India’s residential rooftop solar capacity to increase by ~60% in FY2023

Rising demand among consumers coupled with strong government support is propelling residential rooftop solar installations

Key Takeaways:

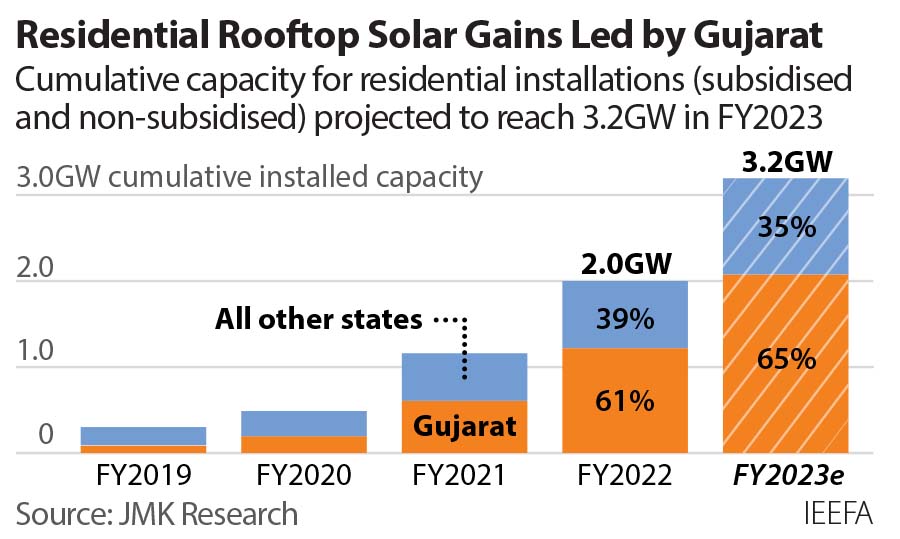

From 2 gigawatts (GW) capacity of cumulative installation (as of FY2022), the residential solar market is likely to reach a size of 3.2GW by FY2023

The new and simplified rooftop solar subsidy scheme (introduced by the Indian government in July 2022) has the potential to significantly catalyse the growth of the residential solar market

The integration or bundling of multiple business aspects (financing, insurance, equipment supply, installation, O&M, etc.) by suppliers could ease the consumer buying process

6 October (IEEFA India & JMK Research): The increasing need for cost savings and growing awareness among residential consumers, along with a strong push by the central government, is helping accelerate the pace of rooftop solar installations in India’s residential segment, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

“India has more than 300 million households and is endowed with abundant sunshine almost throughout the year, with an annual average of 300 sunny days. This shows that the potential for rooftop solar installations in residential spaces is huge in India. We expect the growth of residential rooftop solar installations to accelerate in the near term across India because of the strong policy push and resurgent market demand,” says the report’s co-author Vibhuti Garg, Director – South Asia, IEEFA.

“The Indian residential rooftop solar segment is at the cusp of a robust growth phase. From the 2 gigawatts (GW) cumulative installed capacity (as of fiscal year (FY) 2022), the residential market will likely reach 3.2GW by FY2023.”

Regarding demand-side drivers, the report highlights that there has been a key change brought about in consumer behaviour and demands after COVID-19.

“The lack of consumer awareness had been one of the major impediments to adoption, especially in the pre-COVID-19 era. However, post-COVID-19, there has been a strong surge in demand, backed by enhanced consciousness about cost savings, the environment, etc.,” says co-author Jyoti Gulia, Founder, JMK Research.

“Interestingly, while the pace of the solarisation of India’s residential segment has been underwhelming, the country has been the world's least expensive residential solar power market for about a decade.”

In 2020, the average cost of a residential rooftop solar system in India was US$658 per kilowatt (kW), declining by 73% from the 2013 level. In comparison, in 2020, the residential rooftop solar cost in leading residential markets, such as Japan, the United Kingdom, Switzerland and the U.S., was 3.3x to 6.4x that of India.

The report adds that the central government’s recent push by launching a single national digital portal to simplify the process of residential rooftop solar installations and formalising a direct benefit transfer mechanism will boost capacity addition.

“The new Central Financial Assistance (CFA) scheme will allow residential consumers to buy rooftop solar systems from any registered supplier of their choice. This broadens consumers’ options for quality products and services,” says co-author Prabhakar Sharma, Senior Research Associate, JMK Research.

While initiatives by the central government are positive developments, the report also finds that some policy hurdles persist at the state level. For example, state governments must resolve issues such as delays in net metering approvals and proper communication of the benefits of rooftop solar installations. Sometimes, state electricity distribution companies (DISCOMs) delay subsidy payments to the installers, disrupting the latter’s working capital flow.

“Concerning the residential solar regulations, all state electricity distribution companies (DISCOMs) must grant net metering approvals to the consumers within a strict and short timeline. In the case of residential rooftop solar systems, DISCOMs, in general, need to be restricted to carrying out two activities: inspecting solar plants and selling the net meters,” says co-author Akhil Thayillam, Senior Research Associate, JMK Research.

In addition to policy hurdles, some other challenges that the residential rooftop solar segment currently faces are increasing overall system costs (in the past couple of years) and weak financing support.

To better understand the states that are performing better in attracting residential rooftop solar installations, the report also provides a State-Wise Attractiveness Index for Residential Rooftop Solar Sector. We assigned each state ‘marks’ out of five, with one meaning the ‘least favourable’, across four different parameters: electricity cost savings, net metering favourability, subsidy outlook and DISCOM rating.

Our findings show that Gujarat, Haryana and Maharashtra are the three most attractive states for residential rooftop solar installations.

Read the report: Indian Residential Rooftops: A Vast Trove of Solar Energy Potential

Webinar: Register here for the webinar on the Residential Rooftop Solar Market in India at 3pm IST, 6 October.

Media contact: Rosamond Hutt ([email protected]) Ph: +61 406 676 318

Author contacts: Vibhuti Garg ([email protected]); Jyoti Gulia ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)