Addressing regulatory barriers will boost renewable energy investment in Indonesia

With a goal of securing US$146 billion in private investment by 2030, Indonesia needs to reevaluate its planning, procurement, and investment processes

Near-term renewable energy investments from the private sector worth US$146 billion are needed to achieve Indonesia’s 2030 climate target, which requires urgent policy reformation to increase investor confidence, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

Despite abundant untapped renewable energy sources and strong economic growth, investment in renewable energy in Indonesia has stagnated for the past seven years. In 2023, it only attracted US$1.5 billion, translating to a mere 574 megawatts (MW) of additional renewable energy capacity. It lags far behind its Southeast Asian neighbors, which have installed significant solar and wind capacity. Vietnam, for example, has a solar capacity of 13,035MW and 6,466 MW of wind generation.

The government has issued several regulations to promote investment in renewable energy from the private sector or Independent Power Producers (IPPs). However, these have not attracted new investors due to unfavorable policies and weak regulatory implementation. Demanding contractual requirements regarding solar and wind power raises costs and discourages private investment.

The report identifies barriers that reduce investors’ willingness to finance Indonesia’s renewable energy sector, including a mandatory partner system, restrictions on the transfer of ownership rights, an unfavorable deliver-or-pay scheme, unattractive ceiling tariffs, stringent local content requirements (LCRs), a lack of carbon credits incentives, and complicated procurement procedures.

“Private investors would be encouraged to enter the Indonesian renewable energy market if there were clear and concise procurement procedures, along with consistent and reliable implementation of current regulations,” says Mutya Yustika, the report’s author and an Energy Finance Specialist at IEEFA.

Challenges hindering investments

The government’s renewable energy asset ownership strategy places PT Perusahaan Listrik Negara (PLN), Indonesia’s national electricity utility, and its subsidiaries in the driving seat of renewable energy development through a mandatory partner and 51% majority shareholders’ scheme.

This equity co-ownership discourages private investors as PLN becomes the de facto owner of any project. As the sole off-taker of any renewable energy generated, PLN’s dual role of equity shareholder and off-taker creates a conflict of interest.

Since 2017, the Indonesian government has restricted the transfer of project ownership rights before the commercial operation date. This restriction limits the private sector's ability to obtain additional capital and technical expertise during project delivery.

To ease PLN’s financial burden, Indonesia replaced the ‘take-or-pay’ system with a new ‘deliver-or-pay’ scheme, with an annual contracted energy arrangement for renewable energy projects. This scheme further penalizes the private sector if the IPP fails to meet availability or capacity requirements.

