IEEFA: ExxonMobil Planned Asset Sales

ExxonMobil asset sales to fill cash gap a strategic misstep, likely to be distressed

Key Takeaways:

Oil majors struggle to balance long-term production needs with investors’ short-term expectations

April 2, 2020 (IEEFA U.S.) ‒ ExxonMobil’s strategy of selling assets to make up for inadequacies in its annual cash budget are likely to continue to fall short, according to a briefing note released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

Even before this year’s oil price dive, ExxonMobil’s planned assets sales faced a challenging market, according to the IEEFA analysts. In 2019, the company anticipated $5 billion in proceeds from asset sales, but produced only $3.7 billion, well below target and about $1 billion below the company’s ten-year annual average.

At its Investor Day conference in March, ExxonMobil lowered its annual asset sales target from $5 billion to $3 billion per year through 2025. Yet even that goal may be unrealistically high in today’s market.

“ExxonMobil’s failure to meet its cash targets for asset sales, particularly at a time of low oil prices, contributes to the company’s poor cash flow. This is a significant contributing factor to Exxon’s deteriorating stock performance,” said IEEFA financial analyst Kathy Hipple, lead author of the note.

ExxonMobil isn’t alone in its divestment plans: other global oil and gas supermajors plan to sell off assets as well. With numerous large oil companies looking to unload assets that do not fit the definition of high-grade, the risk is that any sales ‒ if they occur at all ‒ may garner substantially less than anticipated. Further, in the current environment where many companies are reducing capital expenditures, less money will be available for acquisitions.

With weak, or potentially no, asset sale proceeds, ExxonMobil will increasingly be forced to borrow to cover its dividend payments and capital expansion plans, Hipple said.

Moody’s, which gives Exxon an Aaa rating, cited rising debt concerns when putting the company on negative outlook. Last week, during a turbulent time in the bond markets, the company borrowed an additional $8.5 billion to support its capex and dividend strategies.

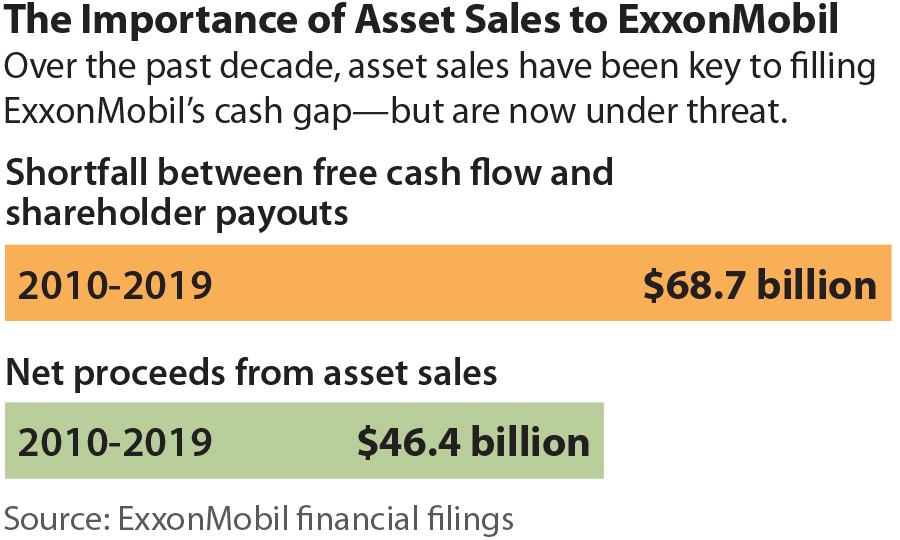

ExxonMobil has increased its dividend payments for 37 consecutive years, and regularly distributes cash to shareholders by means of share buybacks. Yet over the past decade, the company’s free cash flows have only covered two-thirds of these payouts. Just last year, ExxonMobil paid $15.3 billion to shareholders, while generating only $5.4 billion in free cash flows—leaving a $9.9 billion deficit that the company made up from other cash sources, including $5.4 billion in new long-term borrowing and $3.7 billion in asset sales.

Credit analysts increasingly cite ExxonMobil’s cash flow challenges as an area of concern. Moody’s pointed to the company’s cash flows through 2021 when it changed its outlook from stable to negative, noting that even if ExxonMobil completes its planned asset sales, the company’s debt levels will still increase. Similarly, S&P recently downgraded Exxon from AA+ to AA while maintaining its negative outlook, citing worries about the company’s cash flow.

“ExxonMobil’s asset sales program should raise a red flag for investors,” said Tom Sanzillo, director of finance and co-author of the brief. “This strategy is looking increasingly questionable given current financial conditions. With other supermajors pursuing similar asset divestment strategies, the likelihood of ExxonMobil’s plan appears increasingly unattainable.

Briefing Note: ExxonMobil’s Planned Assets Sales: Another Strategic Misstep

Authors

Kathy Hipple is an IEEFA financial analyst.

Tom Sanzillo is IEEFA’s director of finance.

Media Contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.