Key Findings

Lackluster demand growth combined with a massive wave of new export capacity is poised to send global liquefied natural gas (LNG) markets into oversupply within two years.

In Japan, South Korea, and Europe—which together account for more than half of the world’s LNG demand—combined imports fell in 2023 and will likely continue falling through 2030.

In emerging Asian markets, structural LNG demand growth faces economic, political, financial, and logistical challenges that an oversupplied environment may not fully resolve.

IEEFA expects global LNG supply capacity to rise to 666.5 MTPA by the end of 2028, which exceeds International Energy Agency (IEA) demand scenarios through 2050.

Executive Summary

Lackluster demand growth and a massive wave of new export capacity are poised to send global liquefied natural gas (LNG) markets into oversupply within two years. These two trends are developing even faster than anticipated.

Declining Russian gas supplies to Europe, driven by Russia’s full-scale invasion of Ukraine, caused a spike in European LNG imports that sent global prices to record highs. But despite modest new LNG export capacity additions in the last two years, prices have retreated from 2022 levels, largely due to falling demand from developed economies. (All prices in this report are in U.S. dollars [USD] unless otherwise specified.)

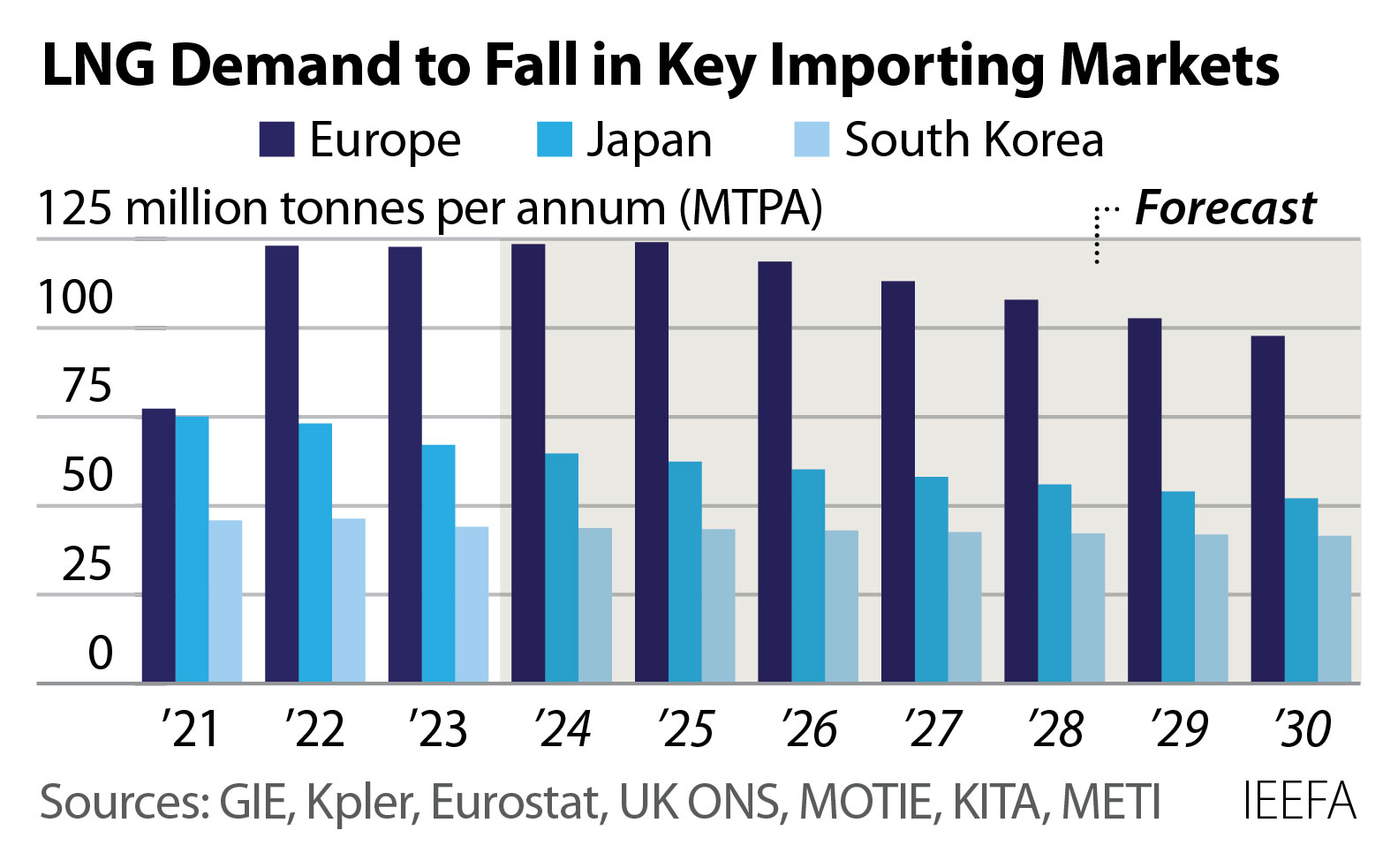

In Japan, South Korea and Europe—which account for more than half of the world’s LNG demand—combined imports fell in 2023 and will likely continue falling.

- In Japan, formerly the world’s largest LNG importer, demand fell 8% in 2023. Since 2018, Japan’s annual LNG imports have fallen 20%. A planned increase in nuclear and renewables generation—spurred by climate and energy policies, along with years of high LNG prices—will likely send demand even lower.

