IEEFA U.S.: Plummeting oil and gas prices leave New Mexico’s budget short by hundreds of millions of dollars

October 20, 2020 (IEEFA) — After years of benefitting from record oil and gas revenues, global markets are signaling the beginning of the end of New Mexico’s financial reliance on fossil fuels.

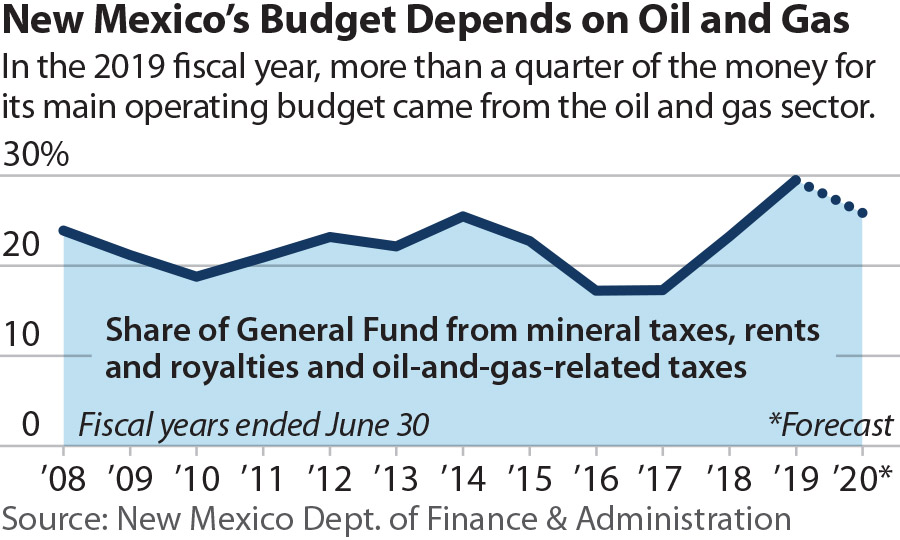

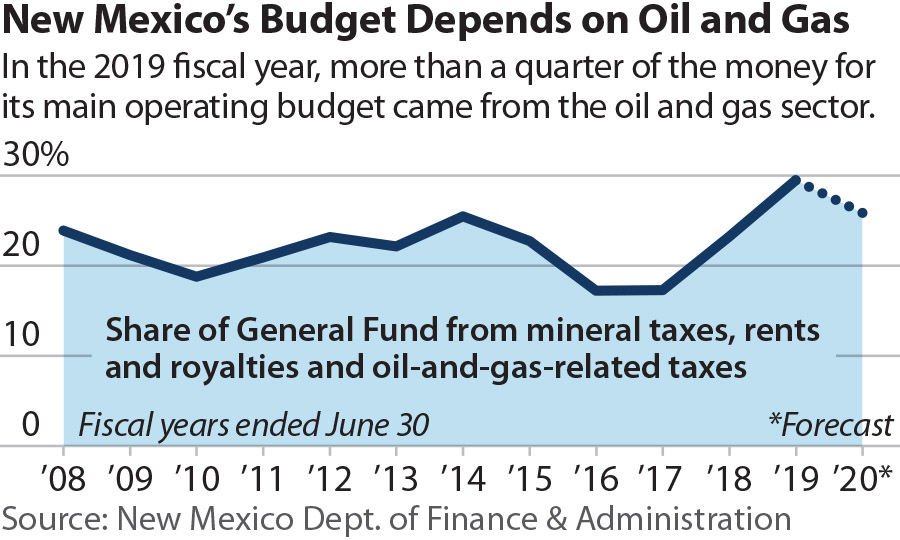

Leases, royalty payments and taxes from the oil and gas industry have directly accounted for as much as 30 percent of the state’s revenues over the last dozen years, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA). More than one-quarter of last year’s state operations budget came from the industry.

Leases, royalty payments and taxes from the oil and gas industry have directly accounted for as much as 30 percent of the state’s revenues over the last dozen years, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA). More than one-quarter of last year’s state operations budget came from the industry.

New Mexico oil prices, however, have been declining since 2014. Between 2010 and 2014, prices averaged $86 per barrel (bbl). But between 2015 and 2019, prices averaged $48/bbl—even before the coronavirus pandemic decimated demand.

“Even in its most optimistic scenario, the New Mexico Legislative Finance Committee puts the average price of oil at only $43.50/bbl through fiscal year 2022,” said Tom Sanzillo, the study’s co-author. “It’s an improvement over the historic lows hit in April 2020, but still far below what’s needed to return New Mexico to robust fiscal health. The situation is unlikely to improve anytime soon.”

Prices have edged up since reaching negative territory in the spring. For the market to get back on track, oil prices would need to soar to $80/bbl for several years; oil and gas reserve values rise with solid expectations of continued increases; company debt levels decline, credit ratings upgraded and the rate of bankruptcies drop; debt would be used primarily to create revenue-producing assets; state owned oil and gas enterprises and host governments would be fiscally and politically stable and rising demand for fossil fuel products would need to be unfettered by competitors. These features need to be in alignment, a scenario that is highly unlikely.

The industry and the state’s ailing finances are recognized by key New Mexico producers, one of whom has called the current business model “an economic disaster.” The oil and gas sector held 29 percent of the Standard & Poor’s 500 index in 1980; they now have only 2.1 percent.

ExxonMobil, which was recently removed from the Dow Jones Industrial Average, has seen its market capitalization fall below $150 billion after being worth $527 billion in 2007. The five largest publicly traded oil and gas companies—ExxonMobil, BP, Chevron, Total and Royal Dutch Shell—have funded shareholder dividends since 2010 by using asset sales and long-term debt to cover shortfalls.

A combination of high infrastructure costs, oversupply, shifts in energy demand and increasing market competition from renewable energy options have permanently weakened the industry’s financial position. Consequently, the industry’s future is likely to be one of long-term decline.

“New Mexico can no longer expect oil and gas revenues to bounce back. But the negative outlook for the oil and gas industry does not have to be a negative outlook for New Mexico,” said Sanzillo. “If heeded, this warning can result in New Mexico capturing what remains of oil and gas revenues and building future economic growth on a broader, more secure foundation,” he added.

Full report: New Mexico’s Risky Reliance on Oil Revenue Must Change: Industry Fundamentals Point to Long-Term Decline

Author Contact

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Suzanne Mattei ([email protected]) is an energy policy analyst.

Media Contact

Vivienne Heston ([email protected]), +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.