In Ohio, AEP and FirstEnergy Adopt an Audacious Strategy That Could Cost Ratepayers Dearly

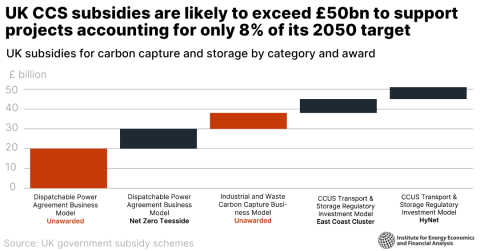

We’ve posted a research note today that explains how reregulation schemes in Ohio by FirstEnergy and AEP bear a striking resemblance to one approved in West Virginia that resulted in a recent push to raise electricity rates by 12.5 percent.

The gist of our memo, “West Virginia Bailout Emboldens FirstEnergy and AEP in Ohio,” is that the Public Utilities Commission of Ohio would be doing its public a disservice—much as the West Virginia Public Service Commission did its public a disservice—by approving the FirstEnergy and AEP plans.

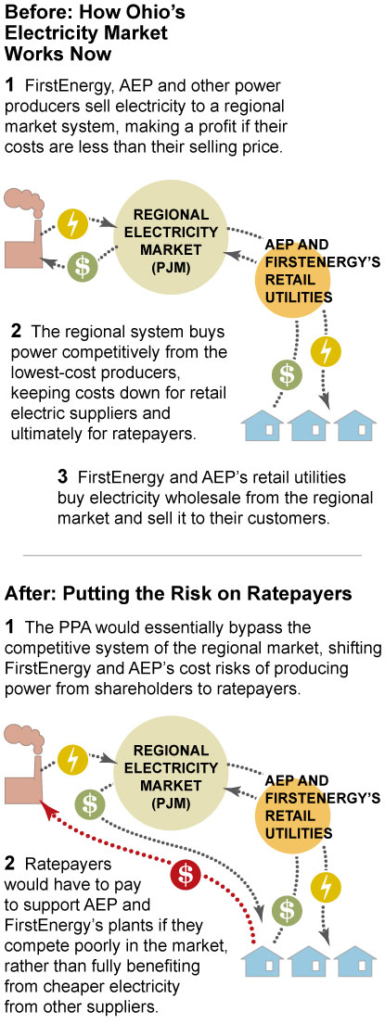

The diagram here shows how the Ohio proposals would shift the risk of higher costs for keeping the plants open from company shareholders to ratepayers.

The plants in question—7 coal-fired units and one nuclear plant—are failing to compete in evolving energy markets that are changing in part because of the rise of renewables and the promise of greater energy efficiency proposals.

AEP and FirstEnergy, which are following a broader utility industry pattern aimed at putting risk on ratepayers rather than plant owners, in effect are seeking a bailout in Ohio.

If their proposals are allowed to go through, they will cost AEP and FirstEnergy customers billions of dollars over the next decade and will preserve outdated electric plants that should be retired.

Cathy Kunkel is an IEEFA energy analyst.

West Virginia Bailout Emboldens FirstEnergy and AEP in Ohio (pdf)