Pakistan’s PKR2.1 trillion capacity payments crisis triggers power purchase agreement renegotiations with independent power producers

Revising power purchase agreements is necessary and has the potential to benefit both the government and independent power producers, but the renegotiation process should be conducted transparently

December 5, 2024 (IEEFA Asia): As capacity payments in Pakistan reached a staggering PKR2.1 trillion in 2024, exacerbated by reduced industrial output and shrinking grid demand, the government was forced to renegotiate power purchase agreements (PPAs) with Independent Power Producers (IPPs) under the International Monetary Fund’s directive.

A new report from the Institute for Energy Economics and Financial Analysis (IEEFA) analyzes how these renegotiations have progressed and finds that while the government’s targeting of middle-aged, underutilized fossil fuel-based plants with no debt obligations is an appropriate solution, the negotiation process should be more transparent.

“Developing countries, riddled with excess capacity payments and surplus power generation, are using contract renegotiation to reduce the burden of capacity payments and save foreign exchange. In Pakistan, IPPs have allegedly profited excessively by under-reporting efficiency gains and over-invoicing, thus necessitating PPA renegotiations,” says report author Haneea Isaad, an Energy Finance Specialist at IEEFA.

Recurring renegotiations and discounted deals

Renegotiating contractual agreements is common in the private sector if they are precipitated by changing economic conditions, such as the significant macroeconomic shocks experienced by Pakistan. The government attempted PPA renegotiations in 1998, 2012, 2020, and now in 2024.

