clear policy,” says Waite.

“Investors will be very keen to hear what AIA are doing.”

Read the report: Time for AIA To Prove Their Climate Credentials – AIA Is Too Important To Lag Global Insurers in Coal Investment, Divestment, and Exclusion

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Norman Waite ([email protected])