Australia’s green iron and steel race – Global competition leaves no time to wait for technology

Key Takeaways:

Australia must not delay beginning its green iron journey. Although emerging ironmaking technologies still need to be developed that can use Pilbara iron ore in low-carbon iron and steelmaking, Australia does not need to wait for them.

Producing lower-emissions iron and steel without coal via DRI-EAF and high-grade ore is a mature pathway already in use at commercial scale outside Australia. Building domestic iron ore processing capacity using proven, available technologies is essential to stay competitive with the likes of Brazil, Canada and the Middle East.

Developing new high-grade magnetite iron ore operations – along with the necessary concentrate and pellet facilities – can take up to a decade to reach stable production. While a few magnetite projects are progressing, early action is essential to ensure future readiness and meet the growing global demand for greener steel feedstock.

22 May 2025 (IEEFA AUSTRALIA) | Australia is in a race against time to kickstart its transition to green iron and steel. As international competition intensifies, it cannot afford to wait for emerging technologies to mature.

New research from the Institute for Energy Economics and Financial Analysis (IEEFA) reveals how Australia is currently not well placed for a green steel transition based on the available resources and set-up in its mining and steel sector. Green iron production using the latest direct reduction (DR) technology requires higher-grade ore, but Australia’s iron ore supply is dominated by lower-grade ores.

To remain competitive, Australia has two options. It can develop new magnetite mines capable of producing higher-grade ore; or it can deploy emerging technologies that enable use of its abundant low- to mid-grade ores. In its new briefing note, Australia’s green iron journey: Racing against time, waiting on technology, IEEFA argues that both options will be necessary if Australia is to remain relevant amid rapidly intensifying global competition.

“The critical factor is time,” says Soroush Basirat, energy finance analyst, global steel at IEEFA. “Both pathways take years to develop. Even for the first option, where the technology already exists, developing new mines, as well as constructing the concentrate and pellet facilities we will need, can still take up to a decade. However, it will keep us in the race.”

The most promising pathway for decarbonising primary steel production involves the production of direct reduced iron (DRI) using electric arc furnaces (EAF). The technology is already widely deployed in regions such as the US, India and the Middle East & North Africa (MENA). The mining and processing set-up for DRI feedstock is more complex than for conventional blast furnaces, which can use a wider range of iron ores.

