IEEFA Update: The Emperor Exxon Isn’t Wearing Very Much

The energy sector is going through a time of unprecedented change, and investors should take heed.

We publish often on the sweep and pace of this shift in our ongoing analysis of the U.S. coal industry; our research on oil majors like Exxon; our work on public policy from Puerto Rico to Norway; our commentary around regional trends (Texas comes to mind) and news of note (Alaska); and our reports on a rapid transformation gaining momentum locally, nationally, and globally (from China, Indonesia, Japan, the Netherlands, the U.K. and so on).

We publish often on the sweep and pace of this shift in our ongoing analysis of the U.S. coal industry; our research on oil majors like Exxon; our work on public policy from Puerto Rico to Norway; our commentary around regional trends (Texas comes to mind) and news of note (Alaska); and our reports on a rapid transformation gaining momentum locally, nationally, and globally (from China, Indonesia, Japan, the Netherlands, the U.K. and so on).

Take a walk through our blog sometime to get a feel for how fast things are happening, and see our Reports, Briefing Notes, Memos and Testimony page for a deeper dive.

Then take a look at a report just out by Oil Change International and Greenpeace—“Forecasting Failure”—that offers a powerful critique of how science and technology are creating vast new industrial applications that challenge traditional extractive models of fossil fuel production. The report, in an Emperor-Has-No-Clothes way, finds the oil and natural-gas industries either unable or simply unwilling to cope with what’s occurring.

“Forecasting Failure” finds these industries either ill-equipped to understand their rising competition, or worse, unable to acknowledge the truth—maybe not even to themselves and certainly not to investors. These industries continue to rely upon—and promote—outlooks that have been shown to consistently underestimate the growth of renewable energy and electric vehicles. Are these forecasts really the best analysis the companies have or are they just part of their marketing plans?

THE OIL INDUSTRY STORY IS WRIT ESPECIALLY LARGE AT EXXONMOBIL, where the company’s dismal performance can be traced to three bets gone bad:

- Overpaying for natural gas assets and being late to the fracking play;

- Imprudently acquiring oil sands assets only to see oil price declines eviscerate the economic viability of these assets;

- Sticking to a strategy of conventional oil production that is doing little more than eroding its revenue position.

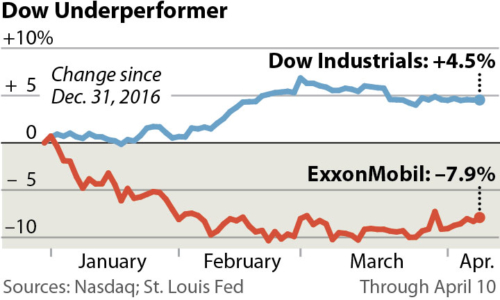

The three decisions above have left Exxon in competition with Verizon for the worst-performing stock in the Dow Jones Industrial Index this year. Recent statements by the company that it will be reallocating capital to “short cycle” investments are going largely unchallenged, even though this tack reflects a sharp departure from the historic capital investment strategy of the company. The old models aren’t working anymore but we suspect that a “quick buck” future is fraught.

That said, and notwithstanding the powerful movement afoot in the renewable energy and electric vehicle sectors, the oil and gas industries will be around for a long time to come. Even in a diminished state, they possess scientific and technological wizardry sufficient to hold their own in the capital markets. But their greatest days are done. Long term, the laws of economics are with renewables, where fuel costs nothing.

This is no abstract debate. Much of the power of the Oil Change/Greenpeace report is in its recognition of the fracturing of historic alliances between the auto industry and the fossil fuel industry. Big auto companies—GM, Ford, Toyota, BMW, Volkswagen and the upstart Tesla are all putting significant muscle into electric vehicles. China is on the move in this area too. The uptake of electric vehicle use continues, creating a web of jobs and factories and an economic chain that will compete head-on politically with oil and gas.

So a broader discussion about finance and business is inevitable. It will be driven by the increasingly difficult proposition for investors to accept the nonchalance with which an industry can so casually write off $236 billion over two years—and then lurch along with weak fundamentals and a negative outlook while talking happy talk as it goes.

Greenpeace and Oil Change International have issued a wise warning to conventional energy thinking. It’s a report that sounds a knell that will grow. Expect the fossil fuel industry to be called out with rising force as more investors notice that the Emperor is down to his skivvies.

Tom Sanzillo is IEEFA’s director of finance.

RELATED POSTS:

IEEFA Report: Red Flags on ExxonMobil: Core Financials Show a Company in Decline

IEEFA Exxon: White House’s Endorsement Is Just More Evidence of Distress