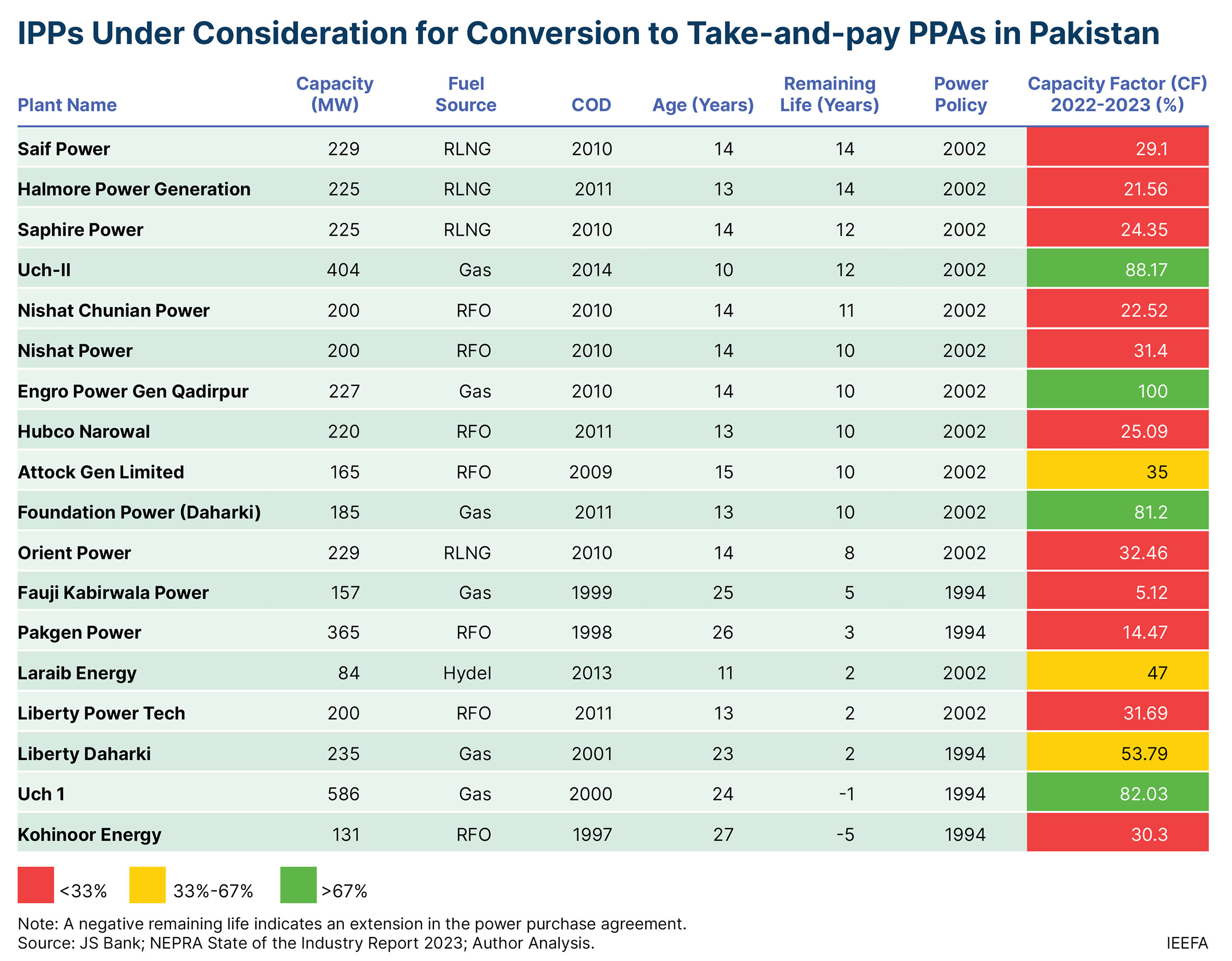

During the current contract revisions, PPAs with five IPPs were terminated as a first step. Two of the five IPPs took haircut deals, accepting a discount of up to PKR20 billion. 18 other IPPs face possible conversion to take-and-pay contracts, whereby the state-owned off-taker will only be liable to pay for energy consumed by the grid, eliminating capacity charges.

The IPPs and their investors have criticized the allegedly unfair deals and coercive tactics used for contract termination. They assert that repeated contract renegotiations and intimidating tactics will hurt investor confidence and future expansion opportunities in the power sector.

An examination of the PPA terms reveals that the incentives offered to IPPs have been overly generous with backstopped payment guarantees, dollar indexation, and high return on equity allowances, contributing to Pakistan’s ever-rising power sector circular debt.

“Considering that the IPPs under review have paid off their debts and have earned reasonable returns on equity, contract termination or conversion to a take-and-pay basis is a reasonable proposition given Pakistan’s persistent economic struggles and foreign exchange shortage,” says Isaad.

Potential benefits for the government and IPPs

Many plants scheduled for premature PPA termination and conversion to take-and-pay contracts have had low capacity factors. Some were in the middle of their PPAs or close to retirement, while others were undergoing a PPA extension and had paid off all long-term debts. Furthermore, these plants operate on furnace oil or imported liquified natural gas, resulting in a high generation cost and low dispatch.

Many of these IPPs are owned by local conglomerates with diverse business portfolios. These could serve as secondary markets for power offtake once the government fully implements its wheeling regulations and establishes bilateral markets. The government has even offered this as a concession to the IPPs in its renegotiation package.

While renegotiation could allow the government to save scarce economic resources, the IPPs may also have a chance at quick compensation for unpaid dues or the ability to sell power to secondary markets once Competitive Trading Bilateral Contract Market (CTBCM) reforms are operationalized.

“This process could be mutually beneficial, with IPPs quickly recovering unpaid dues and the government avoiding paying for unrequired idle capacity. However, the negotiation process should be commercial and transparent to ensure optimal outcomes.”

Optimizing economic outcomes in the long term

Pakistan’s continued emphasis on generation addition, without consideration of the principle of ‘least-cost’ based expansion, led to the entrenchment of unsustainable incentives, which are challenging to modify. Contract renegotiations and early terminations can benefit the government in the short term. However, the inflexible PPA model should be revised in the long term, adopting a staggered approach for phasing out incentives.

“While competitive procurement may provide the final solution, transitioning to a fully liberalized market will take years, if not decades. Until that happens, PPAs will likely govern a significant share of the power market,” adds Isaad.

Isaad recommends that robust auditing processes be established and that future IPP solicitation should be through competitive bidding aligned with the country’s socio-economic development and budget to prevent recurrences of the current situation.

Read the report: Optimizing Pakistan's economy by renegotiating power purchase agreements

Author contact: Haneea Isaad ([email protected])

Media contact: Josielyn Manuel ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)