- In South Korea, historically the largest buyer of U.S. LNG, imports fell almost 5% last year. Long-term climate and energy plans in South Korea envision LNG imports falling 20% through the mid-2030s, as solar, wind and nuclear plants come online.

- Europe’s LNG imports stagnated in 2023, defying expectations of rising imports to replace lost Russian gas supplies. Europe’s overall gas consumption fell 20% in the past two years due to high prices, energy security mandates and climate policies. IEEFA expects Europe’s LNG demand to peak by 2025 and decline through 2030.

In emerging Asian markets, structural LNG demand growth faces a complex web of economic, political, fiscal, financial and logistical challenges. The global LNG crisis of the last several years heightened those challenges, spurring some Asian nations to reduce the role of LNG in their development plans and accelerate the development of alternative energy sources.

- In Southeast Asia, protracted timelines for new LNG infrastructure projects, plus the favorable economics of alternative energy sources, are likely to constrain LNG demand growth, particularly in Vietnam and the Philippines.

- In South Asia, LNG imports fell by 16% in 2022 but rebounded in 2023 as global spot prices fell. But two years of high prices and unreliable supplies triggered fiscal challenges and fuel switching. Pakistan, for example, announced last year that it would stop building new LNG fired power plants. Price declines will likely boost the region’s imports, but fiscal issues and competition from other power sources point to uneven growth in demand.

- In China, imports will likely increase as prices fall, but domestic gas production, pipeline gas imports, and policies favoring domestic energy industries could constrain structural demand growth and leave Chinese LNG buyers with a surplus of contracted volumes.

