Hydrogen's potential for onshoring Australian green iron production

Hydrogen-based ironmaking will move beyond gas

Key Takeaways:

As more global rivals turn to green iron and steel production, the government’s Hydrogen Headstart funding and tax credits can help Australia compete.

South Australia’s new green iron EOI and Quinbrook’s project highlight the growing push to bypass gas and shift straight to green hydrogen-based DRI in Australia.

The Future Gas Strategy’s notion that gas has a role in steelmaking directly contradicts the steel sector’s growing global shift towards green hydrogen.

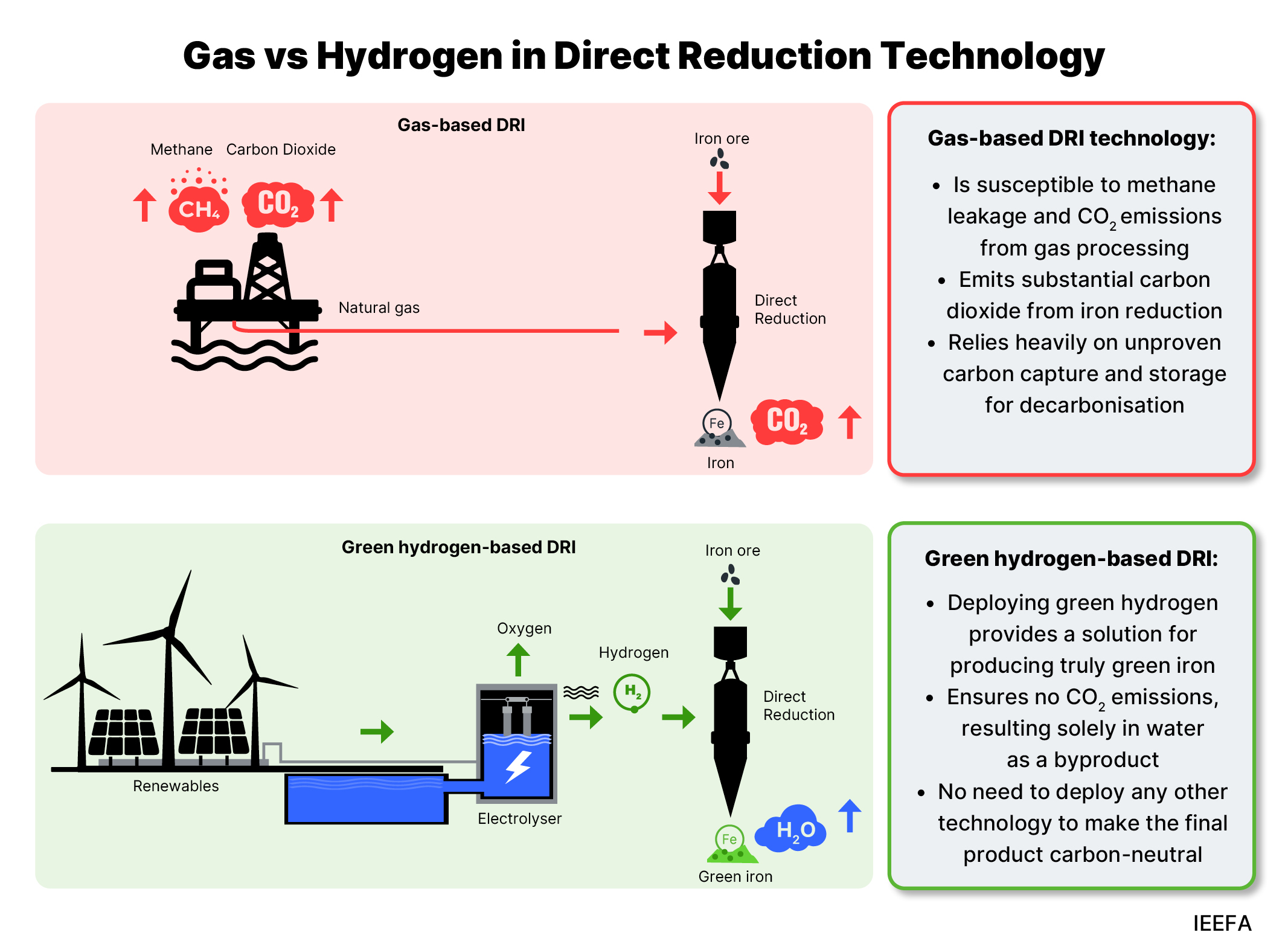

Gas-based DRI has lower emissions than coal-fired blast furnaces, but still emits significant CO2. Carbon capture and storage technology (CCS) is unable to effectively decarbonise gas-based steelmaking.

4 July 2024 - (IEEFA Australia): The global shift towards green hydrogen-based steelmaking holds great potential for Australia to process its vast iron ore resources onshore for export, according to new research from the Institute of Energy Economic and Financial Analysis (IEEFA).

The world’s steelmakers need to reduce their significant GHG emissions amid growing investor pressure and the implications of increasing trade-restrictive regulations such as the EU’s carbon border adjustment mechanism (CBAM).

Hydrogen-based direct reduced iron (DRI) is a key alternative to using fossil fuels in ironmaking. Australia’s renewable energy resources will make producing green hydrogen relatively cheap, sparking interest in the potential to process iron ore into “green iron” onshore for export to steelmakers seeking emissions reductions.

The government’s Future Made in Australia initiative aims to harness the nation’s renewable energy advantages to support manufacturing in the energy transition. It includes a green Hydrogen Production Tax Incentive of A$2/kg of green hydrogen and a further A$1.3 billion to fund green hydrogen project development over the next decade through the Hydrogen Headstart program.

“With hydrogen export looking prohibitively expensive, Australian green hydrogen should be used domestically, with ironmaking a key potential off-taker,” says Soroush Basirat, IEEFA energy finance analyst, global steel.

“Iron ore is Australia’s biggest export, which means that a truly low-carbon makeover of this sector using green hydrogen is potentially the most impactful part of the Future Made in Australia plan.”

