IEEFA: Frackers produce positive cash flows in 2020 with deep capital expenditure cuts

March 24, 2021 (IEEFA)—A cross-section of 30 shale oil and gas producers marked the first full year of positive free cash flows since the fracking boom began—but only after deep cuts to capital expenditures that raise troubling questions about the industry’s future.

The report by the Institute for Energy Economics and Financial Analysis (IEEFA) found the 30 producers generated $1.8 billion in free cash flows last year after slashing capital spending by $20 billion from the previous year.

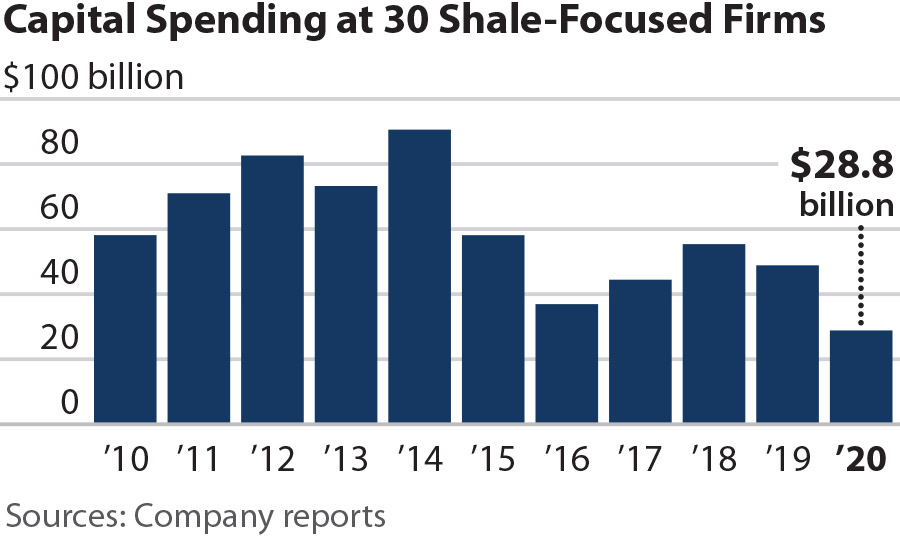

“Last year’s positive free cash flows were only possible because shale companies cut their capital spending to the lowest level in more than a decade,” said Clark Williams-Derry, IEEFA energy finance analyst and co-author of the report. “Restraining capital spending could help the fracking sector generate cash, but low levels of investment also undermine the industry’s prospects for growth.”

Free cash flow is defined as the amount of cash generated by a company’s core business, minus its capital spending. Since 2010, the 30 companies examined by IEEFA had reported negative free cash flows totaling $158 billion.

Last year was a difficult time for the oil industry, as the global coronavirus pandemic pummeled the sector with falling demand, low prices and a wave of bankruptcies. The 30 producers responded by slashing capital spending to $28.8 billion, a 41 percent cut from the 2019 figure of $48.9 billion. Capex reductions, which started in mid-2018, have helped the companies report positive free cash flows during five of the preceding seven quarters.

“Despite this turnaround, a decade of dismal financial performance casts a shadow over the industry,” said Trey Cowan, IEEFA oil and gas industry analyst and report co-author. “The positive free cash flows pale in comparison to the industry’s accumulated debt loads.”

The 30 shale producers owe almost $90 billion in long-term debt, and the reductions in capital expenditures are unlikely to ensure that the industry grows. U.S. oil production plunged last year by 332 million barrels, the largest one-year drop in history.

“Oil and gas producers face a dilemma,” said Ashish Solanki, an IEEFA fellow and co-author of the report. “Keeping capital spending in check could improve the industry’s cash performance. Yet falling investment will also constrain production.”

Full report: In a Tumultuous 2020, Shale Firms Slashed Capex to Generate Cash

Author contacts

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Trey Cowan ([email protected]) is an IEEFA oil and gas industry analyst.

Ashish Solanki ([email protected]) is an IEEFA fellow.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.