Australian gas users pay price as LNG producers prioritise export windfalls

Policy solutions are key to supply gap risks – not new production

Key Takeaways:

Focusing on new gas production to address projected supply gaps has not worked -- eastern Australia is closer to a supply gap than ever, with market conditions likely to remain challenging for gas buyers.

Consideration should be given to policy solutions, including diverting gas intended for discretionary LNG spot sales into the domestic market to alleviate the current scarcity.

Governments should consider measures to lower domestic gas demand in households and suitable industry to improve east coast gas supply adequacy.

Without further reform to free up gas for industry, further industrial closures are likely amid increasingly challenging conditions, including potentially higher gas prices due to scarcity.

20 FEBRUARY 2025 (IEEFA Australia): Australian gas users are struggling with needlessly high energy costs as producers instead prioritise exports to lucrative LNG spot markets, according to a new report from an independent think tank.

According to the Institute for Energy Economics and Financial Analysis (IEEFA), new policy solutions are urgently needed to alleviate the challenges faced by gas users in Australia. In addition, IEEFA’s new briefing note, Australian gas users pay price as LNG exporters prioritise spot market windfalls, debunks ongoing calls for increased gas supply to address the looming gas supply gap in the eastern states.

Most recently, the Australian Competition and Consumer Commission (ACCC) raised concerns over future supply for the east coast gas market arising from as early as 2027. In its latest report, the ACCC called for reduced regulatory barriers to incentivise new gas development and production. However, IEEFA’s report argues that new production will not reduce the risk of supply gaps, and that more innovative policy solutions are required instead.

Josh Runciman, Lead Analyst, Australian Gas at IEEFA, is the report’s author. Prior to joining IEEFA, he was a director on the ACCC’s Gas Inquiry 2017-2030, where he worked on a range of issues, including supply adequacy, gas commodity and pipeline pricing, LNG netback pricing and retailer behaviour.

Runciman says: “Focusing on developing new gas supply is not the answer to the looming east coast supply gap. We’ve seen these measures fail consistently over the last few years. Governments and energy agencies, including the ACCC, need to explore other solutions; in particular they should look at diverting LNG exports into the domestic market.”

IEEFA’s report notes that the LNG industry accounts for about 80% of Australia’s total gas consumption. The development of the Queensland LNG export sector has coincided with increasing gas prices for domestic users. Most notably, market conditions have become increasingly challenging for major industrial gas users, leading to the closures of manufacturing facilities including Incitec Pivot and Qenos.

More troublingly, in recent years, gas exports have exceeded the levels required under long-term contracts, as exporters have sought to capitalise on high prices on LNG spot markets. This has occurred at a time when the Queensland LNG producers have become net withdrawers of gas from the east coast.

