European LNG Tracker

Last updated: February 2025

About

IEEFA’s European LNG Tracker is an interactive data set to visualise Europe’s* LNG infrastructure, demand and capacity outlook, and import flows. It is built by compiling data from a range of sources, including Kpler, Gas Infrastructure Europe, Aggregated LNG Storage Inventory, Eurostat, Dukes and IEEFA analysis.

Note: Using an updated internet browser will help to ensure all graphics on this page display correctly. For any issues, contact us.

Subscribe to receive all the latest updates

* For the purpose of this project, the term "Europe" refers to the 27 member states of the EU (EU27), the UK, Norway and Türkiye.

Key Findings

Europe’s LNG imports declined by 19% in 2024. The continent’s gas consumption fell by 20% between 2021 and 2024 thanks to renewables deployment and demand reduction policies.

The LNG buildout slowed last year. While Europe’s LNG import capacity increased by 22% between 2021 and 2023, it grew by 7% in 2024 due to terminal delays and indefinite postponements.

The average utilisation rate of the EU’s LNG import terminals fell from 58% in 2023 to 42% in 2024.

The US is the main supplier of LNG to the EU. While the bloc decreased its imports of LNG from the US, Qatar and Algeria last year, those from Russia rose by 18%.

IEEFA estimates that EU countries spent €6.3 billion on Russian LNG between January and November 2024.

As new LNG import projects come online and gas consumption continues falling, IEEFA forecasts that Europe’s 2030 regasification capacity will be more than three times higher than its 2030 LNG demand.

Almost three years after the beginning of Russia’s full-scale war against Ukraine, Europe encounters a new energy reality, and its resilience is tested once again.

Thanks in part to renewable energy deployment and policies aimed at curbing gas consumption, Europe’s gas demand declined by 20% between 2021 and 2024. Its 2024 gas consumption was flat year on year.

Countries across Europe have been installing or expanding LNG terminals to reduce their dependence on Russian gas. But European imports of Russian LNG have increased since 2022.

Since the beginning of 2022, the continent’s LNG import capacity has grown by 31%. However, this buildout doesn’t match demand: Europe’s LNG imports sharply decreased by 19% in 2024.

Russian gas transit via Ukraine – totalling about 15 billion cubic metres (bcm) in 2024 – ended on 1 January 2025. Europe’s LNG imports fell by about 32 bcm in 2024. Its gas demand is not expected to rise in 2025. This means that Europe could potentially replace the lost Russian gas pipeline supply and refill gas storage with LNG while still importing lower LNG volumes than in 2023.

Content Overview

Use the links below for quick navigation:

1. EU policies help deliver energy security

2. Existing and planned LNG infrastructure

3. Gas consumption and LNG outlook

4. LNG import volumes

5. EU27 spending on LNG

6. Russia: LNG infrastructure and trade with Europe

Europe LNG updates

EU member states cut their gas consumption from April 2024 to March 2025 by 15.6% compared to their average annual consumption between April 2017 and March 2022.

Deutsche ReGas, the only private operator of LNG terminals in Germany, has terminated the charter contract for the FSRU Energos Power, saying it was losing money over the investment.

Banning Russian LNG transshipments doesn’t affect the EU’s security of supply and is in line with the EU’s policy objective of preventing Russia from using the bloc’s terminals for its own gain.

Reducing gas consumption has been pivotal to European Union (EU) efforts to contain the energy crisis, but the EU’s target for 2024 and 2025 could allow for increased gas use.

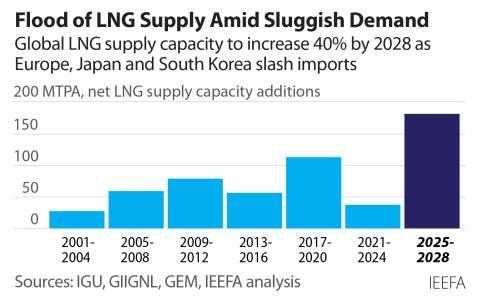

Lackluster demand growth combined with a massive wave of new export capacity is poised to send global liquefied natural gas (LNG) markets into oversupply within two years.

EU policies help deliver energy security

The EU has diversified energy supplies over the last three years. In 2024, wind and hydropower generation increased, solar power production hit a record high and fossil fuel generation continued falling.

EU gas consumption was flat in 2024, and its LNG imports decreased by 16%, or 21 bcm. The bloc’s gas storage was 72.16% full by the end of December 2024.

