Global LNG outlooks point to rough waters ahead for Bangladesh

Key Findings

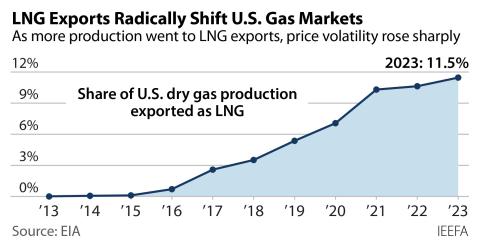

LNG prices are likely to remain high and volatile. As global prices skyrocket, suppliers may also deliver the minimum contractually obligated volumes to achieve higher profits elsewhere.

Since LNG imports began in 2018, the government subsidy burden in Bangladesh has ballooned to keep up with higher costs.

Pressure to raise end-user gas and power tariffs may increase, along with risks of fuel and power shortages. Ultimately, citizens could end up bearing the costs.

Global liquefied natural gas (LNG) markets are extremely turbulent. Since winter 2021, LNG prices have repeatedly spiked to new records, pushed higher by the Russian invasion of Ukraine. Bangladesh, which relies on liquefied natural gas (LNG) imports for 20% of its gas needs, has been forced to pay exorbitant prices or forego purchases altogether, causing fuel and power shortages.

Price volatility and supply insecurity may be here to stay. According to a recent analysis from global consulting firm Rystad Energy, global LNG demand is likely to remain above global supply for the foreseeable future, meaning there won’t be enough LNG to go around.

Unless Bangladesh can rapidly accelerate its transition to cheaper domestic renewable energy alternatives, high imported fuel prices and energy insecurity will continue to undermine national economic development. Here’s what global LNG outlooks mean for Bangladesh:

1. LNG prices are likely to remain high and volatile

After the Russian invasion, Europe announced a plan to reduce its dependence on Russian gas by buying LNG from elsewhere. This new competition for limited global LNG supply has lifted prices, which could increase further this year as countries buy more LNG to meet winter heating demand.

Yet, Petrobangla intends to buy 18 cargoes from spot markets from July to December—50% more than the first half of the year—putting Bangladesh on a collision course with a tighter, more expensive global market.

Since October 2021, Bangladesh has been forced to purchase LNG at between US$30-37 per million British thermal unit (MMBtu). At these prices, a single shipment can cost US$110-135 million. This is five times the cost in May 2021 and 10 times the cost in May 2020.

Bangladesh has long-term contracts that, in theory, should protect it from price spikes. However, 59% of its LNG comes from spot markets, exposing the country to price volatility. LNG prices from long-term contracts are linked to global oil prices, which have also risen dramatically since the crisis broke out.

Moreover, when global prices skyrocket, suppliers will deliver the minimum contractually obligated volumes to Bangladesh to achieve higher profits elsewhere.

2. The government subsidy burden is likely to grow

As a result of skyrocketing commodity prices, the government’s LNG import bill has grown rapidly. According to a Petrobangla official, the LNG import bill is expected to reach Tk. 40,000 crore (US$4.6 billion) by June 2022, more than double the previous fiscal year.

Since LNG imports began in 2018, the government subsidy burden has ballooned to keep up with higher costs. The government prepared a subsidy package of Tk. 82,745 crore (US$9.4 billion) for the next fiscal year starting July 2022, with the largest portions going to electricity and fuel imports. This is a nearly 54% increase from the subsidy outlay in 2021, which also had to be revised upward to mitigate the impact of commodity price shocks.

As global prices remain high and volatile in the near-term, the government subsidy burden may increase significantly more than expected.

3. Pressure to raise end-user gas and power tariffs may increase

With a growing subsidy burden, pressure has increased on the government to raise gas and power tariffs. In January 2022, gas distributors proposed that retail gas tariffs be increased by an average of 117%, and the Bangladesh Power Development Board (BPDB) proposed raising electricity rates by 66%.

In May, the Bangladesh Energy Regulatory Commission recommended increasing electricity rates by 58%, slightly less than proposed by BPDB. Key economic associations and consumer groups have strongly opposed any proposed tariff increases, with one representative calling rate hikes “suicidal” for the textile industry.

Tighter global markets for LNG could add further upward pressure on gas and power rates, fueling more public debate and protests. Ultimately, citizens could end up bearing the costs.