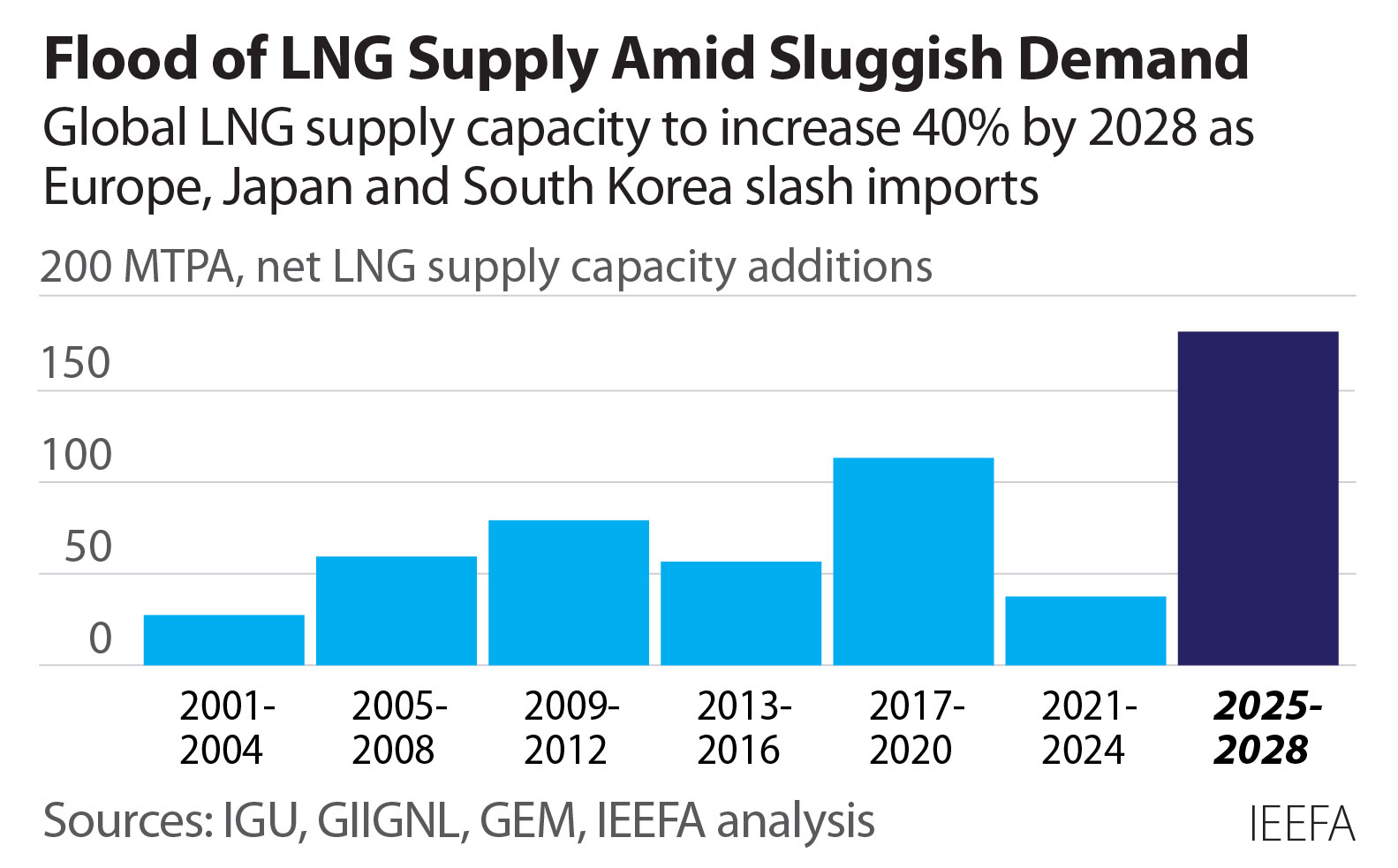

Even as the LNG crisis undermined global demand growth, high prices spurred an unprecedented flood of new supply, with LNG developers more than doubling the previously planned buildout of export capacity. IEEFA anticipates that nameplate LNG liquefaction capacity from projects that have already begun construction, or that are approved by financially capable backers, could add 193 million metric tons per year (MTPA) of new supply capacity from 2024 through 2028—a 40% increase in five years. (Note: One million metric tons of LNG is the equivalent of 1.36 billion cubic meters of gas.)

By the end of 2028, the world’s total nameplate liquefaction capacity could reach 666.5 MTPA. For perspective, the International Energy Agency (IEA) projects total LNG trade in 2050 to reach 482 MTPA under its stated policies scenario. In other words, LNG liquefaction capacity coming online through 2028 exceeds IEA long-term demand scenarios. (Note: The IEA’s Stated Policies Scenario [STEPS] “provides an outlook based on the latest policy settings, including energy, climate and related industrial policies.”)

Robust supply growth will likely lead to lower prices, encouraging an uptick in short-term buying. Yet in South and Southeast Asia, ongoing fiscal challenges and lengthy delays for new gas and LNG infrastructure pose structural challenges to demand growth that a low-price environment does not fully resolve.

To overcome these challenges and cultivate new demand, LNG traders and portfolio players—the largest counterparties to new long-term LNG offtake contracts over the last three years—are investing in regasification, power, gas distribution and other infrastructure. Some LNG importers in Northeast Asia are investing in and trading with emerging market buyers to offload surplus contracted supplies. Similarly, European players justified new offshore regasification terminals partly by arguing that they could eventually be relocated to Asia.

