IEEFA update: Oil majors paid $216 billion more to shareholders than they earned directly from business over the past decade

April 6, 2020 (IEEFA U.S.) ‒ The world’s five largest publicly traded oil and gas companies shelled out a total of $71.2 billion in dividends and share buybacks last year, while generating only $61.0 billion in free cash flow. This “deficit spending” points to a deeper crisis in the increasingly volatile industry, according to a briefing note released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

In 2019, ExxonMobil paid $9.9 billion more to shareholders during the year than it generated from its core business operations, while Shell paid $7.4 billion more. Meanwhile, Chevron’s cash flow surplus declined by $6.4 billion, year over year, while Total and BP both improved their cash performance compared with 2018.

In 2019, ExxonMobil paid $9.9 billion more to shareholders during the year than it generated from its core business operations, while Shell paid $7.4 billion more. Meanwhile, Chevron’s cash flow surplus declined by $6.4 billion, year over year, while Total and BP both improved their cash performance compared with 2018.

With shareholder payouts exceeding free cash flow, ExxonMobil and Shell relied on other sources of cash to sustain dividends and share buybacks.

“For the five supermajors, 2019 was a big comedown from the previous year, when they produced $17 billion more in free cash flow than they paid out to shareholders,” said IEEFA energy finance analyst and lead author of the report Clark Williams-Derry.

All told, these five companies generated $340 billion in free cash flows from 2010 through 2019, while rewarding their shareholders with $556 billion in share buybacks and dividends—leaving a $216 billion cash flow deficit that these companies covered with other sources, including new borrowing and asset sales. In other words, over the last decade, these five companies covered only 61 percent of their shareholder payouts from free cash flows, while funding 39 percent of those payouts by other means.

“Everything seems fine when the dividend checks keep coming in the mail, but there is an underlying weakness in the supermajors’ practices that should give investors pause,” said Tom Sanzillo, IEEFA’s director of finance.

Oil executives have managed these shareholder payouts carefully, often aiming to keep dividends stable or growing over time, while using share buybacks as an efficient means to distribute surplus cash, according to IEEFA analysts.

The five oil supermajors have employed a range of dividend strategies in response to their cash challenges. ExxonMobil and Chevron maintained steady dividend increases over the decade, betting that investors would reward their commitment to shareholder payouts amidst oil market instability. Meanwhile, Shell boosted dividends significantly in some years and trimmed them back in others, while BP and Total cut dividends substantially after oil prices fell in 2015 and 2016, helping narrow their cash flow deficits in those years.

BP led the supermajors in asset sales, raising $70.8 billion since 2010, trailed narrowly by Shell at $70.2 billion. Yet 2019 represented the low-water mark for asset sales over the decade, with just $16.9 billion in asset sales across the five firms—even though the companies have all announced that a significant portion of their assets are for sale.

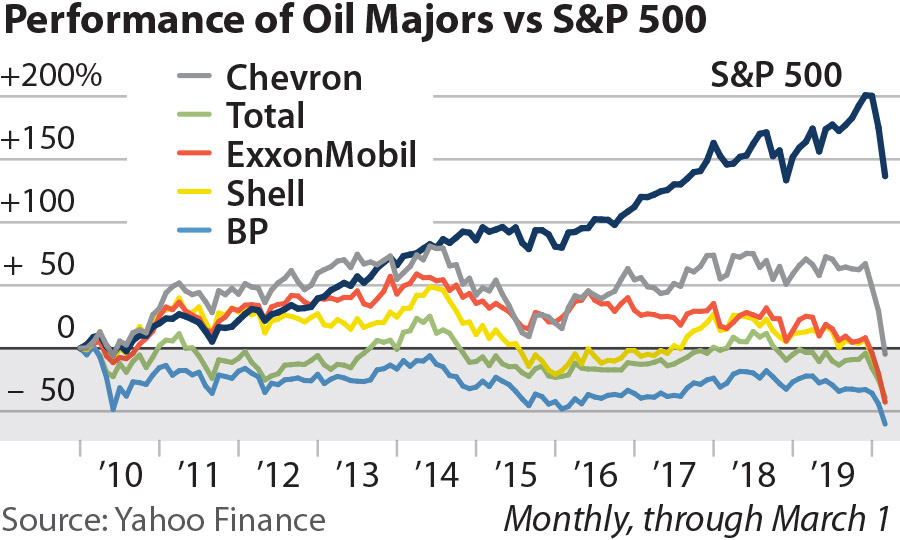

“Even before the twin crises of COVID-19 and the Saudi-Russia price war, stock market valuations reflected decreasing confidence in the industry,” said Williams-Derry. “The only way forward is downward for the foreseeable future.”

Full report: Beyond Their Means: Oil Majors Pay More to Shareholders Than They Earn by Selling Oil and Gas

Authors

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

Media Contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.