IEEFA report: Canada Trans Mountain Pipeline financials provide few clues on actual price tag and future costs

April 10, 2019 (IEEFA North America) – The controversial Trans Mountain Expansion Project is structured in a way that makes it difficult to determine how much Canadian taxpayers are paying now and will pay in the future, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

April 10, 2019 (IEEFA North America) – The controversial Trans Mountain Expansion Project is structured in a way that makes it difficult to determine how much Canadian taxpayers are paying now and will pay in the future, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

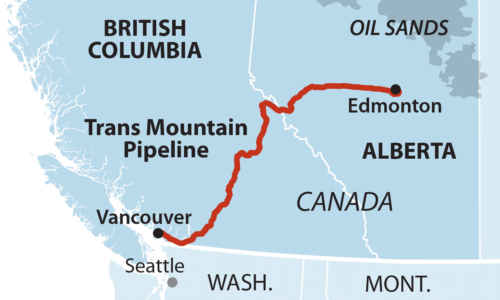

The planned expansion and ongoing operation of the pipeline is a multi-year, multi-billion-dollar project, the exact costs and liabilities of which remain unknown, according to the report: Trans Mountain Pipeline Financials: Built on Quicksand and Clear as Mud.

“The Canadian government has an obligation to tell its people how much the Trans Mountain pipeline project is going to cost,” said Tom Sanzillo, IEEFA’s director of finance who co-authored the report. “Government officials really need to be more upfront about monitoring and reporting so that the project can demonstrate whether it is being conducted in the public interest.”

Will investment be recovered when government sells the finished pipeline?

The complexity of the pipeline project also raises concerns since it involves numerous federal agencies and public/private companies, according to the report. The Canadian government has already routed payments to fund and develop the pipeline through a maze of government agencies with different missions, reporting mechanisms and accounting standards.

Transparent accounting is especially needed in light of several important factors, according to Sanzillo and co-author Kathy Hipple, an IEEFA financial analyst:

- the controversial nature of the project,

- the lack of commercial standards,

- the size and complexity of the acquisition,

- construction and operations costs, and

- the financial risks involved with a resale of the pipeline.

Recently, Canada’s Parliamentary Budget Officer (PBO) issued an oversight study examining the economic impacts of the government’s purchase and development of the Trans Mountain Pipeline. The study assessed certain risk factors that might impact the cost, such as construction expenditures, timing and additional mandates. It also examined the short- and long-term employment outlook related to the pipeline. The study was an important first step in assessing the economic impact of the project.

“People should be concerned, not only about the ongoing fiscal implications of the Trans Mountain Pipeline project but also about how much of the $6 billion and counting investment will ultimately be recovered when the government sells the finished pipeline in an increasingly high-risk and volatile market,” said Hippple

Full Report: Trans Mountain Pipeline Financials: Built on Quicksand and Clear as Mud

Author Contacts

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

Media contact

Vivienne Heston, IEEFA, [email protected], +1 (914) 439-8921