Hard truths staring Whitehaven in the coal face across Asia

Miner’s key export markets shrinking amid accelerating switch to renewables, and emerging economies won’t fill the gap

Key Takeaways:

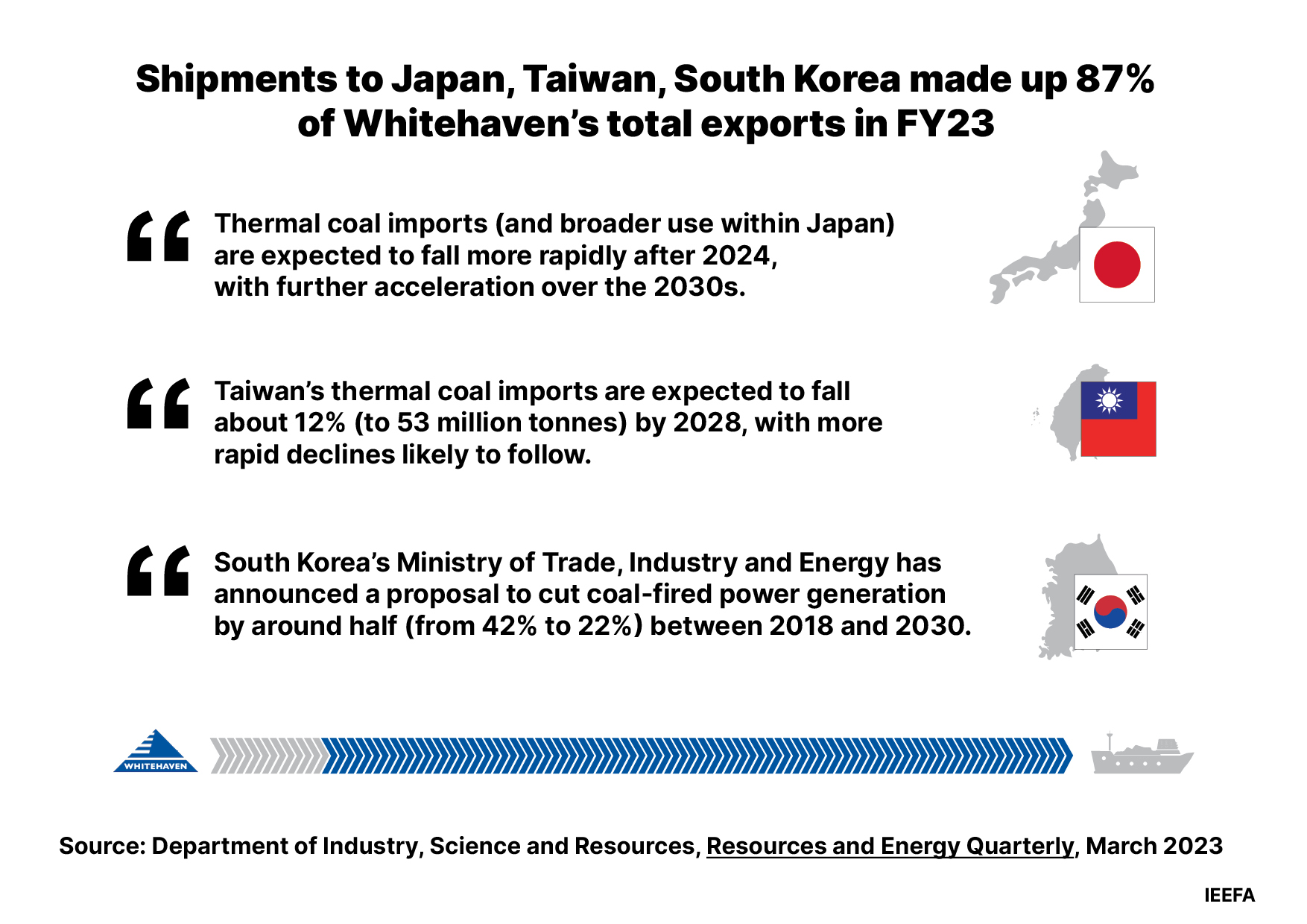

Coal imports to Whitehaven’s three largest export destinations (Japan, Taiwan and South Korea) are going into decline, according to the Australian government.

Emerging economies such as India and Vietnam don’t import the high-calorific value coal Whitehaven produces, and likely never will.

No nation is relying on a switch to high-calorific value coal to reduce its carbon emissions.

The long-term outlook for metallurgical coal is starting to change now that the steel technology transition is accelerating.

EMBARGOED TO 6 October 2023 - (IEEFA Australia): Whitehaven’s mantra that its high-energy coal will be the last to exit a rapidly transitioning Asian energy market ignores the reality unfolding across the region, according to a new report released today.

Whitehaven – whose Annual General Meeting takes place on 26 October – ships 87% of the coal it exports to Japan, Taiwan and South Korea, all of which have begun to phase out coal in favour of renewables. Potential alternative markets are also dwindling as coal-power development in emerging economies comes to an end much sooner than anticipated.

Competition from rival exporters will only intensify as developing nations turn to cheaper sources of domestically mined and/or lower-grade coal while investing in renewable alternatives, according to the report’s author, Simon Nicholas, IEEFA’s lead energy finance analyst, coal mining Australia.

“Whitehaven says that its high-energy coal will be the last to leave the market. This arguably doesn’t fully reflect what is happening across Asia,” Mr Nicholas says.

“India doesn’t import high-energy thermal coal, and likely never will. The Australian government acknowledges that the last coal power plants to be built in Vietnam are being configured for Indonesian, not Australian, coal.”

Whitehaven claims its high-calorific-value thermal coal is helping decarbonisation efforts, and that coal-reliant nations will replace older coal-fired power plants with new, more efficient ones to meet Paris Agreement goals.

“Given the relatively small emissions impact of burning higher-energy coal compared with lower-energy coal, no nation can credibly plan to reduce power system emissions by merely switching from one grade of coal to another,” Mr Nicholas says.

“No nation has announced such a move as part of any power system decarbonisation plan. Where a change in emphasis in coal sourcing is planned, it is a shift away from thermal coal imports and towards increased reliance on domestic coal, such as in China, India and Pakistan, for the purpose of increased energy security and lower cost.”

“Although Japan and South Korea have a few remaining coal power projects under construction, the clear trend is one of declining coal power capacity as large numbers of plants are closed. The remaining plants under construction in these countries will be the last they ever build.”

“Construction in Taiwan has already ended and even emerging economies like Vietnam are planning an end to construction. As older plants close, they are clearly not going to be replaced with new ones.”

Despite increasing acceptance within Australia that the outlook for the seaborne thermal coal market is one of declining demand and dwindling volumes in the long term, Whitehaven Coal continues to maintain that future demand for its product is strong.

“We consider that certain of the statements made by the company about the demand outlook for its product are at risk of not being fulfilled given what is happening with the Asian seaborne coal market,” Mr Nicholas says.

“Even in the metallurgical coal market, the long-term outlook is starting to change now that the steel technology transition away from coal is gaining momentum.”

Read the report: Whitehaven Coal: Assessing its Claims About its Long-Term Outlook

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Simon Nicholas, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)