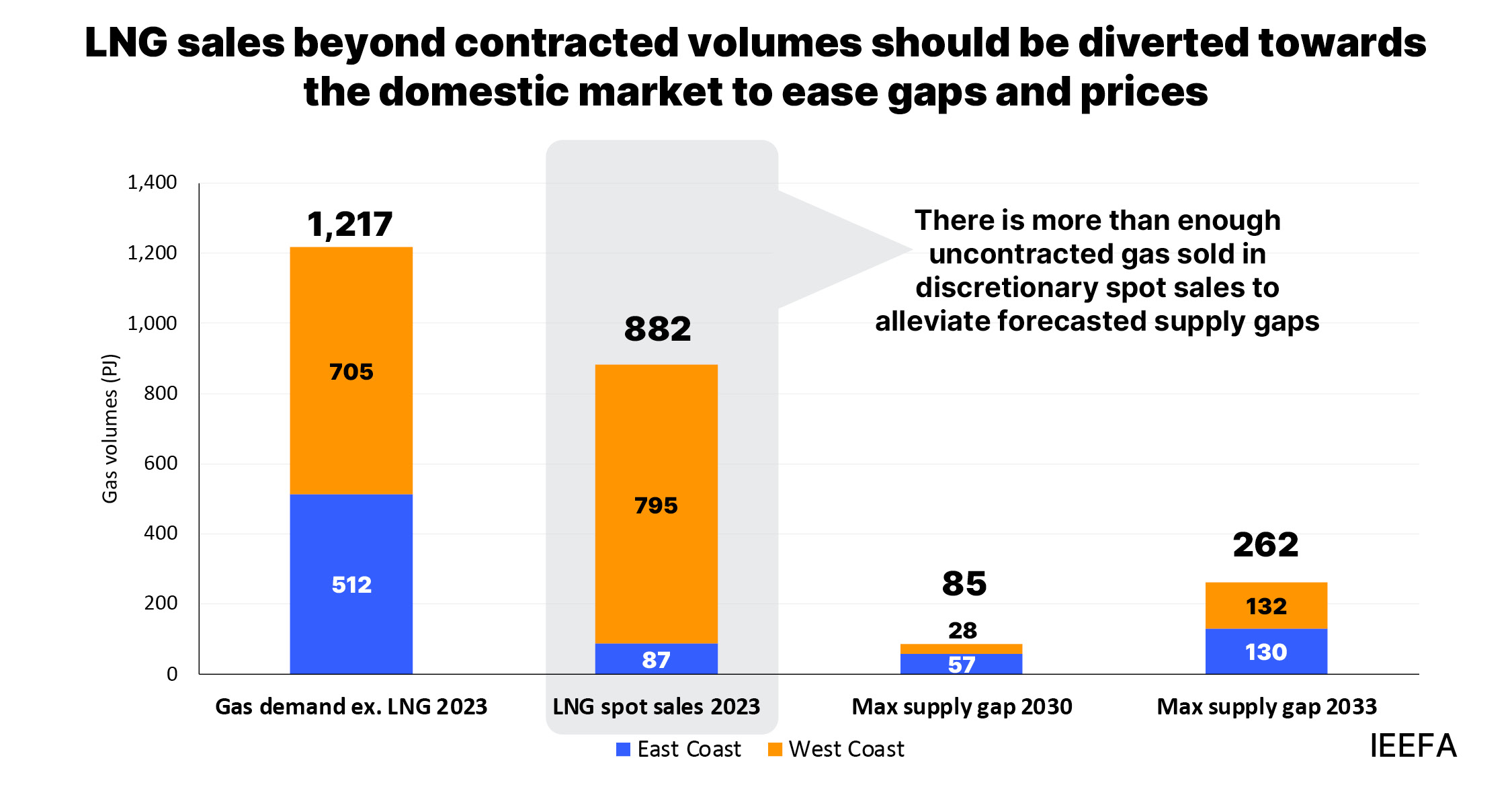

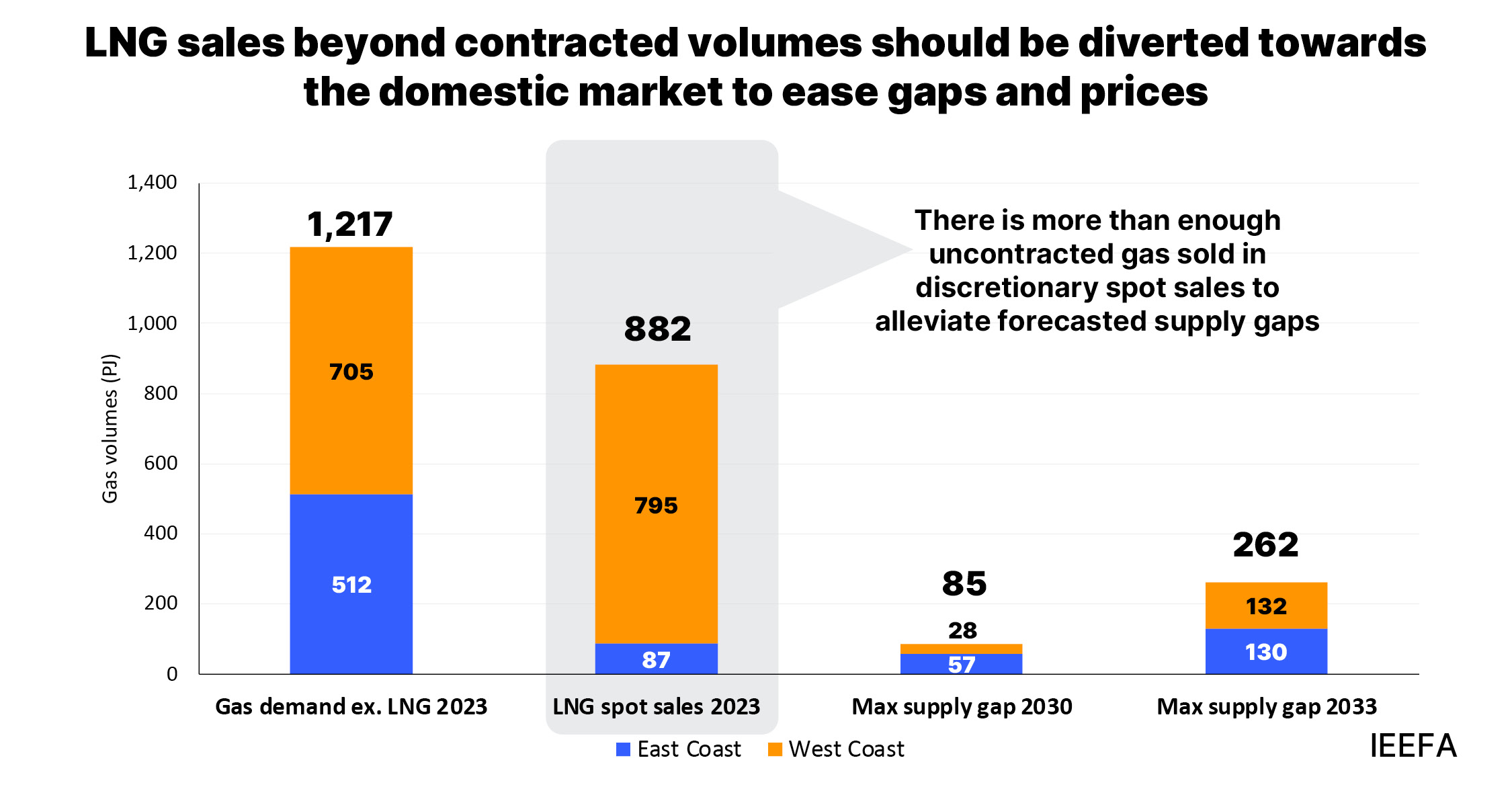

Diverting these discretionary exports into the domestic gas market, through export caps or similar mechanisms, could significantly alleviate supply concerns. For example, the additional volume of gas exported by Queensland LNG exporters in 2023 was 150% of the anticipated supply gap in 2030.

Runciman adds: “Global LNG markets will soon see an unprecedented glut of new low-cost supply. In this context, redirecting gas for domestic use would have minimal impact on LNG exporters. And it would offer the opportunity to resolve the east coast supply issue, ensuring we retain gas-intensive manufacturing jobs and skills.”

IEEFA’s report also examines ways to alleviate the impending supply gap through relatively simple, cost-effective demand-side measures. It identifies vast opportunities to drive further electrification and energy efficiency upgrades in both households and industry, that could materially improve the supply-demand outlook on the east coast.

Runciman concludes: “Continued calls for new gas production have not altered the likelihood of future supply gaps in the east coast gas market. Fortunately, however, there are many other things we can do to improve the supply-demand outlook and mitigate the risks of supply gaps. These options are likely to be lower-cost, with lower emissions, and improve the operation of the east coast gas market.”

Read the analysis: Australian gas users pay price as LNG exporters prioritise spot market windfalls

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Joshua Runciman, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)