IEEFA U.S.: Four of five oil supermajors pay investor dividends even as operations losses mount

May 26, 2020 (IEEFA) — Four of the world’s five largest oil and gas companies spent more cash on dividends and share buybacks during the first quarter of the year than they generated from their core business operations, according to a briefing note released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

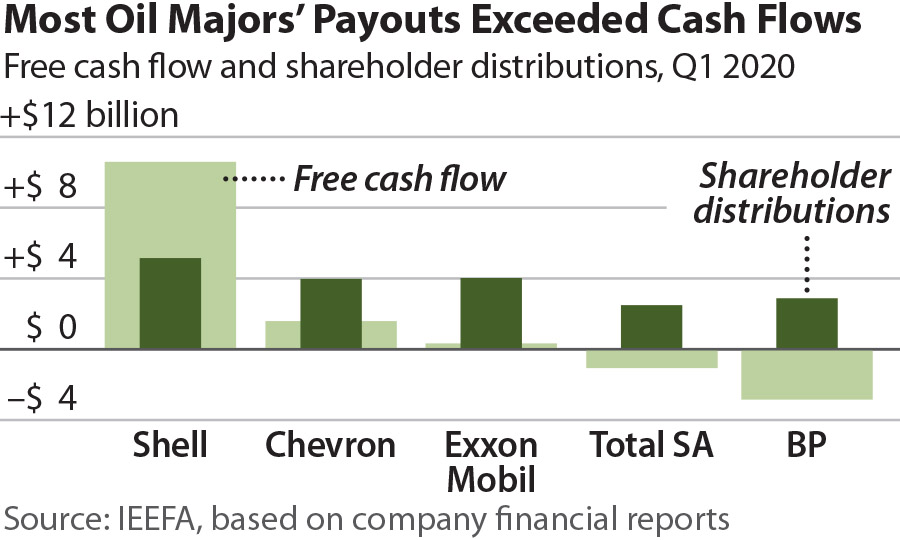

The analysis found that the five oil and gas supermajors collectively paid out $18.5 billion in dividends and buybacks during the quarter, while generating only $8.6 billion in free cash flows. The companies covered the $9.9 billion shortfall with other sources of cash, including borrowing, asset sales, and drawdowns of cash reserves.

“Typically, investors expect private companies to fund payments to shareholders out of free cash flow—the cash generated by the company’s operations, minus cash spent on capital projects,” said Clark Williams-Derry, an IEEFA energy finance analyst. “When a company deviates from this standard, investors raise questions about the firm’s business model, applying extra scrutiny to its financial underpinnings.”

Report highlights:

- Two of the companies – BP and Total ‒ spent more during the first quarter on capital projects than they received from operations, yet still paid dividends to shareholders.

- Chevron and ExxonMobil reported modest positive free cash flows in the first quarter, but paid out far more to shareholders, making up the deficit with cash from other sources.

- Royal Dutch Shell was the only oil supermajor to stay in the black. The company generated $10.6 billion in cash from the oil and gas business while spending $5.2 billion on dividends and share buybacks during the quarter.

The IEEFA analysis found that the five supermajors—ExxonMobil, Chevron, Shell, BP and Total SA—have been spending beyond their means for much of the past decade. Together, the companies generated cumulative free cash flows of $340 billion from the beginning of 2010 through the end of 2019, while spending $556 billion on dividends and buybacks, resulting in a net deficit of $216 billion.

“Today’s global oil and gas market—characterized by faltering demand, low prices, and rising volatility—will further weaken the industry’s prospects for generating the reliable, robust cash flows that attract investors,” said IEEFA’s director of finance Tom Sanzillo.

“In this environment, oil and gas majors now face a troubling choice: They can cut dividends to avoid taking on new debt or they can borrow money to sustain short-term shareholder distributions, while potentially weakening their long-term finances,” said co-author Kathy Hipple.

Briefing Note: In Q1, Four of Five Oil Majors Paid More Cash than They Made from Operations

Authors

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Tom Sanzillo ([email protected] is IEEFA’s director of finance.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

Media Contact

Vivienne Heston [email protected], +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.