Keeping pace with building new energy projects is key to maintaining reliability

Key Takeaways:

The Australian Energy Market Operator’s latest update to its 2023 Electricity Statement of Opportunities (ESOO) features a number of reliability risks.

AEMO’s update highlights the importance of a timely rollout of new renewables, storage, transmission and distributed energy resources to maintain reliability.

[22 May 2024] IEEFA Australia: The Australian Energy Market Operator (AEMO) on 21 May published an update to its 2023 Electricity Statement of Opportunities (ESOO) for the National Electricity Market (NEM).

The ESOO shows that the key to maintaining reliability to build out new energy projects at a fast pace.

Johanna Bowyer, Lead Analyst, Australian Electricity at IEEFA, stated:

“The AEMO ESOO shows that if transmission, generation and storage build-out proceeds per the timelines considered typical by AEMO, alongside committed investments in coordinated consumer energy resources, NSW and Victoria are forecast to breach the reliability standard over most of the outlook period.”

“Delays to Project Energy Connect, Central West Orana Renewable Energy Zone, a number of battery energy projects and other energy projects, alongside changes to demand forecasts and other factors, have contributed to a poorer reliability outlook over the next few years.”

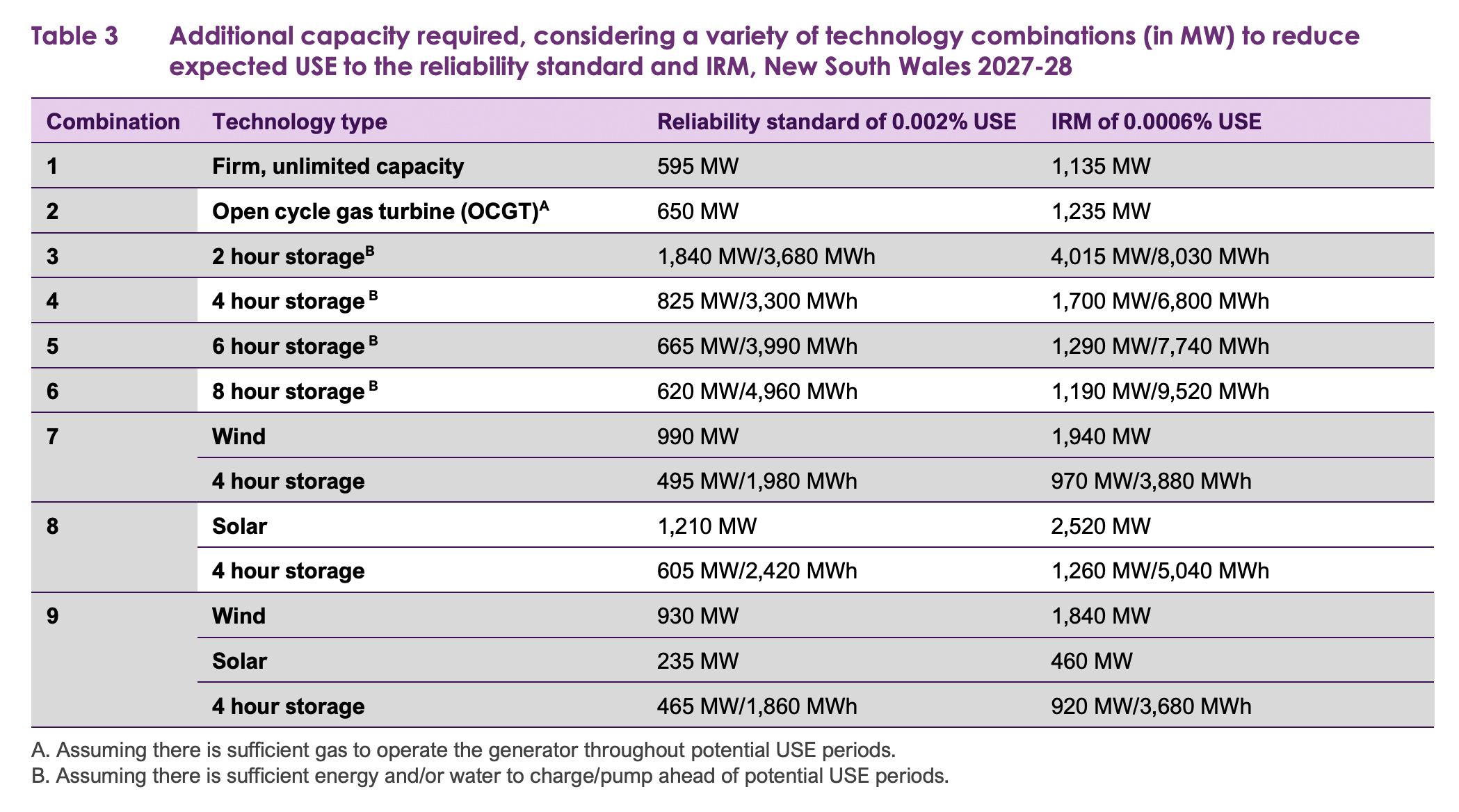

“But the AEMO report also shows how the reliability risks could be managed. Over the next few years in NSW the gap ranges from 510MW to 695MW. The report shows that this could be filled by installing a few energy projects, for example a four-hour storage project of 825MW / 3,300MWh could fill the 2027-28 gap of 595MW.

“The announced battery projects at Tomago (500MW / 2,000MWh) and Mt Piper (500MW / 2,000MWh) could fill that 2027-28 gap if they were available in time. These projects have been publicly announced but are not yet committed or anticipated, so are not yet included in AEMO’s modelling.

“So, we know that while the central scenario from AEMO does demonstrate there are risks, the risks could be managed.

“The reserves mechanisms in the NEM will also help maintain reliability.

“Further, the federal and state schemes sensitivity modelled by AEMO shows a more optimistic reliability outlook, based on what might happen if more energy projects go ahead, and projects are installed on schedule – rather than assuming a typical delay as per the central scenario.”

“If a larger number of energy projects are included in the outlook, and these projects are assumed to be installed on time as per the developer-advised schedule, while coordinated consumer energy resource uptake grows more strongly, the reliability standard is maintained except for in NSW in 2025-26 and some of the later years in Victoria.

