IEEFA Report: Two Pipelines Proposed for Construction From West Virginia Into Virginia and North Carolina Show Overbuilding by Natural Gas Industry

CLEVELAND, APRIL 27, 2016 (IEEFA) — The Institute for Energy Economics and Financial Analysis (IEEFA) today published a study concluding that natural gas pipelines proposed for construction from West Virginia into Virginia and North Carolina are indicative of a rush toward industry overbuilding.

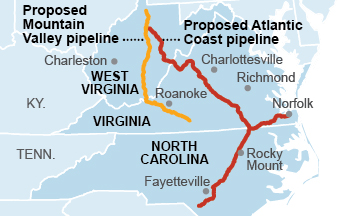

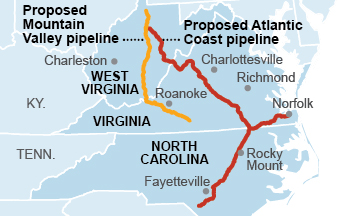

The study, “Risks Associated With Natural Gas Pipeline Expansion Across Appalachia,” examines the proposed Mountain Valley Pipeline, which would traverse West Virginia into eastern Virginia, and the proposed Atlantic Coast Pipeline, which would cross Virginia and branch deeply into North Carolina. The pipelines combined would run for more than 800 miles and together would cost roughly $9 billion.

Tom Sanzillo, IEEFA’s director of finance and a co-author of the study, said the projects are not being adequately scrutinized by regulators and that their construction would put local landowners and towns at risk alongside electric ratepayers. “Demand for natural gas will not keep pace with the level of capital investment currently going into pipeline infrastructure,” Sanzillo said. “Those affected, at bottom, are the communities through which the pipelines run and the consumers who pay the rate increases needed to underwrite pipeline development.”

Cathy Kunkel, an IEEFA energy analyst and lead author of the report, said the projects show how developers, who are guaranteed a return on their investment by the Federal Energy Regulatory Commission, are rewarded for overbuilding.

Cathy Kunkel, an IEEFA energy analyst and lead author of the report, said the projects show how developers, who are guaranteed a return on their investment by the Federal Energy Regulatory Commission, are rewarded for overbuilding.

“There’s a widespread assumption that a pipeline would only be proposed if it is necessary, but this assumption is not supported by the facts,” Kunkel said. “We found that the dynamics of the pipeline business tend toward building excess pipeline capacity. Major pipeline companies are competing with each other to build out the best, most well-connected pipeline networks. And utility companies are entering the pipeline space because much of the risk of overbuilding can be pushed off onto captive ratepayers. And natural gas production companies are entering the pipeline business because their core business of drilling is underperforming and they are looking for ways to boost revenue and investment value. These kinds of financial considerations on the part of individual companies do not add up to the kind of socially rational, long term planning of natural gas infrastructure that we need.”

The study, published by IEEFA at the request of Appalachian Mountain Advocates and Appalachian Voices, is especially important for its findings on flawed regulatory processes, said Joe Lovett, Executive Director of Appalachian Mountain Advocates. “This report shows why FERC must consider whether new pipelines are actually needed in our region,” Lovett said. “It makes plain that FERC must consider all the proposed pipelines together. FERC may not allow pipeline companies to take private property before it conducts an informed analysis about whether such takings are necessary.”

Among the report’s conclusions:

Overbuilding puts ratepayers at risk of paying for excess capacity, landowners at risk of sacrificing property to unnecessary projects, and investors at risk of loss if shipping contracts are not renewed and pipelines are underused.

The Federal Energy Regulatory Commission facilitates overbuilding. The high rates of return on equity that FERC grants to pipeline companies (up to 14 percent), along with the lack of a comprehensive planning process for natural gas infrastructure, attracts more capital into pipeline development than is necessary.

The arguments for the Atlantic Coast Pipeline have not been adequately scrutinized. While the pipeline developers have asserted that some of the gas supplied is needed by Dominion Resources for its new Brunswick and Greensville natural gas plants, Dominion has told the Virginia State Corporation Commission that it can supply those plants through the existing Transco pipeline.

While ratepayers of the utilities (largely Duke Energy and Dominion Virginia Electric and Power) that have contracted to ship gas through the Atlantic Coast Pipeline would be burdened with the costs of building the pipeline (which would include a profit to the developers, largely Duke and Dominion), they will probably not realize the economic benefits promised by the developers.

Communities along the Mountain Valley Pipeline face the risk that EQT Corporation (which owns the largest stake in that pipeline and has contracted for the largest volume of capacity on the pipeline) will continue to be harmed financially by weak natural gas prices and will not be a long-term, stable partner for these communities.

Full report

Media Contacts:

Karl Cates, Institute for Energy Economics and Financial Analysis, 917-439-8225, [email protected],

Joe Lovett, Appalachian Mountain Advocates, 304-520-2324, [email protected]

Kate Rooth, Appalachian Voices, 434-293-6373, [email protected]

About IEEFA

The Cleveland-based Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy and to reduce dependence on coal and other non-renewable energy resources.