Emerging investment opportunities in India’s clean energy sector

Download Full Report

View Press Release

Key Findings

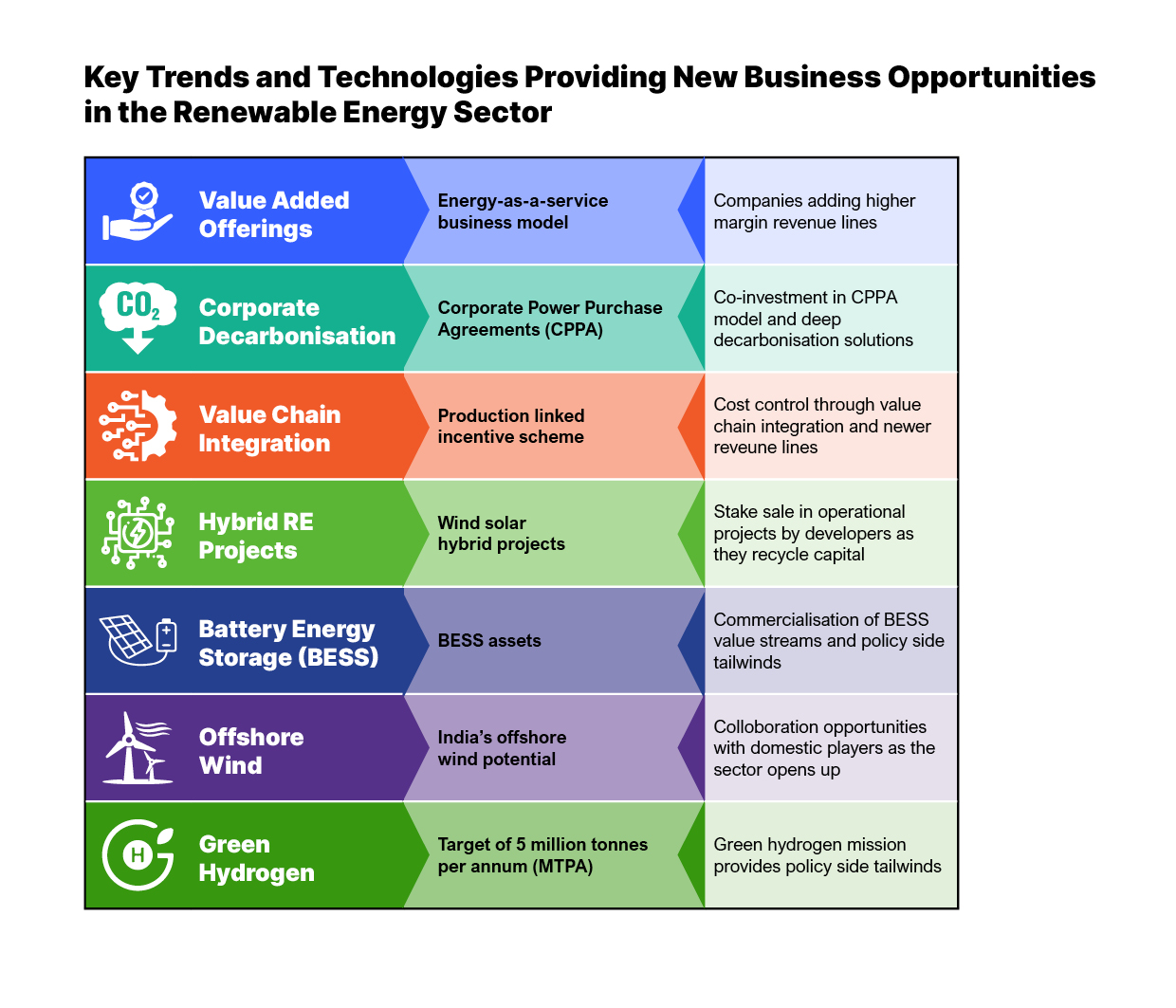

New business models, value-added products and services, such as Energy-as-a-Service and corporate decarbonisation solutions, are evolving rapidly in the renewable energy sector.

Investment opportunities also exists in battery energy storage systems (BESS), offshore wind and green hydrogen.

The government's push for solar-wind hybrid projects offers investors another avenue to enter the Indian renewable energy sector.

Executive Summary

India's installed renewable energy capacity stands at 166.4 gigawatts (GW) (including large hydro) as of November 2022. The sector has grown exponentially over the last decade. The Indian government’s reforms, policies, and an overall pro-business environment in the country have facilitated the growth of the renewable energy sector. These measures, coupled with a constant deflation in key renewable energy technologies’ costs, have helped India record an all-time low solar tariff of Rs1.99/kilowatt-hour (kWh) in 2020. However, recently, several headwinds, such as the rising module prices and increased taxes and financing costs, have changed the sector leading to an increase in discovered tariffs to Rs2.9/kWh.

The sector’s growth has attracted investors from all quarters of the global financial markets. Over the years, domestic clean energy players have raised substantial amounts of capital, both debt and equity, to fund their expansion plans. On the debt side, Indian companies have extensively raised green and sustainability-linked bonds and loans. On the equity side, the sector has had increasing interest from mature long-term passive investors such as sovereign wealth funds (Abu Dhabi Investment Authority and Singapore’s GIC) and pension funds (Canada Pension Plan Investment Board and Caisse de dépôt et placement du Québec (CDPQ)). With the exit of several early investors and many capital recycling opportunities available, the Indian renewable energy market has matured to attract global capital.

