‘Golden age of gas’ falls short of hype after decade of LNG exports

Key Takeaways:

The reality of Queensland's LNG export industry has failed to live up to the hype, plagued by cost blowouts and billions in asset writedowns.

The Queensland government's expectations of an LNG revenue bonanza have not been met, with gas royalties remaining lacklustre by international standards.

As LNG export contracts expire, the industry faces a global supply glut, declining prices and demand, and stiff competition from cheaper overseas producers.

Exporting LNG has shackled eastern Australia's gas supply to volatile global markets, driving up gas prices, constraining local supply and forcing manufacturers to close.

6 February 2025 (IEEFA Australia): When the first shipment of LNG left Gladstone in 2015, a golden age of gas beckoned, promising billions in investment, revenue and royalties. Ten years on, few have benefited from this boom, with some, such as domestic gas consumers and Australian manufacturers, actually ending up worse off.

In a new report, Queensland LNG exports: A decade of high domestic prices, falling local demand, IEEFA’s Australian gas finance analyst Kevin Morrison examines whether the industry delivered on all its promises.

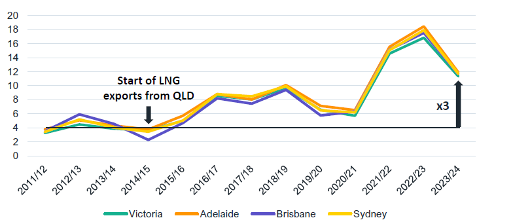

Exporting LNG from Queensland’s coal-seam gas reserves tied eastern Australia’s gas market to volatile international trade, and domestic gas prices have tripled as a result.

“According to the Reserve Bank of Australia (RBA), prices are likely to remain higher than pre-2015 levels for decades to come,” Mr Morrison says. “Correspondingly, gas demand in eastern Australia has dropped to a 25-year low.

“This reflects the closure of petroleum refineries, the loss of minerals and chemicals processing capacity, and the impact of worsened economic conditions, including higher gas prices, on smaller manufacturers, which have forced some plants to close.”

Eastern Australia gas prices (A$/GJ)

Source: Australian Energy Regulator, Gas Market Prices

In addition, two of Gladstone’s three LNG plants have had to source gas from other gas producers to meet their production quotas, diverting further supplies away from domestic consumers.

The highly contentious royalty regime has failed to deliver the riches the Queensland government was banking on, by up to two-thirds of state budget projections in some cases.

“Royalties from the gas production for LNG exports have been largely below expectations for most of the past decade,” Mr Morrison says.

For the first seven years, the LNG ventures paid just 2.3% of their total export revenue in state gas royalties. This has since risen to 5% due to the combined effects of a royalty rate increase in 2021 and the global price spike caused by the war in Ukraine a year later.

Despite this belated boost to state coffers, the Queensland government’s take pales in comparison with global industry standards, even when federal corporate taxes are taken into account. The International Energy Agency estimates about half of the US$3.5 trillion in annual global oil and gas revenues has flowed to governments since 2018.

Meanwhile, only three of the eight proposed LNG plants were built, and they have been plagued by delays, cost blowouts, billions in asset writedowns, and poor financial returns for investors. Rates of return for three LNG projects range from 3.4% to 7.7%.

“All are well below contemporary investment hurdle rates for European and US oil and gas companies of 11% to 30%,” Mr Morrison says.

Queensland’s LNG exporters face strong headwinds as cheaper LNG supplies from Qatar and North America flood the global market in coming years, driving down prices and increasing competition.

Heavy reliance on China, which buys 60% of the state’s LNG, is a key concern as the looming global gas glut will coincide with the renewal of Queensland’s export contracts.

“Future demand from China is uncertain, with potential for significant gas over-contracting by 2030, putting in question contract renewals,” Mr Morrison says.

“In the long term, large volumes of uncontracted LNG and increased competition mean Australian LNG exporters could find it more difficult to secure firm sales and purchase agreements (SPAs) to replace expiring contracts.

“In this context, it will be hard for the Queensland LNG industry to justify continuing to take gas away from a tight domestic market to supply its international consumers.”

Read the report: Queensland LNG exports: A decade of high domestic prices, falling local demand

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contact: Kevin Morrison, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)