EU countries cut gas consumption by 20% between 2021 and 2024, exceeding their targets. The European Council encouraged EU member states to continue curbing gas use from April 2024 to March 2025 to ensure they are prepared for any potential supply disruption.

EU gas storage measures have helped to absorb supply shocks, mainly during the winter heating season. Storage facilities play a vital role in providing gas during peak consumption months and thus increasing security of supply.

In 2022, as the EU aimed to reduce security of supply risks and boost its competitiveness, the bloc set a target to refill its gas storage facilities to 80% by 1 November of that year. The target was raised to 90% by the same date in subsequent years.

In the last two winters, storage supplied almost a quarter of EU gas demand.

Explore the data

• EU monthly gas and LNG consumption

• EU gas supply during peak months

Next: Existing and planned LNG infrastructure

Back to top

Existing and planned LNG infrastructure

Since the beginning of Russia’s full-scale war against Ukraine, Europe has added 78.6 bcm of new LNG regasification capacity, of which the EU has added 70.9 bcm.

Countries that have added regasification capacity since February 2022 include Germany (24.7 bcm), the Netherlands (13 bcm), Türkiye (7.7 bcm), Italy (7.5 bcm), France (6.5 bcm), Belgium (6.3 bcm), Greece (5.5 bcm), Finland (5 bcm), Poland (2.1 bcm) and Croatia (0.3 bcm).

The European LNG terminals expanded last year were Belgium’s Zeebrugge (by 6.3 bcm in 2024 and 1.8 bcm in January 2025) and Poland’s Świnoujście (by 2.1 bcm). In Germany, Neptune FSRU was relocated from Lubmin to the port of Mukran; Energos Power FSRU* also started operating at Mukran.

On 20 January 2025, Greece's Ministry of the Environment and Energy granted approval for the installation of the new Dioriga Gas FSRU.

Europe’s LNG buildout slowed last year. While its LNG import capacity increased by 22% between 2021 and 2023, it grew by 7% in 2024 due to terminal delays and indefinite postponements.

Cyprus’s 2.4 bcm Vasiliko terminal is still stalled. Plans to expand Lithuania’s Klaipėda terminal have been suspended.

In 2023, Latvia’s Skulte terminal lost support from the country’s government because it deemed it no longer necessary. Plans for a second FSRU at Poland’s Gdańsk terminal were shelved due to a lack of interest. Other terminals shelved in 2023 were Shannon (Ireland) and Vlora (Albania).

*On 11 February 2025, Deutsche ReGas announced the termination of the charter contract for the FSRU Energos Power.

Gas consumption trends and LNG outlook

European gas demand was flat in 2024, thanks in part to renewables deployment and energy efficiency measures.

The continent’s 2024 gas consumption was at an 11-year low of 450 bcm. EU 2024 gas consumption was also flat.

IEEFA forecasts that European gas demand will decline by 1.5% in 2025. LNG demand is forecasted to increase by 17% to 158 bcm, which is 6% less than the continent’s likely peak LNG consumption in 2022. By 2030, Europe’s LNG demand is expected to drop to 127 bcm.

The average utilisation rate of the EU’s terminals fell from 58% in 2023 to 42% in 2024.

In 2024, half of the EU’s LNG terminals had utilisation rates lower than 40%, including some of the new FRSUs:

-

Ostsee/Mukran (Neptune FRSU/Energos Power FSRU), Germany (8%)

-

Alexandroupolis FSRU, Greece (9%)

-

Ostsee/Lubmin (Neptune FSRU), Germany (11%)

-

Barcelona, Spain (12%)

-

Le Havre (Cape Ann FSRU), France (14%)

-

El Musel, Spain (14%)

-

Toscana FSRU, Italy (18%)

-

Cartagena, Spain (18%)

-

Sagunto, Spain (21%)

-

Revithoussa, Greece (22%)

-

Panigaglia, Italy (23%)

-

Huelva, Spain (23%)

-

Zeebrugge, Belgium (33%)

-

Eemsenergy (Eemshaven FSRU), the Netherlands (34%)

-

Inkoo (Exemplar FSRU), Finland (38%)

Nonetheless, European countries are still planning investments in new LNG import terminals.

IEEFA forecasts that this could result in Europe’s 2030 regasification capacity having a 30% average utilisation rate.

As new LNG import projects come online and gas consumption continues falling, IEEFA forecasts that Europe’s 2030 regasification capacity will be more than three times higher than its 2030 LNG demand.

