Finnish taxpayers pay the price for Fortum’s Uniper debacle

Key Takeaways:

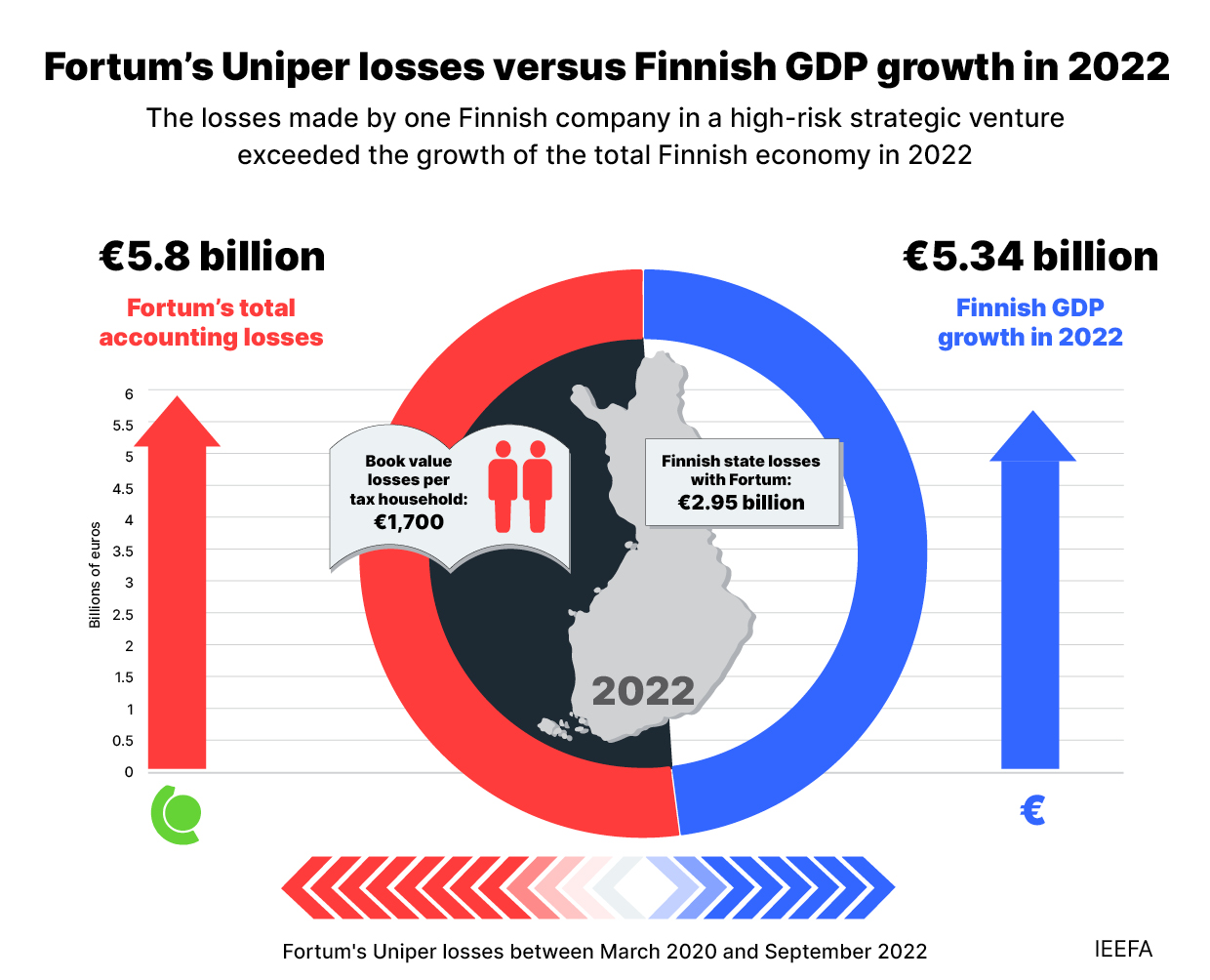

Fortum’s losses from Uniper are huge, reaching €5.8 billion in accounting losses alone. This could have been avoided through less risky investment decisions.

Overall, Fortum’s financial risk exposure in Russia resulted in losses and has been an excessive share of the company’s assets from a risk mitigation perspective.

In IEEFA’s view, executive management decisions in state utilities’ strategic investments should be monitored and approved by executive or legislative powers, in order to protect the long-term interest of taxpayers.

13 November 2023 (IEEFA) | Finnish energy company Fortum’s ill-fated acquisition of German utility Uniper was a foreseeable financial disaster that has cost Finland’s taxpayers billions of euros and could have been avoided through more prudent management.

With the Finnish state owning 51.2% of Fortum, n

Following the €7.2 billion acquisition in 2020, Russia’s move to cut gas exports to the European Union (EU) left Uniper on the verge of bankruptcy as gas prices soared, leading Fortum to sell the company to the German state for just €500 million.

Beyond the book value losses directly attributable to the Uniper transaction, a significant share of Fortum’s stock market value collapse, in IEEFA’s view, may be attributable to the German utility. Indeed, while the stock value of the European utility sector is almost flat since the start of Russia’s full-scale invasion of Ukraine in February 2022, Fortum’s stock value is down 53.3%.

“While the media spotlight has moved on from Fortum’s Uniper debacle, there are lessons to be learned from the affair to ensure that mistakes are not repeated elsewhere,” said Jonathan Bruegel, co-author of the report and an IEEFA power sector analyst. “With an acquisition of this scale, the correct course of action should be to consult executive and legislative powers to protect taxpayers. There should also be appropriate accountability checks for leadership of state-owned companies.”

Former Fortum CFO Markus Rauramo is now the company’s CEO and is still in this position despite his leading role in the €5.8 billion loss.

On 2 November 2023, Fortum announced a new efficiency programme to slash its annual fixed costs by €100 million that is expected to include job cuts. The programme aims to “improve [the company’s] profitability and ensure its competitiveness over time”.

During the acquisition period, Fortum was criticised in the Finnish media and by climate activists for purchasing fossil fuel assets through the deal. In addition, while many other international companies reduced their activities in Russia following its occupation of Crimea, Fortum increased its presence in the country by acquiring Uniper, whose portfolio was mostly made up of coal- and gas-fired power generation in Germany and Russia.

“Due diligence around the acquisition should have alerted Fortum to the overbearing risk of placing this bet on fossil fuel power and on Russia. Instead, management proceeded with a disastrous deal that has cost Finnish taxpayers dearly,” said Arjun Flora, co-author of the report and IEEFA director for Europe.

As well as the losses related to Uniper, Fortum wrote down losses for all its assets in Russia following the nationalisation of foreign entities by the Kremlin in 2023.

Fortum said in May that the net cash loss from its so-called "Russian journey" was €2 billion. However, as that figure does not include losses from the Uniper deal related to Russia, it underestimates Fortum’s Russian losses and, in IEEFA’s view, shareholders potentially may not perceive the scale of the losses.

Read the report: https://www.ieefa.org/resources/fortum-uniper-finnish-taxpayers-staggering-losses-were-predictable-and-avoidable/

Press contacts

Sofia Russi | [email protected] | +393493229728

Jules Scully | [email protected] | +447594920255

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org