IEEFA update: In extremis – crisis continues for Appalachian shale producers

March 25, 2020 (IEEFA U.S.) ‒ Another year, another gusher of red ink.

March 25, 2020 (IEEFA U.S.) ‒ Another year, another gusher of red ink.

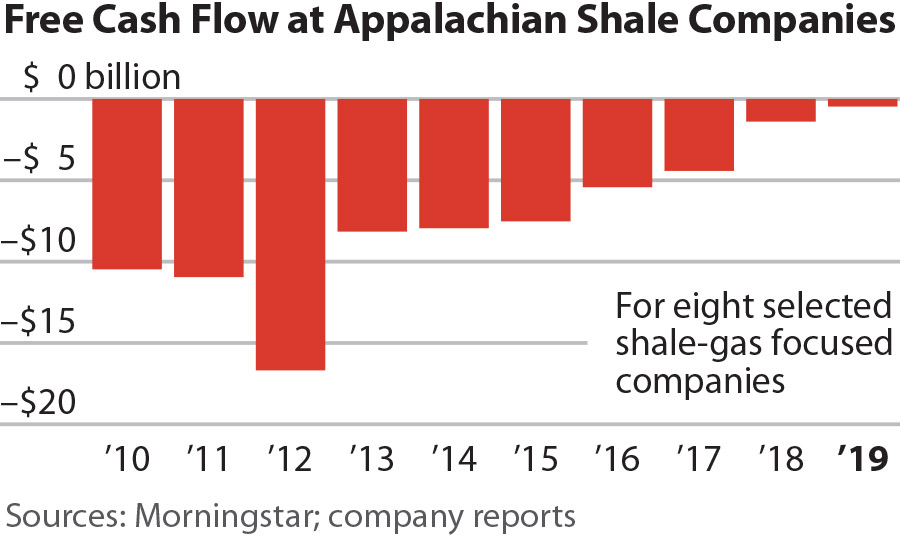

Fracking (Exploration & Production) companies in Appalachia have failed to produce positive free cash flow each year for the past decade, according to an IEEFA analysis released today.

In a briefing note (In Extremis: Crisis Mounts for Appalachian Shale Producers), IEEFA analysts found that eight of Appalachia’s largest producers collectively spent $73.4 billion more on drilling and other capital expenses than they realized by selling natural gas during the decade.

Faced with persistently low gas prices, these eight companies continued to struggle financially in 2019, recording negative cash flows of $427 million in the fourth quarter alone.

“The fracking sector as a whole has been struggling mightily throughout the decade to register positive free cash flow but for those based in Appalachia, the numbers have been even more dismal,” said IEEFA financial analyst and briefing note co-author Kathy Hipple.

Negative cash flows for the full year, at $466 million, actually represented the decade’s best performance for these companies. Yet only two of the eight firms in the IEEFA sample, Cabot Oil and Gas and EQT, were cash flow positive for the year. Five of the eight companies—Antero Resources, CNX, Chesapeake, Gulfport, and Range Resources—reported negative cash each year throughout the decade. Southwestern’s cash flow was negative in nine of the 10 years, including 2019.

“The paradox for the fracking sector is that the oil and gas production bonanza has been a cash flow bust,” said IEEFA energy finance analyst Clark Williams-Derry. “Q4 2019 was no exception.”

On an annual basis, U.S. benchmark gas prices peaked in 2008, at $8.86/MMBtu. But prices have dropped dramatically since then, falling to just $2.56/MMBtu on average in 2019, and well below $2.00 more recently.

For a brief period in March 2020, some Appalachian-focused gas producers saw their stock prices improve, even as stocks for other oil and gas companies plummeted. This bounce was propelled by an emerging narrative that lower oil prices would curtail drilling in the Permian, translating into reduced gas production from the U.S.’s most prolific shale basin. This comparative improvement in some Appalachian producers’ stock performance lost steam by late March, as natural gas prices continued to decline along with the price of oil, hitting $1.60/MMBtu.

“We expect gas prices to remain depressed for the foreseeable future and add to that decreased demand from the coronavirus pandemic and that spells continuing distress for producers in Appalachia,” said IEEFA’s director of finance Tom Sanzillo.

Kathy Hipple is an IEEFA financial analyst.

Clark Williams-Derry is an IEEFA energy finance analyst.

Tom Sanzillo is IEEFA’s director of finance.

Briefing Note: In Extremis: Crisis Mounts for Appalachian Shale Producers

Media Contact

Vivienne Heston, [email protected] tel: +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.