LNG import volumes

In 2024, European and EU LNG imports declined by 19% and 16%, respectively.

LNG supplied 30% of Europe’s gas demand and 34% of the EU’s gas demand in 2024, decreasing from 37% and 40% in 2023, respectively.

Europe’s top LNG-importing countries in 2024 were France (19% of the total), the Netherlands (14%), Spain (13%), Italy (11%), Türkiye (9%), the UK (8%), Belgium (6%), Germany (5%) and Poland (5%).

Most European countries decreased their LNG imports in 2024. The exceptions were Poland, Germany, Finland and Malta. The countries that reduced their LNG imports the most last year were the UK (by 47%), Belgium (by 29%) and Spain (by 28%).

In 2024, 46% of Europe’s LNG imports were from the US, 16% from Russia, 11% from Algeria, 10% from Qatar, 5% from Norway and 4% from Nigeria.

Last year, Europe’s reduced its LNG imports from the US (by 18%), Qatar (by 30%), Nigeria (by 35%) and Algeria (by 4%). Conversely, imports from Russia and Norway increased by 12% and 11%, respectively.

EU27 spending on LNG

From January to November 2024, IEEFA estimates that EU countries spent €35.9 billion on LNG imports. An estimated €16.2 billion of this was from the US, €6.3 billion from Russia, €3.7 billion from Qatar, €4.2 billion from Algeria, €1.7 billion from Norway, €1.5 billion from Nigeria, and €2.4 billion from other countries including Trinidad and Tobago, and Angola.

Average price of LNG paid by EU Member States

Russia: LNG infrastructure and trade with Europe

Europe increased its imports of Russian LNG by 12% in 2024. One-third of these volumes were spot trades.

The EU Agency for the Cooperation of Energy Regulators has called on member states to gradually reduce imports of Russian LNG, starting with spot trades. However, the bloc’s imports of Russian LNG jumped by 18% in 2024. 31% of these volumes were spot trades.

France, Spain and Belgium accounted for 85% of Europe’s imports of Russian LNG last year. France and the Netherlands both increased their imports of Russian LNG by 81%, while Spain and Belgium marginally reduced theirs.

The European terminals that imported the most Russian LNG in 2024 were Dunkerque (France), Bilbao (Spain), Zeebrugge (Belgium), Montoir-de-Bretagne (France), Gate (the Netherlands), Mugardos (Spain) and Huleva (Spain). Each of these terminals is part publicly owned.

Dunkerque more than tripled its imports of Russian LNG last year.

The biggest known buyers of Russian LNG in 2024 were Naturgy, SEFE M&T and Yamal LNG. 24% of the Russian LNG imported by Europe was bought by Naturgy, 23% by SEFE M&T, 21% by Yamal LNG, 2% by Botaş, 2% by Novatek, 1% by Gasum Oy and the rest by unknown buyers.

In June 2024, the EU agreed to ban transshipments of Russian LNG. This is the process by which LNG cargoes from Russia’s Yamal peninsula arrive at a terminal in Europe and are transferred from icebreakers to conventional LNG carriers. This can involve the intermediate transfer of LNG to other vessels or into storage tanks. The LNG is then sent to third markets, with European countries facilitating the sale of Russian LNG. The ban will come into effect from March 2025.

The Zeebrugge and Montoir-de-Bretagne terminals continued transshipping Russian LNG from Yamal after the ban was agreed last year. In 2024, 3.5 bcm of LNG from the Yamal terminal was transshipped by Zeebrugge and 0.70 bcm by Montoir-de-Bretagne.

Sanctions

EU, UK and US sanctions against Russian LNG operations

Vysotsk and Portovaya LNG plants

-

The US sanctioned two Russian LNG terminal operators: Portovaya operator Gazprom and Cryogas Vysotsk. (January 2025.)

LNG vessels

-

The UK sanctioned 15 vessels and entities involved in the Russian LNG sector. (September 2024.)

-

The EU’s 15th round of sanctions against Russia. (December 2024.)

-

The US sanctioned entities and assets deemed to be supporting the development of the Arctic LNG 2 project. (August 2024.)

The EU’s 14th package of sanctions (June 2024)

-

Ban on reloading services of Russian LNG in EU territory for the purpose of transhipment operations to third countries (will take effect on March 2025).

-

Ban on new investments for the completion of LNG projects under construction.

More information on sanctions: US sanctions list, US Department of the Treasury, Sovcomflot, Wison Zhoushan, Novatek, Belokamenka yard

Contracts

Yamal LNG

Novatek