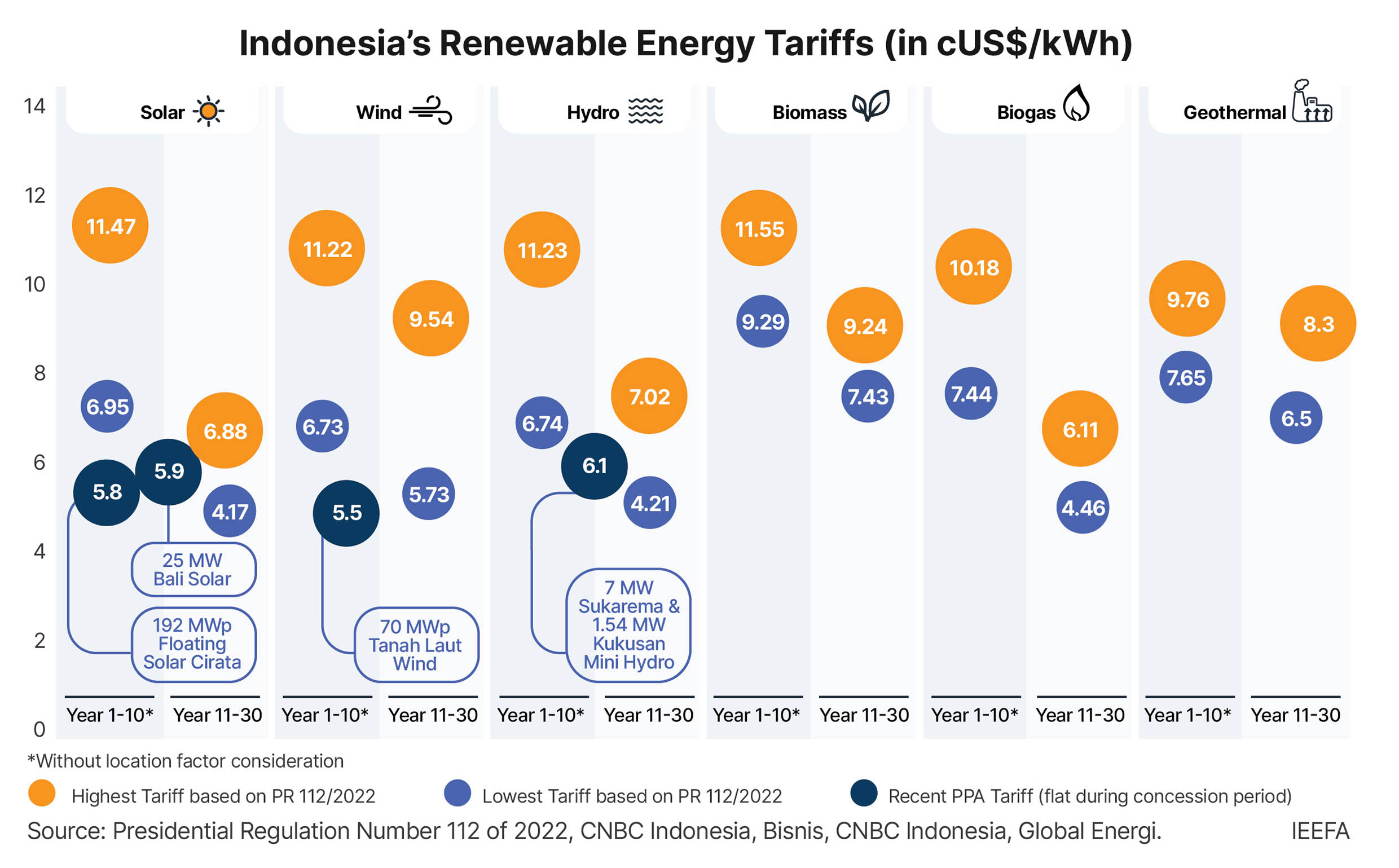

Despite the push for a feed-in tariff for renewable energy projects, the Indonesian government has introduced a new ceiling tariff. The tariff is staggered over two periods, with a higher ceiling tariff for the first period (years 1 – 10) to enable the IPP to recover its costs and pay debts and lower for the second period (years 11 – 30). As a result of the auction process, where IPPs are selected based on the lowest proposed tariffs, it is difficult for investors to achieve profit targets. Auctions for new projects become unappealing.

Although intended to boost the local industry, stringent LCRs have prevented the acceleration of renewable energy development. The local sector lacks sufficient capacity and relies heavily on imported materials to manufacture equipment. Domestically made solar modules are 30%-45% more expensive than imported products. The LCRs have increased investment costs and caused initial system expenses to be significantly higher than global market averages.

Carbon credits have a value that can be sold within the carbon market and become a source of additional revenue for investors. However, Indonesia’s recent Power Purchase Agreement states that any renewable energy market-based instruments, including carbon credits and renewable energy certificates, will be fully allocated to PLN. Consequently, investors can no longer benefit from carbon credits.

There is also a lack of transparency in PLN’s procurement of renewable energy projects. Project procurement is through either direct appointment or direct selection. To participate in the procurement process, IPPs must pre-register on a List of Selected Providers (DPT). The DPT application process has no defined timeline and can range from a few weeks to a year.

Under Presidential Regulation 112 of 2022, the procurement lead time should be around 90 days for direct appointment and 180 days for direct selection. However, there is no guarantee that the procurement process will adhere to the timeframes provided. At times, tenders are delayed or canceled without explanation. Investors who have spent money on tender preparation costs, providing details such as an initial study, bid bond, and legal documents, would have to record these expenses as sunk costs.

“One-on-one negotiations, fluid timelines, and unapproved projects undermine the procurement process, resulting in declining investor interest,” says Yustika.

The IEEFA report recommends introducing transparent and well-defined procedures in renewable energy procurement, supported by commercially balanced contractual terms and conditions, which will provide assurance for potential private investors and ensure Indonesia meets its decarbonization goals.

Read the report: Unlocking Indonesia’s renewable energy investment potential

Read this press release in Bahasa

Read the fact sheet: Addressing Indonesia's renewable energy investment potential through policy reforms

Author contact: Mutya Yustika ([email protected])

Media contact: Josielyn Manuel ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. www.ieefa.org