Financial risks of carbon capture and storage in Canada

Concerns about the Pathways Project and Public Energy Policy

Key Takeaways:

A plan to capture CO2 from 13 oil sand processing facilities and store it in Alberta is threatened by cost challenges.

Total costs including interest, insurance, depreciation and taxes for existing commercial-scale carbon capture plants in Alberta are approaching thresholds that threaten profitability.

There is a risk that the oversupply of carbon emission performance credits (EPCs) will reduce project revenues.

Without substantial efficiency improvements, the cost per tonne of CO2 captured at the Pathways facility is likely to exceed the revenue that the project can generate for each tonne captured.

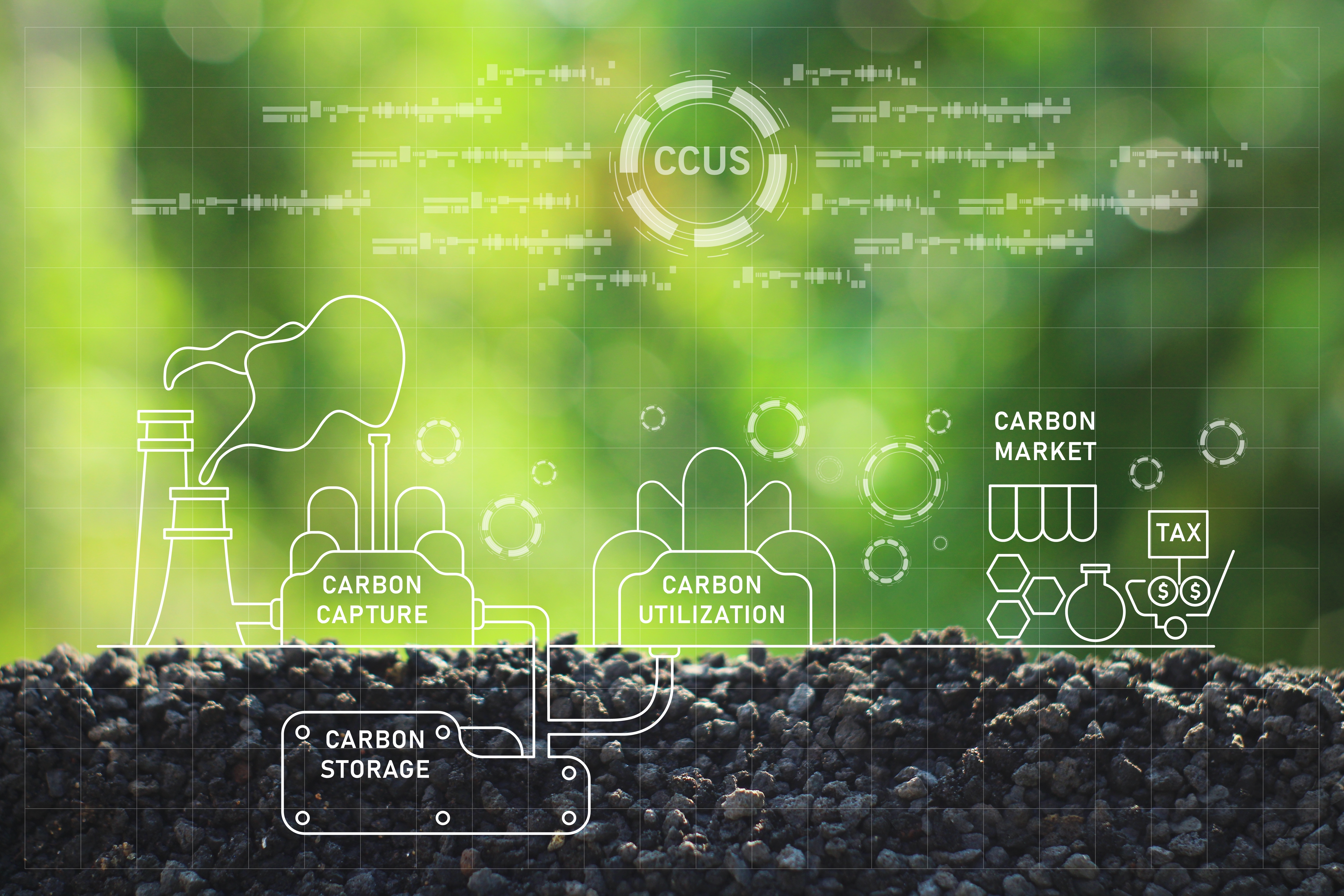

Cost challenges threaten the ability of a large, planned carbon capture project in Alberta to achieve financial sustainability, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA). The report shows that the Pathways Alliance plans to capture carbon dioxide (CO2) generated at 13 oil sand processing facilities, compress the gas and send it by pipeline to a storage hub near the Cold Lake region in Alberta, faces multiple financial challenges.

The IEEFA report, Financial risks of carbon capture and storage in Canada, examined the two currently operating CCS projects in Canada, together with current public policy and provincial carbon market dynamics. The report identifies troubling cost implications for the Pathways CO2 transport and storage project and raises the concern that the Canadian federal government and the province of Alberta may be pressured to make up the likely shortfall. Given the scope of the project and its reliance on government subsidies for survival, it is likely Canadian taxpayers would be left to pay for the majority of the project for years to come.

“The growing realization that carbon capture and storage projects are likely to require permanent government subsidies resets the discussion about the viability of CCS as a tool to effectively reduce carbon emissions,” said Mark Kalegha, IEEFA Energy Finance Analyst, Canada and author of the report. “Public funding of CCS is a costly gamble that may not yield tangible returns on Canada’s journey towards achieving net-zero emissions. This is a financial risk the government cannot afford.”

Main findings from the report:

- Total costs including interest, insurance, depreciation and taxes for existing commercial-scale carbon capture plants in Alberta are approaching thresholds that threaten profitability.

- Rising project costs are not being offset by commensurate increases in CO2 capture volumes and associated revenue. Operating costs are growing at twice the rate of CO2 captured volumes.

- CCS operating revenues are uncertain. An effective cap on emission performance credit (EPC) pricing of CAD$170 per tonne— limits project revenue potential while a looming oversupply of carbon EPCs is a real world example of downward risks to project cash flows. Also, the option to combine Clean Fuel Regulation credits with EPCs is available to ACTL, but this significant financial benefit is not available to the Pathways project.

- Performance risk is financial risk. Without substantial efficiency improvements, the cost per tonne of CO2 captured is likely to exceed the revenue that the project can generate for each tonne captured. An unprofitable carbon capture project will struggle to bring lasting positive economic benefits to host communities.

The economics of CCS projects in general are shaky. If the cost to capture a tonne of carbon exceeds the revenue that can be expected to be generated from that process, then such a project cannot be said to be commercially viable.

As has been seen in Canada and other jurisdictions with similar projects, there comes a point when the government support must stop. The result has been project closures and risk without yielding desired environmental or economic benefits. Alberta would be wise to take a closer look at this project, for the benefit of local communities and to avoid a bad investment.