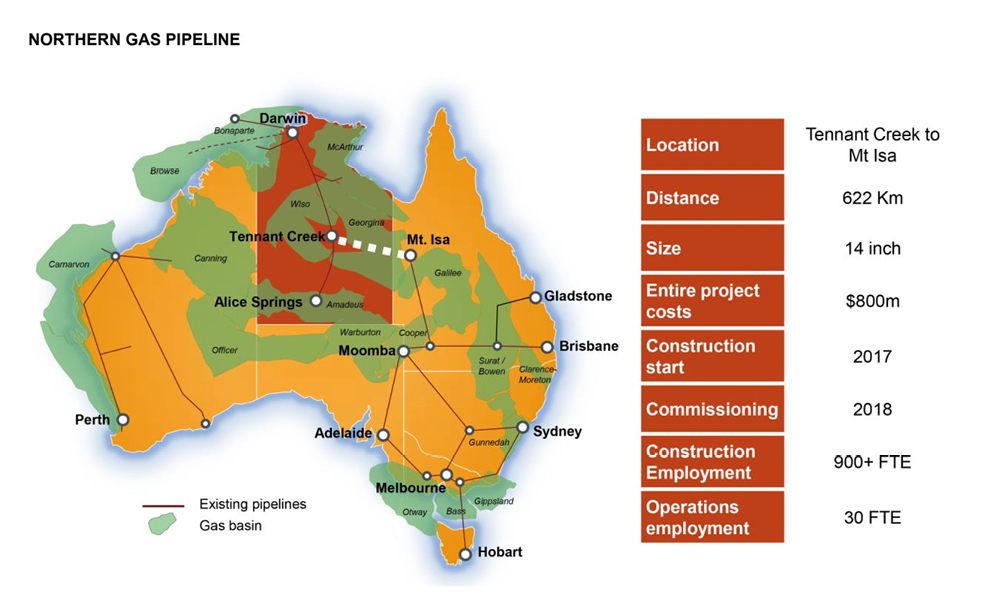

Pipe dreams: A financial analysis of the Northern Gas Pipeline

Download Full Report

Key Findings

Recent capacity downgrades for the project suggest demand for the project is overstated.

The project would most likely be a loss-making enterprise.

Executive Summary

Construction of the North East Gas Interconnector (NEGI) is being proposed at a time in which global liquefied natural gas (LNG) markets are in a glut. The NEGI deal—if it were built—would occur under a monopoly arrangement whose economic benefits, if there are any, would be limited to foreign owners.

This report explores the many risks in how the project is structured financially and how it is being proposed in the face of declining markets.

Highlights of our finding are shown in this Executive Summary, followed by our full analysis.

Please view full report PDF for references and sources.