Latest Institutional Investors Research

See more >

Universal ownership: Decarbonisation in a hostile engagement environment

September 26, 2024

Alasdair Docherty

Report

Universal ownership: A call for practical implementation

May 08, 2024

Alasdair Docherty

Report

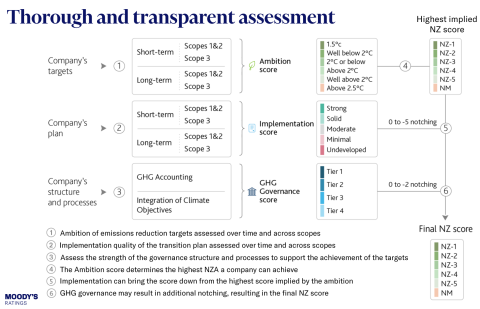

Moody’s sets new course to rigorously assess carbon transition net-zero plans as a business imperative

April 16, 2024

Tom Sanzillo

Briefing Note

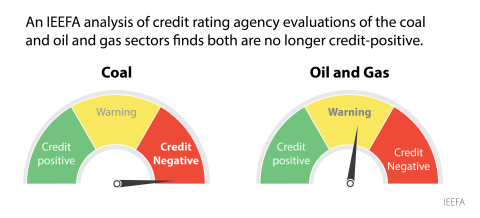

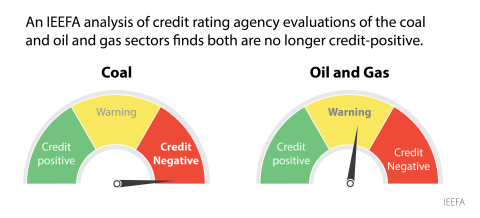

A matter of opinion: Credit rating agencies evolve on climate change, fossil fuel risk

March 14, 2024

Tom Sanzillo

Report

Can G20 help in harmonisation and interoperability of taxonomies?

July 24, 2023

Vibhuti Garg, Shantanu Srivastava

Insights

No “traditional” coal mining at Wandoan but Glencore investors will still have concerns over coal emissions

April 04, 2023

Simon Nicholas

Insights

Private equity investments, climate change and fossil-free portfolios

March 01, 2023

Tom Sanzillo

Insights

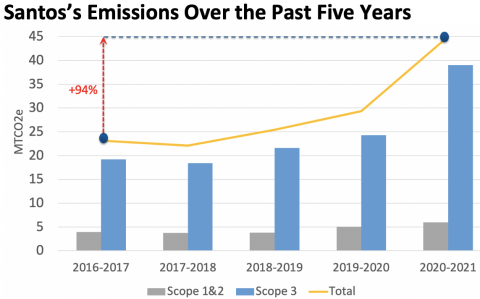

Fossil-linked energy firms have high emissions and the room for denial is shrinking

February 08, 2023

Christina Ng

Insights

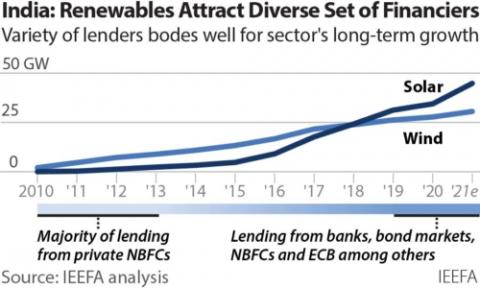

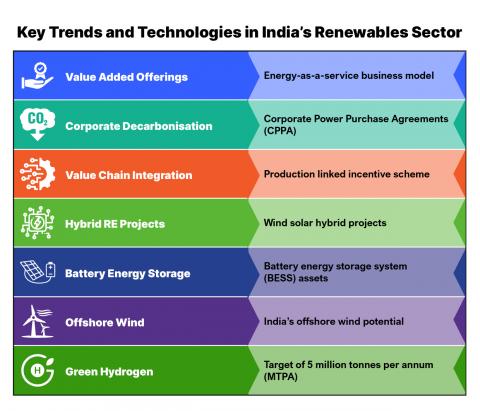

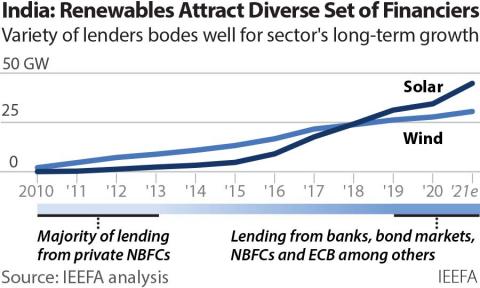

Emerging investment opportunities in India’s clean energy sector

January 18, 2023

Shantanu Srivastava, Kashish Shah, Amit Manohar...