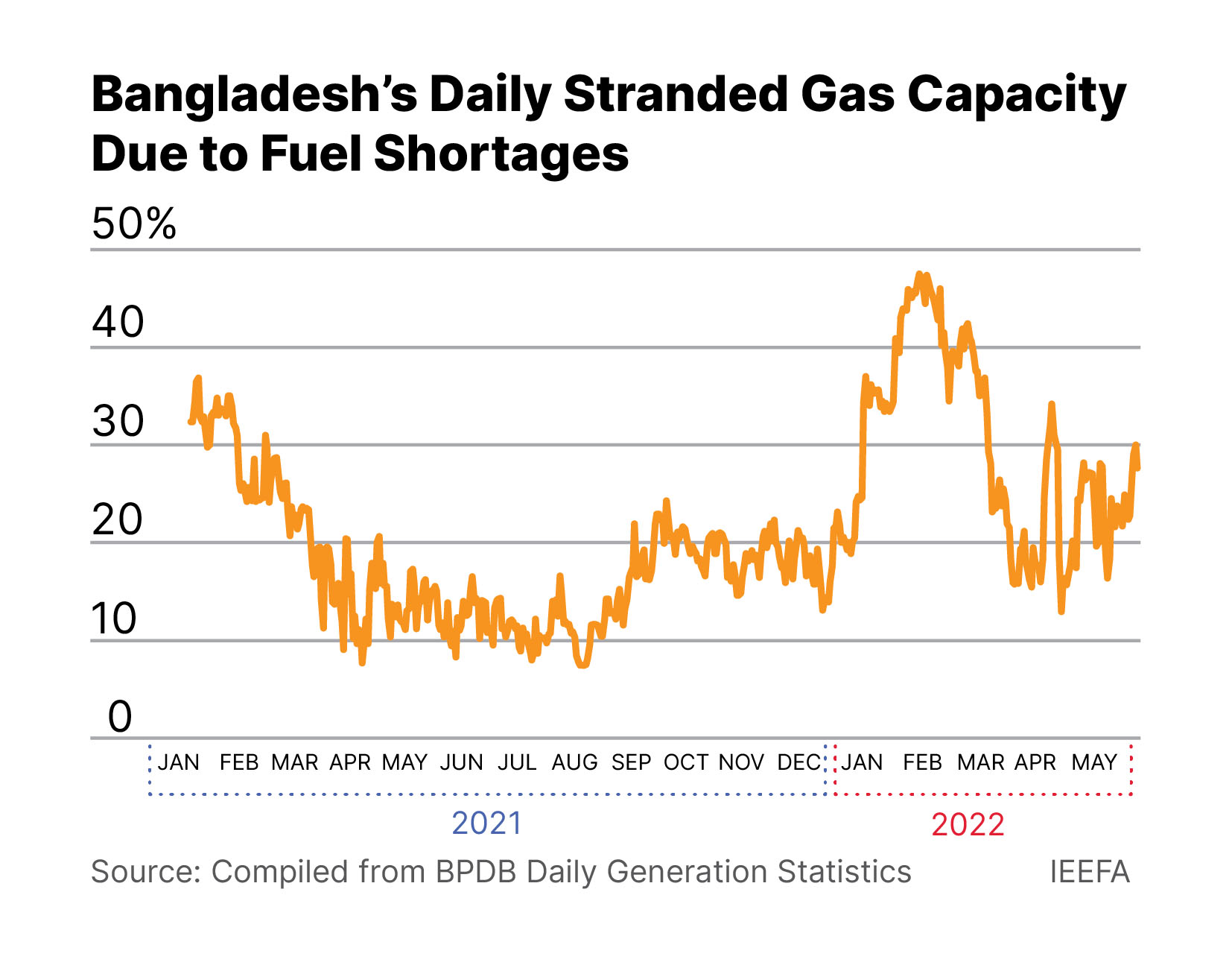

4. Potential fuel and power shortages

If prices spike high enough, Bangladesh could decide to forego cargoes altogether. In winter 2021, Petrobangla opted to cancel an LNG tender due to unaffordable prices. The country did not buy any LNG from the spot market last December and January, contributing to gas shortages for homes, businesses, and power generators. In late January and early February, between 40-50% of gas capacity was offline and stranded due to limitations on gas supply.

Why dig a deeper hole?

Despite the risks inherent in a greater reliance on LNG, policymakers and international players—particularly from Japan and the United States—continue to promote LNG. Nearly US$18 billion of LNG projects are planned in Chattogram region alone.

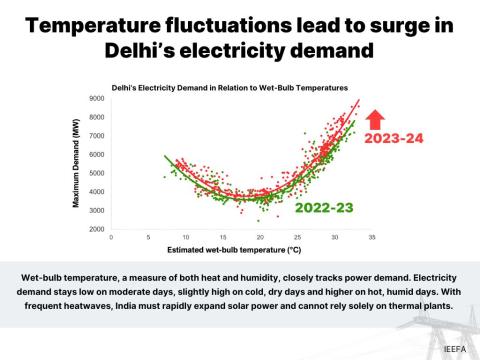

Meanwhile, renewable energy accounted for just 1.32% of the power mix in 2020 despite an estimated wind and solar potential of 240 gigawatts (GW) and 150 GW, respectively. Pivoting the power sector buildout to domestically sourced renewables would help reduce Bangladesh’s exposure to volatile, expensive global LNG markets.

