IEEFA report: Risk factors multiply for GE as California power plant shutters—20 years early

July 25, 2018 (IEEFA U.S.) – The closure of a $1 billion natural gas power plant in southern California, only 10 years into its planned 30-year life cycle, spells trouble for GE, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

July 25, 2018 (IEEFA U.S.) – The closure of a $1 billion natural gas power plant in southern California, only 10 years into its planned 30-year life cycle, spells trouble for GE, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

The report, New Risk Factors Emerge as GE Shutters California Power Plant, says that GE’s once state-of-the-art gas plant designs now feature obsolete technology, declining usage and unsustainably low revenues.

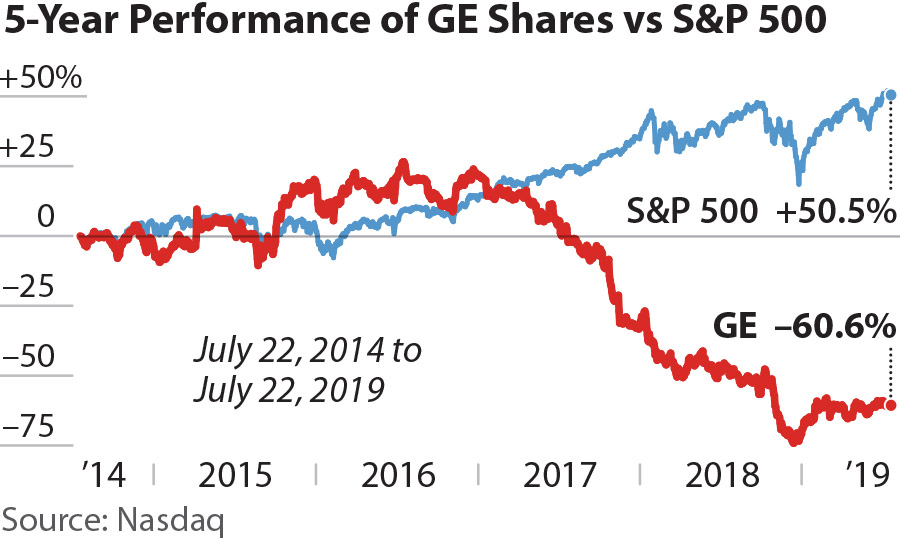

“The announced closure of the Inland Empire power plant is the latest in a string of losses for GE in its fossil fuel investments,” said lead author and IEEFA financial analyst Kathy Hipple. “The company’s plans to step up these investments means investors can expect more losses.”

WITH RENEWABLE ENERGY ALREADY COST COMPETITIVE AND CONTINUING TECHNOLOGICAL IMPROVEMENTS LEADING TO INCREASED EFFICIENCIES, California is moving away from fossil fuels.

“Gas plants now serve as back-up generation. GE has not adapted this technology to current operating conditions,” said Tom Sanzillo, IEEFA’s director of finance who co-authored the report. “The company’s continued investment in fossil fuels applies yesterday’s thinking to outmoded technology.”

Despite the hype, H-class sales were disappointing

The H-class turbines like the one at Inland Empire, were once hailed in trade publications as the ‘four-minute mile’ of gas turbine technology.

GE anticipated sales in the thousands, confident that the improvements would build on the company’s earlier F-class model. But despite the hype, H-class sales were disappointing, the analysts found. In fact, only six combined cycle plants were built using these turbines.

“AN EVEN LARGER RISK FACTOR FOR GE IS WHETHER OTHER EXISTING GAS-FIRED POWER PLANTS WILL SOON BECOME STRANDED ASSETS,” said IEEFA director of finance studies and report co-author Tim Buckley. “With an installed base globally of 7,000 gas turbines, this is no small matter for GE or its investors.”

The IEEFA analysts caution that GE cannot rebuild its assets or reputation on a “foundation of outdated technologies, speculative natural gas markets and head-in-the-sand business thinking.”

“They need to adopt a ‘double vision:’ they need to assure themselves and their investors that their investments add value to the fossil fuel sector and also that their promised efficiencies stack up against increasingly lower cost renewable energy competitors,” said Hipple.

Full Report: New Risk Factors Emerge as GE Shutters California Power Plant

Authors

Kathy Hipple is an IEEFA financial analyst.

Tom Sanzillo is IEEFA’s director of finance.

Tim Buckley is IEEFA’S director of energy finance studies, Australasia.

Media Contact

New York: Vivienne Heston ([email protected]) +1 (914) 439-8921

Sydney: Kate Finlayson ([email protected]) (+61) 418 254 237

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.