Report

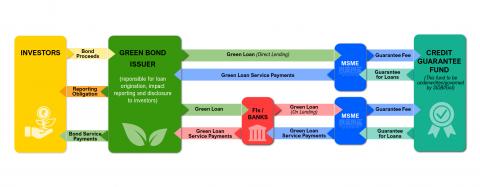

How to mobilise green finance for Indian micro, small and medium enterprises

November 24, 2022

Saurabh Trivedi, Labanya Prakash Jena

Insights

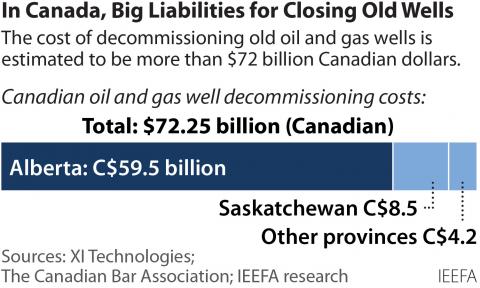

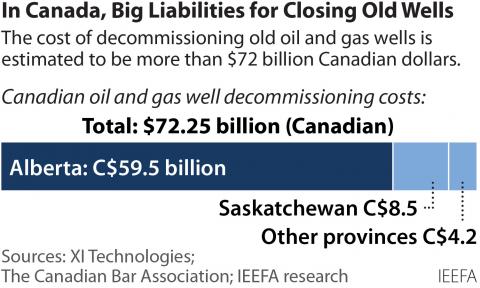

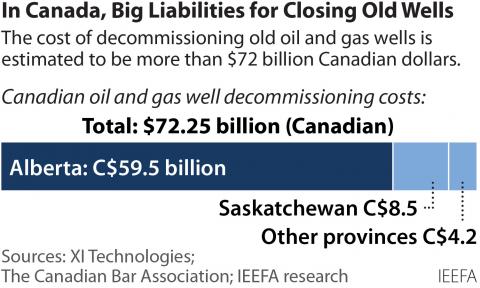

Canada’s oil and gas decommissioning liability problem

May 25, 2022

Omar Mawji

Report

TIAA climate policy gaps erode potential strength of $1.4 trillion fund

May 16, 2022

Tom Sanzillo

Insights

Latest Institutional Investors Reports

See more >

Universal ownership: Decarbonisation in a hostile engagement environment

September 26, 2024

Alasdair Docherty

Report

Universal ownership: A call for practical implementation

May 08, 2024

Alasdair Docherty

Report

A matter of opinion: Credit rating agencies evolve on climate change, fossil fuel risk

March 14, 2024

Tom Sanzillo

Report

Emerging investment opportunities in India’s clean energy sector

January 18, 2023

Shantanu Srivastava, Kashish Shah, Amit Manohar...

Report

Canada’s oil and gas decommissioning liability problem

May 25, 2022

Omar Mawji

Report

Renewable energy financing landscape in India

February 03, 2022

Ankur Saboo, Shantanu Srivastava

Report

Pension funds investing indirectly in Ohio’s Gavin coal plant are at risk as financial, environmental disadvantages mount

October 14, 2021

Dennis Wamsted, Seth Feaster, Tom Sanzillo...