However, the government’s Future Gas Strategy maintains that gas will be a key element of Australia’s energy framework, including for iron and steel.

“These strategies present divergent and contradictory paths for the future of iron production in Australia,” says Simon Nicholas, IEEFA’s lead analyst, global steel.

“Continued reliance on gas presents risks to Australian manufacturing in a world that is transitioning away from fossil fuels.

“Green iron can’t be made with gas. With other countries now examining and executing their green iron and steel opportunity, Australia needs to move fast to make itself a global green iron leader, not just an iron ore leader.”

New green iron projects using green hydrogen are emerging in Australia:

- In Queensland, Quinbrook Infrastructure Partners’ A$3.5 billion (US$2.3 billion) green iron project aims to use green hydrogen from the nearby CQ-H2 facility, one of six projects shortlisted for Hydrogen Headstart funding, and slated to begin production in 2028.

- The South Australian government plans to establish a green hydrogen-based DRI plant by 2030, tapping its abundant renewable energy sources (solar and wind), and vast reserves of high-quality magnetite iron ore for DRI-based steel production.

- In Western Australia, Fortescue already has a green iron pilot plant under construction at Christmas Creek, and its Iron Bridge magnetite mine is ramping up production of ore suitable for DRI-based steelmaking with the goal of becoming a major green iron supplier to China.

International car makers are already signing purchase agreements for green steel made using green hydrogen with virtually no emissions. Definitions of what constitutes “green iron” and “green steel” are only expected to tighten.

“There is a significant risk that steel produced using gas – with or without CCS – won’t meet such definitions,” Mr Basirat says.

“Steel and iron makers will be increasingly exposed to the risk that steel consumers will not want fossil fuels involved in their supply chains at all.”

Read the report: Hydrogen holds great potential for Australia’s onshore green iron production

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contact: Soroush Basirat [email protected]; Simon Nicholas [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)