“This demonstrates how important it is to keep building new energy projects at pace. Governments and the energy industry need to have all hands on deck to quickly roll out new energy projects. Auction processes like the Capacity Investment Scheme will be key to driving in new capacity in a timely manner. But we cannot afford the lengthy planning and grid commissioning processes that we have been seeing.

“Further, the stronger reliability forecast when we see higher levels of coordinated consumer energy resources demonstrates the valuable contribution these resources can make to supporting the grid. Governments need to ensure the right regulations, policies and plans are in place to support more effective integration of distributed energy resources.

“In addition, energy efficiency measures like switching from resistive to heat pump-based appliances could further support reliability.

“Quickly building new energy projects and taking action on the demand side will be key to maintaining reliability as ageing coal assets exit the system.

“For Eraring to exit on time while staying within the reliability standard, all the energy projects in AEMO’s ‘federal and state schemes’ modelling would need to be built on schedule, while coordinated consumer energy resource uptake grows, and additionally, the 2025-26 reliability risk in NSW would need to be addressed by quickly bringing in additional energy supply, storage or demand-side projects.

“Or, when looking at the central scenario, a number of energy projects would need to be accelerated to reduce reliability risks over the coming years – for example the aforementioned battery projects. It will come down to how quickly new projects can be installed and if the delays we have been seeing can be avoided.

“There are potential negative consequences from keeping Eraring online for longer, like higher emissions and significant cost to NSW taxpayers.

“Our own IEEFA modelling demonstrated that if Eraring stays online for longer, other coal-fired power stations in NSW would be impacted financially, as they would sell less power into the market. So subsidising Eraring to stay open for longer could have the unintended consequence of making other coal-fired power plants financially vulnerable.

“We note that a significant amount of the ESOO report is based on the more stringent Interim Reliability Measure (IRM), which is a measure used to support a few specific electricity market processes and was extended last year. This means some reliability risks might appear larger compared to the prior ESOO. The extension of the IRM was opposed by most stakeholders. There is evidence suggesting consumers are not willing to pay for an IRM level of reliability.

“To keep to an IRM level of reliability requires additional projects and demand-side measures.”

Media contact: Amy Leiper [email protected] +61 (0) 414 643 446

Author contacts: Johanna Bowyer [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)