For the LNG industry to thrive financially, emerging Asian nations must not only replace shrinking imports from developed markets, but also absorb the massive volume of new supplies coming online. This renders the LNG industry increasingly reliant on markets with less-creditworthy buyers, riskier business environments and greater sensitivity to high prices. If rapid and sustained demand growth does not materialize, LNG suppliers and traders—particularly those with higher costs and significant uncontracted supplies—will likely face an extended period of low prices and slim profits.

Section Summaries

Global LNG Supply | LNG Portfolio Players: Linking Supply and Demand | Global LNG Demand

Global LNG Supply

Starting in late 2024, the global LNG market will witness an unprecedented wave of new liquefaction projects coming online. This will be the fastest capacity growth in the global LNG industry’s brief history, representing a 40% increase in just five years. The industry is on track to add almost five times as much new liquefaction capacity from 2025 through 2028 compared to the previous four-year period.

The bulk of new LNG capacity to be completed by 2028 will be concentrated in the United States (U.S.) and Qatar. Substantial additional capacity is also under construction in Russia, Canada, and African nations.

During the last major surge in new capacity, from 2017 through 2020, oversaturated LNG markets triggered sharp declines in global prices and weak profits for many LNG suppliers and traders. The addition of a massive amount of new LNG capacity by 2028 could once again result in oversupplied markets and weak economic fundamentals for global LNG suppliers.

Global LNG Production and Reliability

The U.S., Australia, and Qatar produced three-fifths of the world’s LNG in 2023. For the first time ever, the U.S. edged out its two top rivals to claim the lead spot among global LNG exporters.

Although global LNG production capacity is slated to grow, total output will be constrained by operational challenges and declining feedstock gas production at many facilities. Roughly one-third of the world’s LNG plants have suffered from significant mechanical reliability and gas supply challenges in recent years. Global LNG supply also faces risks from disruption of key maritime chokepoints.

With these disruptions, the world’s LNG fleet operated at only 87% of its rated capacity in 2023. However, strong global LNG demand created a powerful incentive for LNG producers to maximize output, and several projects shipped more than their rated capacity in 2023.

United States

Since the startup of its first LNG terminal in early 2016, the U.S. has grown to become the world’s largest LNG supplier. Today there are seven operating LNG facilities in the continental U.S., with a combined nameplate capacity of 92.3 MTPA of LNG, about one-fifth of the world’s total.

Prompted in part by gas price spikes in 2021-22 stemming from the Ukraine crisis, the U.S. Department of Energy paused new authorizations for LNG exports to non-free trade agreement (NFTA) nations in January 2024.

U.S. LNG sales contracts are among the least restrictive in the global industry, but this flexibility means that buyers can cancel LNG cargoes when it is economic for them. An extended period of low global LNG prices could leave the U.S. fleet underutilized.

Australia

Australia exported an all-time high of 81 MT of LNG in 2023, but its LNG output rose by less than 1% year-over year, and the nation ceded its position as the world’s largest LNG exporter to the U.S. Several Australian LNG plants have dramatically underperformed in recent years.

New Australian LNG projects are generally viewed as globally uncompetitive due to high costs for both construction and new gas supplies. The industry also faces stringent emissions obligations under Australia’s Safeguard Mechanism

Increased competition, declining reserves, government gas market intervention, and the potential for LNG buyers to seek alternative supply could lead to a decline in Australia’s LNG exports in coming years. The prospect of declining output has raised concerns that Australia is “quietly quitting” the LNG business.

Qatar

Qatar has embarked on a massive LNG expansion program that will boost its liquefaction capacity by 64 MTPA over the next six years. In October 2023 Qatar Energy commenced construction of its 32-MTPA North Field East Expansion, with the first gas expected as soon as 2025. In February 2024, Qatar announced that it would double the size of the project’s second phase, slated to come online by 2030.

Much of the output from Qatar’s expansion is uncontracted, potentially pointing to an oversupplied spot market in years to come. Qatar’s LNG ambitions are underpinned by the favorable economics of the offshore North Field, which produces abundant volumes of both gas and liquid condensates, which are used as feedstock for gasoline (petrol), jet fuel, and diesel.

