IEEFA report: Dim future for Illinois Basin coal

December 10, 2019 (IEEFA U.S.) ‒ The Illinois Coal Basin, one of the most important coal‑producing regions in the U.S., will likely see declining production and mine closures as the industry continues to contract in the wake of coal-fired power plant retirements and falling exports, concludes a report published today by the Institute for Energy Economics and Financial Analysis.

December 10, 2019 (IEEFA U.S.) ‒ The Illinois Coal Basin, one of the most important coal‑producing regions in the U.S., will likely see declining production and mine closures as the industry continues to contract in the wake of coal-fired power plant retirements and falling exports, concludes a report published today by the Institute for Energy Economics and Financial Analysis.

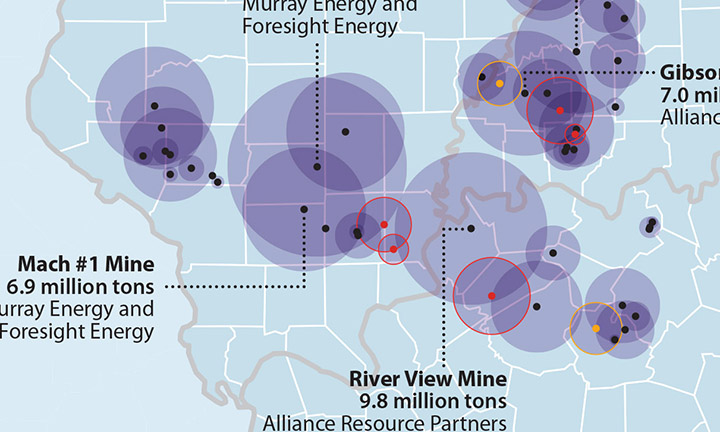

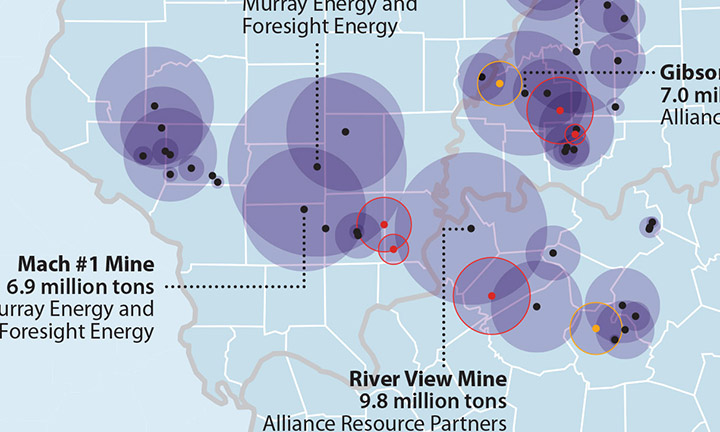

The report, Dim Future for Illinois Basin Coal, details how coal companies in Illinois, Indiana, and Kentucky, which are already facing challenging prospects, will most likely fade away over the next two decades. A significant number of the coal-fired power plants supplied by the three‑state Basin are already scheduled to be shut down by utilities while others are being run less and less often, trends that will likely continue.

By 2024, at least 15 U.S. plants that buy Illinois Basin coal will be fully or partially retired

“From the beginning of 2019 through 2024, at least 15 American plants that buy Illinois Basin coal—in Alabama, Florida, Georgia, Indiana, Kentucky, North Carolina and Tennessee—will be fully or partially retired,” said Seth Feaster, an IEEFA data analyst and lead author of the report. “That number, which reflects formal announcements by utilities, is likely to grow as the economics of coal-fired generation continue to deteriorate relative to renewables and gas.”

“Meanwhile, demand for Illinois Basin coal is shrinking in key overseas markets too, a trend driven by market forces similar to those at work in the U.S.: foreign competition, and increasingly attractive forms of alternative power generation,” Feaster said.

THE REPORT OFFERS A COMPANY-BY-COMPANY OVERVIEW OF THE ILLINOIS BASIN COAL INDUSTRY, noting the coal-mining companies that stand to be affected include (in order of production level): Alliance Resource Partners, Murray Energy and its partner Foresight Energy, Peabody Energy, Hallador, Arch Coal and White Stallion.

IEEFA also notes that the rising number of mine idlings or closures in the past year or so by Alliance, Foresight/Murray, and Peabody may be insufficient to match falling demand from power plants or declines in exports in the wake of recent diminishing international market prices.

Report conclusions:

- The Illinois Basin’s customer base in the U.S. continues to shrink as utilities move toward other forms of generation.

- Export-market demand is trending downwards and will continue to do so because the same policy and market forces at work in the U.S. are also transforming power-generation business models in other countries and regions.

- More Illinois Basin mines will close in the months and years ahead as the coal industry continues its structural and permanent decline.

- Communities and areas that prepare for and are proactive in embracing the energy transition will fare best.

THE REPORT URGES POLICYMAKERS IN ILLINOIS, INDIANA AND KENTUCKY TO PREPARE FOR IMPACTS on industry workers and local households, community tax bases, businesses and the regional economy as a whole, as well as provide leadership and sound policy initiatives to take advantage of the changes that are taking place in the energy industry.

Author Contacts

Seth Feaster, [email protected] +1 (917) 670-4025

Karl Cates, [email protected] +1 (917) 439-8225

Media contact

Vivienne Heston [email protected] +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.