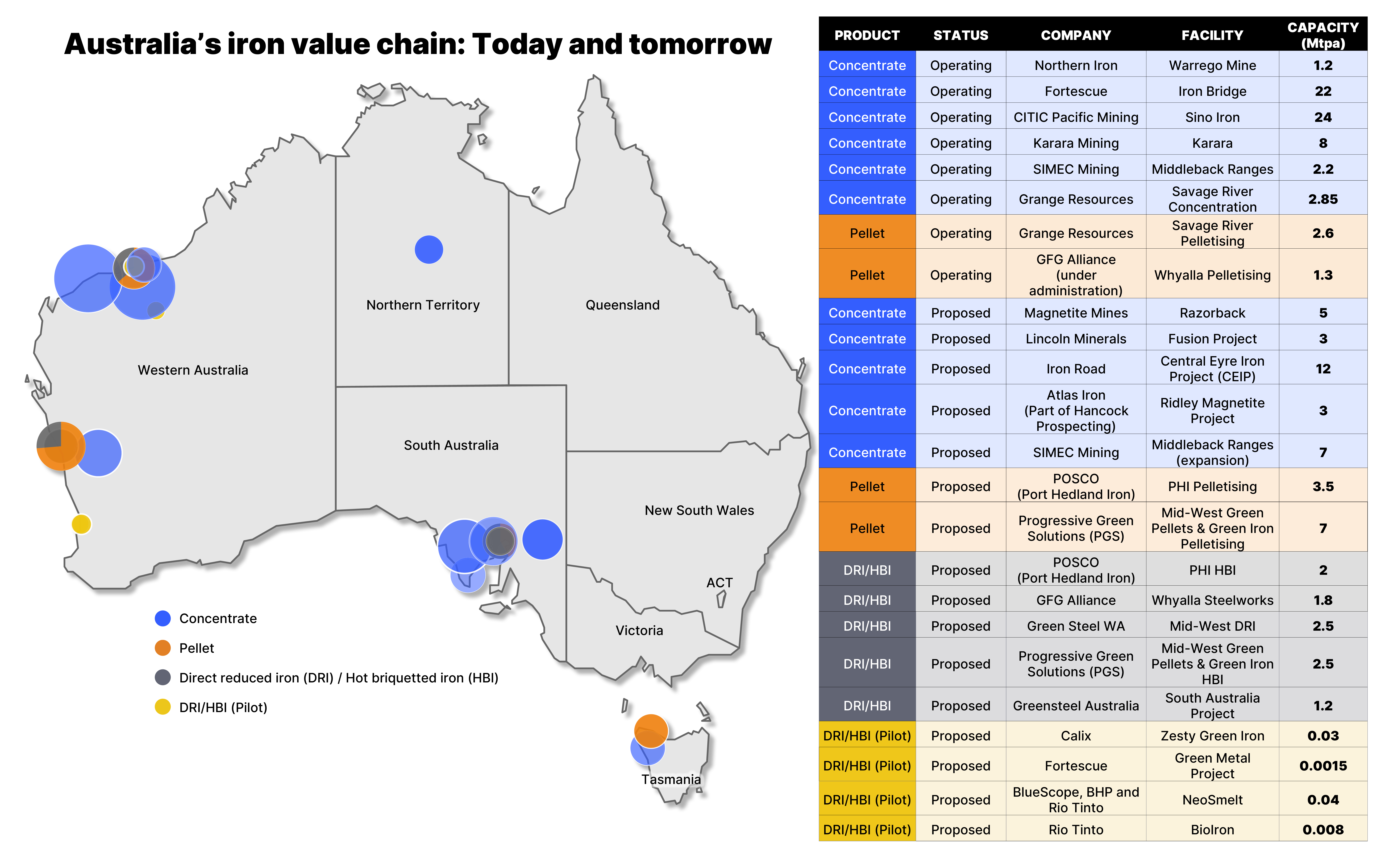

With abundant high-grade iron ore resources and processing facilities, countries like Brazil, Canada and Sweden are better positioned for this transition. If it wants to remain competitive, Australia must focus on developing its magnetite iron ore sector. Over the past two decades, several large-scale concentrate plants have been launched to supply high-grade feedstock, along with two smaller-scale pelletising operations. Despite significant investment, however, these projects have often been plagued by delays, budget blowouts and operational setbacks.

Establishing facilities for iron ore concentrate and pellet production is likely to take up to a decade, meaning that even if a new magnetite project were to start today, it wouldn’t be ready for DRI production until the mid-2030s. Nonetheless, Australia should recognise the value of its existing capacities and build on them, as they will provide a strong foundation for developing a domestic green iron value chain.

“Australia has sufficient iron ore concentrate to begin producing green pellets and, subsequently, green iron,” adds Basirat. “Additional supply will also be needed, and this is currently under development.”

The next stage for Australia will be to enable use of its abundant low- to mid-grade ores in DRI production. For this, an additional processing step – the electric smelting furnace (ESF) – will be required. Prominent technology developers in the steel sector are actively working on smelter technologies, including Australian steelmakers and iron ore miners. However, most of the projects currently in Australia’s pipeline are still at the pilot plant stage and remain years away from reaching reliable commercial scale — if they reach it at all. Relying solely on these new advancements risks Australia falling behind international competitors who are rapidly advancing in the green iron market based on high-grade iron ore.

The development of new technologies that can use Australia’s lower-grade iron ores in DRI-based iron and steelmaking is clearly important. However, Australia has existing high-grade iron ore mines in operation, and more under development, which can enable low-carbon iron and steelmaking using existing, commercial-scale technology now.

Australia must act swiftly to remain competitive. Green iron is more critical to Australia than to any other country, given that iron ore is its leading export and that the country is the world’s largest iron ore exporter.

“The clock is ticking for Australia,” says Basirat. “Major miners must accelerate their efforts and adopt viable solutions quickly, or Australia risks missing out on this once-in-a-generation opportunity.”

Read the report: Australia’s green iron journey: Racing against time, waiting on technology

Media contact: Amy Leiper [email protected] +61 (0) 414 643 446

Author contacts: Soroush Basirat [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)