Russia

Although Russia’s pipeline gas exports slumped after the country invaded Ukraine, its LNG exports have remained robust, with 32 MT exported in 2023. The European Union pledged in 2022 to end its dependence on Russian fossil fuels by 2027, but it imported more Russian LNG over the last two years than before the Ukraine invasion.

With Russian pipeline gas exports expected to remain far below historic highs, Russia hopes to monetize its gas reserves by expanding LNG exports. Central to this strategy is the 20 MTPA Arctic LNG 2 project in Siberia, but the project has been slowed by international sanctions.

Gazprom also hopes to move forward with its Ust-Luga LNG project, with a government target to complete the project’s two phases in 2027 and 2028. However, the project faces its own challenges.

Canada

Canada’s once-lofty ambitions to become a major player in the global LNG market have faded amid high construction and pipeline costs. Of roughly 20 LNG projects once proposed in Canada, most have now been shelved.

Shell and its partners expect to ramp up operations at Canada’s first commercial-scale LNG plant, starting in 2025, but massive cost overruns in the pipeline supplying the project will likely undermine its economic competitiveness. The smaller Woodfibre LNG project is also moving forward, but the project’s total price tag has exploded from an estimated CAD1.6 billion in 2019 to CAD6.9 billion by 2024.

Africa

African LNG shipments have fallen 10% from their 2019 peak. Africa’s two top exporters, Algeria and Nigeria, have struggled for years with faltering gas production, and while Algeria’s LNG output grew in 2023, growing domestic gas consumption and rising pipeline exports will likely squeeze the country’s LNG feedstock supplies

Europe’s energy crisis spurred interest in African LNG to diversify the continent’s gas supplies. LNG developers are now targeting almost 14 MTPA of new African liquefaction capacity by 2028, but pervasive project delays have heightened the financial risks of the LNG buildout.