Given the global outlook for higher LNG prices and limited supply, the renewable energy transition in Bangladesh is now more urgent than ever.

This commentary first appeared in Financial Express

Global liquefied natural gas (LNG) markets are in chaos. Since winter 2021, LNG prices have repeatedly spiked to new records, pushed higher by the Russian invasion of Ukraine. Bangladesh, which relies on liquefied natural gas (LNG) imports for 20% of its gas needs, has been forced to pay exorbitant prices or forego purchases altogether, causing fuel and power shortages.

Unfortunately, price volatility and supply insecurity aren’t going away anytime soon. According to a recent analysis from global consulting firm Rystad Energy, global LNG demand is likely to remain above global supply for the foreseeable future, meaning there won’t be enough LNG to go around.

Unless Bangladesh can rapidly accelerate its transition to cheaper domestic renewable energy alternatives, high imported fuel prices and energy insecurity will continue to undermine national economic development. Here’s what the outlook for global LNG markets means for Bangladesh:

1. LNG prices are likely to remain high and volatile

After the Russian invasion, Europe announced a plan to reduce its dependence on Russian gas by buying LNG from elsewhere. To meet its targets, Europe now has to pay higher prices to attract LNG supply that might typically go to Asia.

This new competition with Europe for limited LNG supply has lifted prices, which could increase further this year as countries buy more LNG to meet winter heating demand.

Yet, Petrobangla intends to buy 18 cargoes from spot markets from July to December—50% more than the first half of the year—putting it on a collision course with a tighter, more expensive global market.

Since October 2021, Bangladesh has been forced to purchase LNG at between US$30-37 per million British thermal unit (MMBtu). At these prices, a single shipment can cost US$110-135 million. This is five times the cost in May 2021 and 10 times the cost in May 2020.

Bangladesh has long-term contracts that, in theory, should protect it from price spikes. However, 59% of Bangladesh’s LNG comes from spot markets, meaning the country is particularly exposed to volatility. LNG prices from long-term contracts are linked to global oil prices, which have also risen dramatically since the crisis broke out. Moreover, when global prices skyrocket, suppliers will deliver the minimum contractually obligated volumes to Bangladesh to achieve higher profits elsewhere.

2. The government subsidy burden is likely to grow

As a result of skyrocketing commodity prices, the government’s LNG import bill has grown rapidly. According to a Petrobangla official, the LNG import bill is expected to reach Tk. 40,000 crore (US$4.6 billion) by the end of the fiscal year, more than double the previous year.

Since LNG imports began in 2018, the government subsidy burden has ballooned to keep up with higher costs. The government prepared a subsidy package of Tk. 82,745 crore (US$9.4 billion) for the next fiscal year starting July 1, with the largest portions going to electricity and fuel imports. This is a nearly 54% increase from the subsidy outlay in the previous year, which also had to be revised upward to mitigate the impact of commodity price shocks.

The outlook for LNG markets suggests global prices will remain high and volatile in the near-term, potentially driving the government subsidy burden even higher than expected.

3. Pressure to raise end-user gas and power tariffs may increase

With a growing subsidy burden, pressure has increased on the government to raise gas and power tariffs. In January 2022, gas distributors proposed that retail gas tariffs increase by an average of 117%, and the Bangladesh Power Development Board (BPDB) proposed raising electricity rates by 66%.

In May, the Bangladesh Energy Regulatory Commission recommended increasing electricity rates by 58%, slightly less than proposed by BPDB. Key economic associations and consumer groups have strongly opposed any proposed tariff increases, with one representative calling rate hikes “suicidal” for the textile industry.

Tighter global markets for LNG could add further upward pressure on gas and power rates, fueling more public debate and protests. Ultimately, citizens least responsible for decisions to import expensive LNG could end up bearing the costs.

4. Potential fuel and power shortages

If prices spike high enough, Bangladesh could decide to forego cargoes altogether. In winter 2021, Petrobangla opted to cancel an LNG tender due to unaffordable prices. The country did not buy any LNG from the spot market last December and January, contributing to gas shortages for homes, businesses, and power generators. In late January and early February, between 40-50% of gas capacity was offline and stranded due to limitations on gas supply.

Why dig a deeper hole?

The risks inherent in a greater reliance on LNG are playing out right before our eyes. Yet, policymakers and international players—particularly from Japan and the United States—continue to promote LNG as a viable solution to energy sector issues. Nearly US$18 billion of LNG projects are planned in Chattogram region alone.

Meanwhile, renewable energy accounted for just 1.32% of the power mix in 2020 despite an estimated wind and solar potential of 240 gigawatts (GW) and 150 GW, respectively. Pivoting the power sector buildout to domestically sourced renewables would help reduce Bangladesh’s exposure to volatile, expensive global LNG markets.

Given the global outlook for higher LNG prices and limited supply, the renewable energy transition in Bangladesh is now more urgent than ever.

This commentary first appeared in Financial Express on June 9, 2022.