Government reforms over the past decade have improved business conditions for the clean energy sector in India. This has also helped create a diverse set of capital sources available for sector players, both domestic and offshore. Industry players are getting ready to ride the next wave of sectoral reforms to accelerate India’s growth as a sustainable energy economy. These reforms include the General Network Access (GNA) regulations, green energy corridor scheme, Production Linked Incentive (PLI) schemes, state electricity distribution companies (DISCOMs) privatisation bids, ancillary regulations and the green hydrogen/green ammonia policy.

India’s success in scaling up renewable energy should give confidence to industry players and potential investors.

The success of these reforms hinges on the government’s ability to weed out implementation bottlenecks, facilitate the availability of long-term competitive finance and ensure that the concerns of industry players are duly addressed. India’s success in scaling up renewable energy should give confidence to industry players and potential investors in this context.

Key Trends Emerging in the Renewable Energy Sector

Along with developments in the generation, distribution, and transmission of renewable energy business models, value-added products and services such as Energy-as-a-Service and corporate decarbonisation solutions are evolving at a rapid pace. While Tata Power has rolled out a turnkey package of energy efficiency services, JSW Energy and ReNew Power are providing on-demand firm dispatchable power for their customers. Greenko, too, recently rolled out cloud energy storage solutions offering on-demand storage to its customers.

Corporate decarbonisation is another growing trend buoyed by increasing net-zero commitments by Indian companies. Corporate Power Purchase Agreements (CPPAs) are proving to be a win-win proposition for independent power producers (IPPs) and corporates. The CPPA market is yet to reach its full potential. The rectification of hurdles, such as delays in the approval of projects and withdrawal of waivers on various charges, will play a prominent role in fulfilling its promise.

For deep decarbonisation, industry players are exploring the many use cases of green hydrogen with several projects and partnerships in storage, mobility, industrial supply, and natural gas blending.

With a target of 25% share of the power exchanges by 2024, the short-term and merchant markets are also growing rapidly. Market-based reforms, along with the integration of the national grid and multiple projects underway to strengthen the interstate transmission system (ISTS), provide tailwinds for the sector's growth. This could lead to companies keeping merchant or un-tied renewable energy capacities to trade through the exchanges.

In the renewable energy generation market, by diversifying upstream into solar module manufacturing and downstream through acquiring state-owned distribution companies, value chain integration provides the much-needed cost control and opens up new revenue streams for the sector’s companies. DISCOM privatisation has achieved impressive results in the past. Going forward, the larger DISCOMs should also be privatised, where industry players will find several opportunities for value creation.

Lastly, with an installed capacity of approximately 104GW of wind and solar to date, the Indian renewable energy sector is making strides to provide solutions for the intermittency of the two generation sources. In India, the complementarity of solar and wind resources provides an opportunity to hybridise the two technologies to minimise variability and optimally utilise the infrastructure, including land and transmission systems. To rectify this, the government has now released tenders for renewable energy auctions for round-the-clock and hybrid projects instead of plain solar or wind tenders.

Key New Technologies and Associated Business Models

In line with global developments, several new technologies and associated business models are taking shape in the country’s clean energy market.

- Battery Energy Storage Systems (BESS)

India plans to integrate large-scale solar and wind energy into its grid by 2030. In this context, battery storage is a vital technology solution as it allows time to shift the dispatch of solar and wind power. With several recent advancements in battery technology and massive cost deflation projections, it is estimated that India will add 140-200GW of battery storage capacity, the largest for any country, by 2040. Several emerging projects at the state and central levels are signs of the development of this segment. The production-linked incentive (PLI) scheme for setting up domestic battery storage production capacities will also facilitate the segment’s growth. A key deliverable to scale up BESS capacities in the country will be ensuring the availability of sufficient bidding pipelines and the timely signing of the required offtake agreements for completed bids. This will give long-term visibility and prove to be a source of confidence for industry players and investors.

- Offshore Wind

India has set an offshore wind power capacity target of 30GW by 2030. The sector may have witnessed a slowdown due to supply-chain and policy-related bottlenecks, but the Ministry of New and Renewable Energy’s announcement of a 4GW tender for offshore wind power off the coasts of Tamil Nadu and Gujarat has reinvigorated the sector. Offshore wind potential in India is pegged at 195GW along the 7,600km coastline with an ability to provide utilisation factors of more than 50-55%. Thus, adding offshore wind to India’s generation mix would potentially provide better round-the-clock clean power resources and add resource diversification benefits.

- Green Hydrogen

Green hydrogen is a prime source of non-polluting energy and has the highest energy output by weight and volume. It is, thus, the fuel that will drive the green energy revolution in the coming years across many hard-to-abate sectors. The government has launched the National Green Hydrogen Mission to fulfil this target. Indian power sector companies have supported the policy with several commitments to invest in this nascent technology and provide solutions for industrial clients. The government forecasts a production capacity of at least 5 million tonnes per annum (MTPA) with an associated renewable energy capacity addition of about 125GW in the country by 2030. Several sectors, such as refining, fertilisers, steel, and cement, will be the major demand drivers. For a scale-up of green hydrogen technology in the country, de-risking of investments is required through policy support such as offtake assurances, production incentives, and availability of long-term competitive financing.