Adding 2,000MW of rooftop solar capacity can help the Bangladesh Power Development Board save up to Tk110.32 billion (US$1 billion) annually

The organisation suffers from a high revenue deficit each year owing to expensive power generation and purchases from furnace oil- and diesel-fired plants. Rooftop solar can help reduce the generation and purchase of costly power.

Key Takeaways:

While the economic benefits of rooftop solar are clear, the sector is held back by a lack of awareness, low confidence, perceived risks, high import duties and tight fiscal conditions.

Expanding rooftop solar deployment requires risk-mitigation instruments, business models for utilities, waiving import duties on solar accessories and easing the letter of credit opening process.

Raising awareness, developing the capacity of stakeholders, and ensuring the quality assurance of accessories will also help build trust in rooftop solar.

While rooftop solar has struggled to gain traction in Bangladesh, a renewed focus and adding 2,000 megawatts (MW) can help the Bangladesh Power Development Board (BPDB) save up to Bangladeshi Taka (Tk) 110.32 billion (US$1 billion) annually, a new report from the Institute for Energy Economics and Financial Analysis (IEEFA) finds.

The report highlights that rooftop solar’s economic benefits are more compelling now than ever for Bangladesh, which has suffered energy price spikes, supply disruptions and deteriorating fiscal conditions since Russia invaded Ukraine in 2022.

“Bangladesh must tap the low-hanging fruit of rooftop solar to stave off the energy sector challenges and reduce colossal imports of fossil fuels. The delay in steering the sector in the right direction could result in a missed opportunity,” says the report’s author, Shafiqul Alam, Lead Analyst – Bangladesh Energy, IEEFA.