LNG Portfolio Players: Linking Supply and Demand

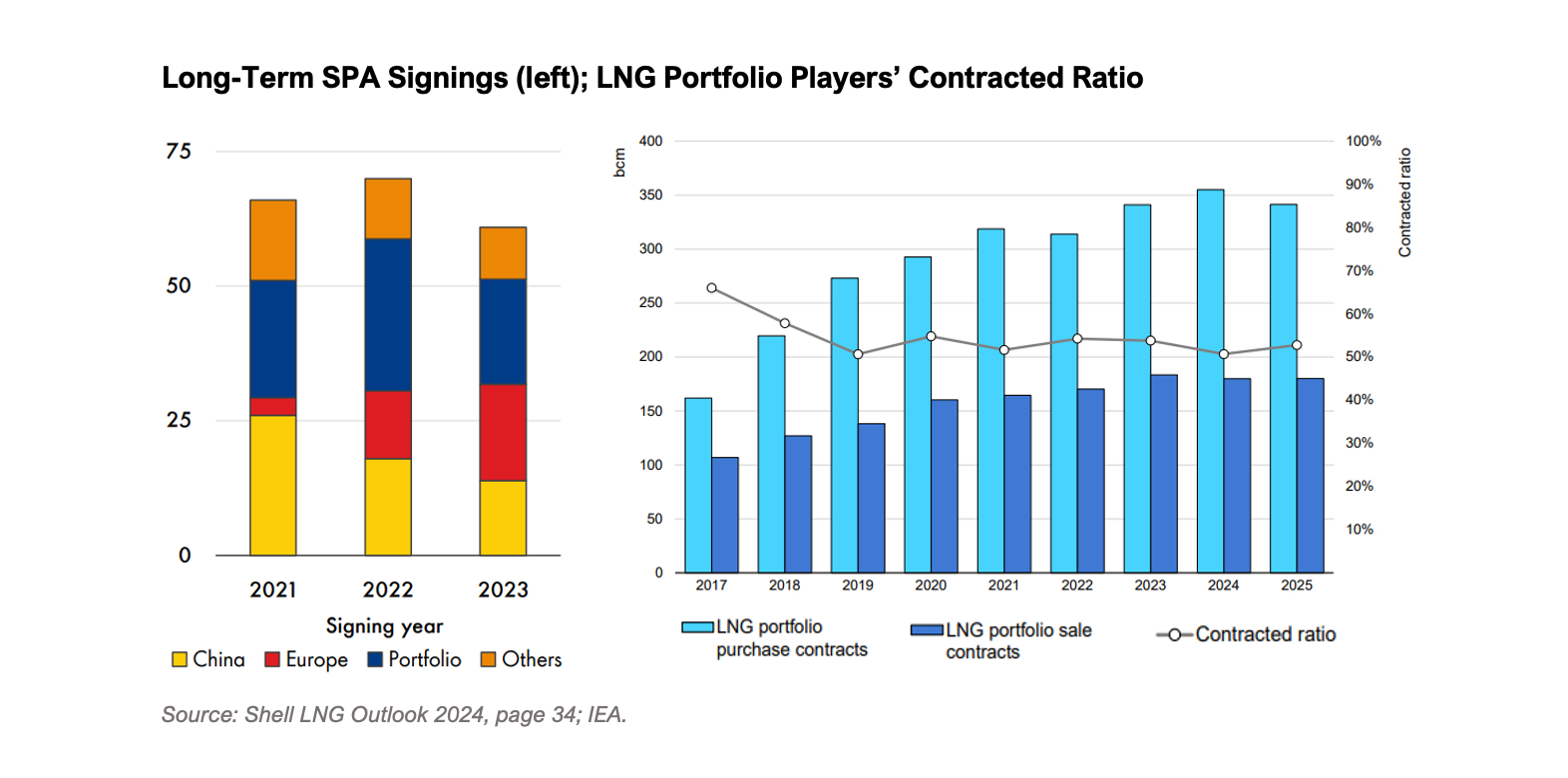

Intermediary companies that buy LNG and re-sell it around the world—called portfolio players or LNG aggregators—have grown to account for a dominant share of LNG trades.

Over the last three years, these companies have been the largest counterparties to new long-term LNG purchase contracts. In 2023, aggregators were reportedly committed to buying roughly two-thirds of the export capacity under construction in North America.

Aggregators resell LNG to buyers via long-term contracts or spot market sales, often at a premium. According to the IEA, the share of LNG that portfolio players are re-selling on long-term contracts is declining, indicating higher exposure to spot markets and a higher degree of marketing risk.

As a result, record increases in global LNG supply and the potential for a medium-term glut could cause margins for portfolio players to fall. Meanwhile, risks to global demand growth could leave aggregators with significant volumes of unsold LNG, exacerbating financial risks. By procuring large volumes of LNG for the long term, aggregators are betting on sustained LNG market growth that may not materialize.