Report

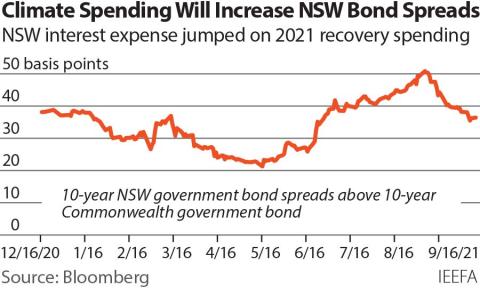

Climate risk and the cost of capital in NSW

October 01, 2021

Trista Rose

Report

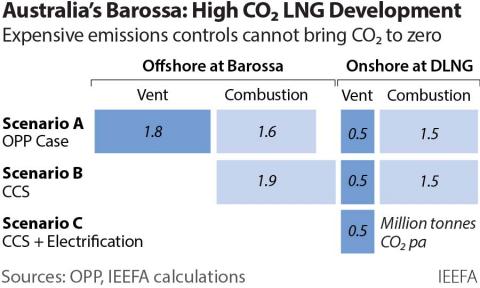

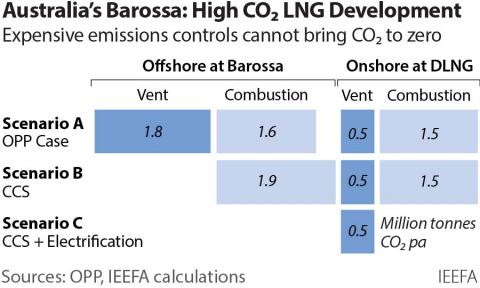

How to save the Barossa Project from itself

October 01, 2021

John Robert

Report

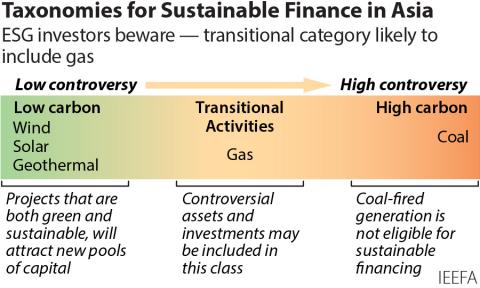

Asian Hopes for Sustainable Finance Will Rest on More Credible Taxonomies

September 01, 2021

Christina Ng

Report

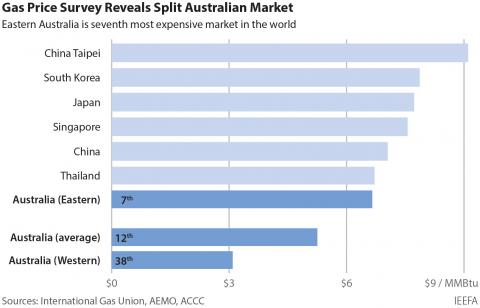

Gas demand is dying under the weight of nose bleed prices

July 01, 2021

Bruce Robertson

Report

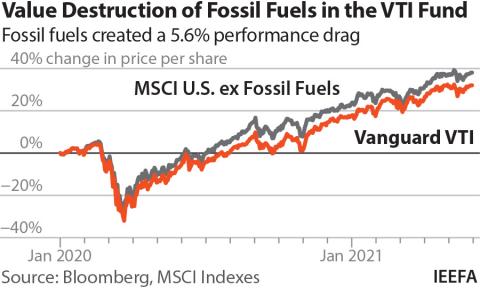

Vanguard Group: Passive about climate change

June 23, 2021

Trista Rose, Tim Buckley

Report

Carbon neutral bonds: has China set the bar too low?

June 01, 2021

Christina Ng

Report

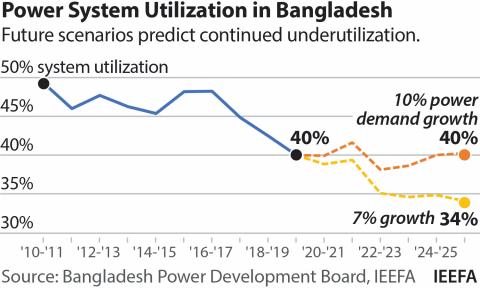

Bangladesh must plan for the energy transition to renewables

May 24, 2021

Simon Nicholas

Report

In a tumultuous 2020, shale firms slashed capex to generate cash

March 25, 2021

Clark Williams-Derry, Trey Cowan, Ashish Solanki...

Report

Latest Institutional Investors Press Releases

See more >

Asset owners need investment products that prioritise decarbonisation over short-term returns

September 26, 2024

Press Release

Universal owner wealth to erode at alarming rate due to carbon pollution of investments

May 08, 2024

Press Release

Credit rating agency evolution on climate change risk and fossil fuel financial viability

March 14, 2024

Press Release

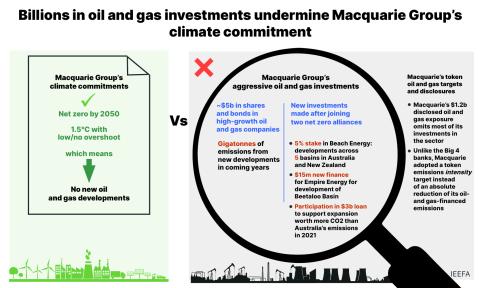

Billions in oil and gas investments undermine Macquarie’s net zero commitments

June 08, 2023

Press Release

India’s renewable energy sector ripe for global and domestic investments

January 18, 2023

Press Release

Canada’s major banks continue funding oil and gas companies despite growing concerns over decommissioning liabilities

May 25, 2022

Press Release

IEEFA and partners renew call to write off Puerto Rico bond debt as part of restructuring plans to ensure low prices, resilient grid

April 21, 2022

Press Release

KEXIM delays investment in Santos’s Barossa gas project despite the company’s carbon capture aspirations, citing concerns

April 08, 2022

Press Release

IEEFA U.S.: Experts offer testimony on Maine fossil fuel divestment planning

February 28, 2022

Press Release

IEEFA India: With green bonds announced in Budget 2022, the sun continues to shine for renewable energy financing

February 03, 2022

Press Release

IEEFA U.S.: Expert testimony supports Oregon’s HB 4115, calls for transparency on climate risk

February 02, 2022

Press Release

IEEFA Update: Santos won’t solve the problem of Barossa LNG with carbon capture and storage

October 20, 2021

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.