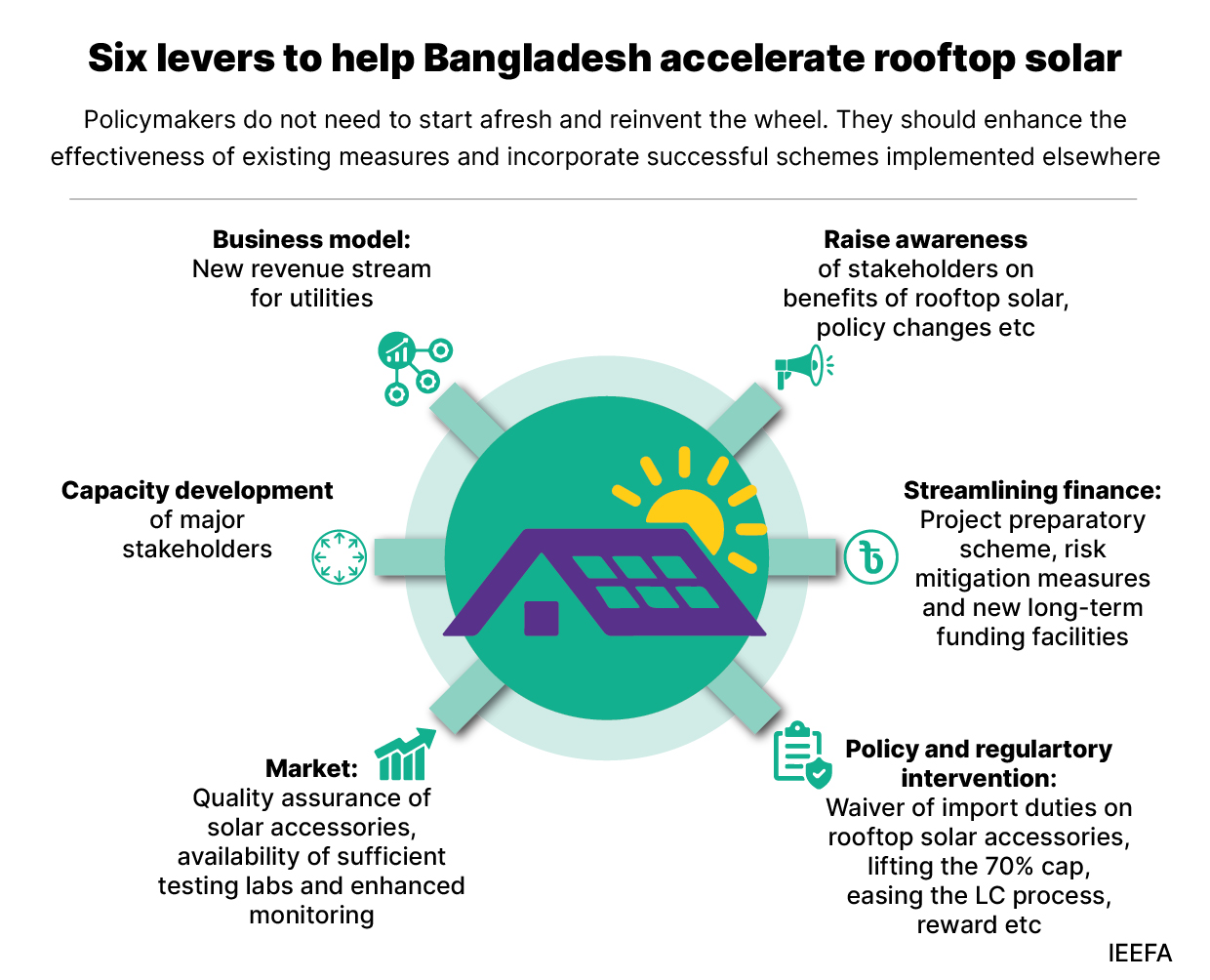

Based on IEEFA’s interviews with select experts and stakeholders of the sector, the report recommends pulling six key levers to accelerate the widespread deployment of rooftop solar. These are raising awareness, streamlining finance, policy and regulatory intervention, quality assurance, business models for utilities and capacity development of key stakeholders.

“While investors want to quickly assimilate information on interest rates, net metering guidelines and policy changes, there is information asymmetry within the sector. Another key hindrance to the wider adoption of rooftop solar is the lack of capacity of stakeholders in terms of personnel, quality assurance and project appraisal,” says Alam.

Therefore, the Sustainable and Renewable Energy Development Authority (SREDA) should design and conduct targeted capacity development and awareness programmes, as well as exposure visits to successful projects for stakeholders.

Although the solar helpdesk, hosted by SREDA, shares information on request, stakeholders feel a performance assessment of the helpdesk is essential to upgrade services based on need and relevance.

The report further highlights that a credit risk guarantee scheme can minimise the perceived risks of financial institutions and increase fund flows to projects. Similarly, a first-loss guarantee can address engineering, procurement and construction (EPC) companies’ challenges linked to repayment from industries and building owners (offtakers).

“While Bangladesh Bank’s green refinancing scheme is the least-cost financing vehicle, all eligible rooftop solar projects will not receive the refinance due to its limited funds of Tk4 billion (US$36.4 million) and the competition with 69 other environment-friendly projects. Therefore, Bangladesh Bank may pre-approve financing for rooftop solar based on an assessment at the initial stage to eliminate any uncertainty about availing of the low-cost scheme,” says Alam.

The Infrastructure Development Company Limited also has a rooftop solar financing facility, but it will not meet the sector’s demand. The report recommends that local financial institutions explore multilateral agencies, international climate finance, and the local bond market to enhance funds in the foreseeable future.

To incentivise the sector, the report calls on the government to waive prevailing import duties on solar panels and four accessories, ranging from 11.2% to 58.6%, at least for a limited period. It also recommends fixing the rooftop solar installation capacity to 100% of the sanctioned load.

“Further, as rooftop solar accessories are usually imported, the Bangladesh Bank and the National Board of Revenue (NBR) should declare rooftop solar a top priority and ease its Letter of Credit opening process. For a rapid expansion, the Bangladesh Bank may give financial institutions an annual disbursement target on renewable energy, including rooftop solar,” says Alam.

The report also highlights the important role utilities can play in expanding the deployment of rooftop solar. Both the utility- and third-party-owned business models can be a source of revenue for utilities, incentivising them to multiply their efforts in the rooftop solar sector. Different utilities can also combine the rooftop solar potential of respective zones and conclude on the national rooftop solar market size, providing the signal to financial institutions on aggregate investment the sector will require.

As interest in rooftop solar increases, the report recommends setting up enough testing labs and increasing market monitoring by the Bangladesh Standards and Testing Institute (BSTI). Further, SREDA can include a consumer feedback mechanism for EPC companies and solar equipment suppliers to ensure quality project implementation and initiate certification for service providers.

“Policymakers do not need to start afresh and reinvent the wheel. They should enhance the effectiveness of existing measures and incorporate successful schemes implemented elsewhere,” says Alam.

Read the report: Towards a Rooftop Solar Transition in Bangladesh

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contact: Shafiqul Alam ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)