Global LNG Demand

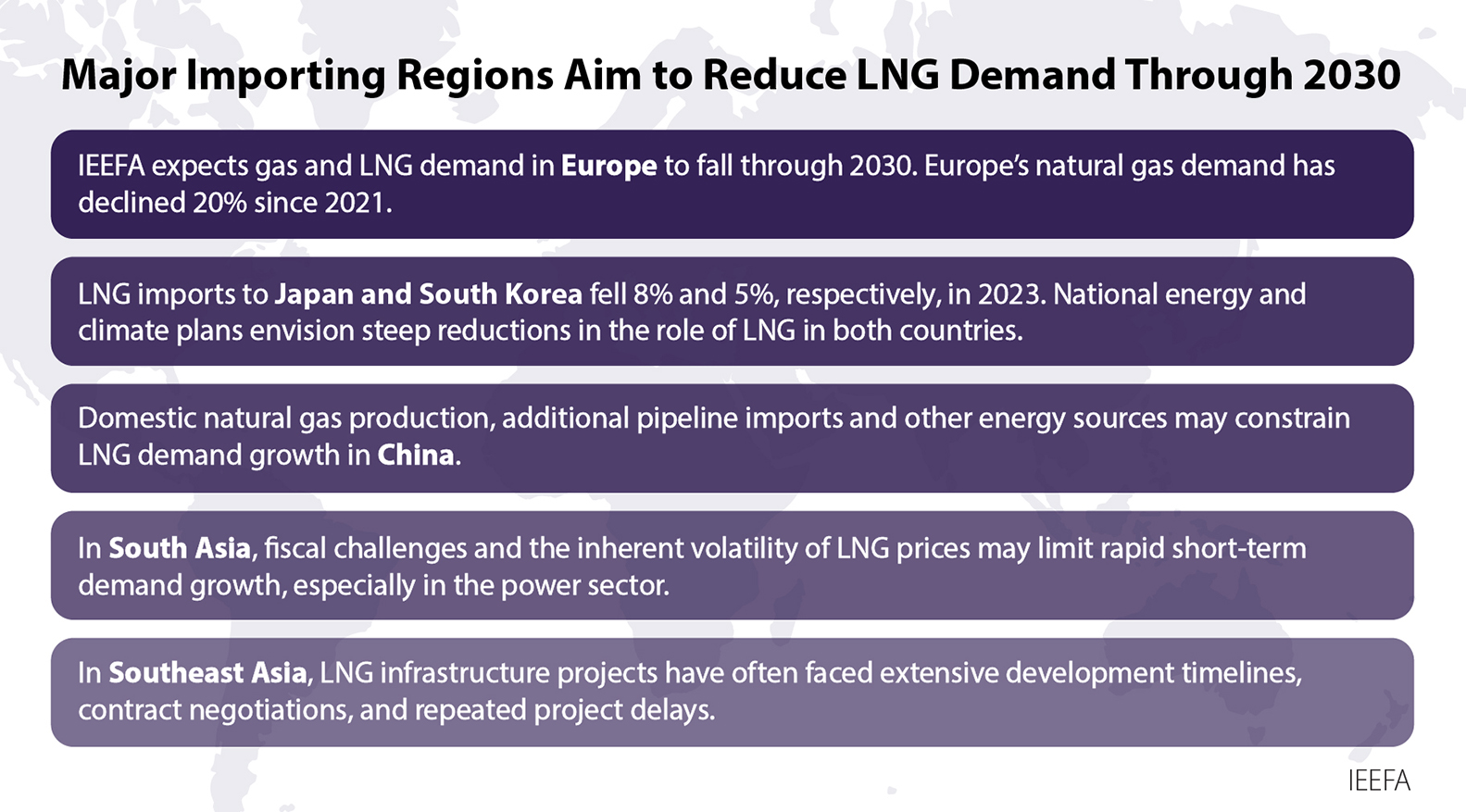

Global LNG demand growth through 2028 will likely disappoint optimistic industry expectations. Demand fundamentals in Europe, Japan, and South Korea – which together accounted for more than half of global LNG consumption in 2023 – point to long-term declines in LNG imports. Meanwhile years of high and volatile LNG prices and extensive infrastructure delays have slowed structural demand growth in emerging Asia.

Oversupplied markets and lower prices this decade will likely elicit some demand response in various regions. However, structural barriers to LNG uptake – including long-term energy and climate plans in Europe and Northeast Asia, as well as infrastructure and financing challenges in emerging Asia – are likely to undermine expectations for rapid, sustained growth over the medium term.

Europe

Europe imported a record amount of LNG in 2022 to replace lost Russian pipeline gas supplies, but in the last two years overall gas demand has fallen 20% to its lowest level in a decade and is expected to fall by 11% between 2023 and 2030. LNG imports are forecasted to peak in 2025.

European gas prices have stabilized amid declining demand and high storage levels. Natural gas prices in Europe have retreated from 2022 highs due to mild winters, weak demand, increased hydroelectric and nuclear generation, and strong renewables performance. EU member states have agreed to continue reducing gas demand to reinforce security of energy supply and contain price volatility.

Europe’s ongoing buildout of LNG infrastructure is likely to result in significant excess capacity and could cause utilization rates to fall over the remainder of the decade.

Japan, South Korean, and Taiwan

Combined LNG demand in the major Northeast Asian markets of Japan, South Korea, and Taiwan fell 5.4% in 2023, after dropping 1% in 2022.

Long-term climate and energy plans could cause LNG demand to decline rapidly in the coming decade, with increasing nuclear and renewables generation continuing to reduce power sector LNG demand. Japan is set to continue restarting idled nuclear facilities, while South Korea aims to add 7 GW of new nuclear capacity through 2033. However, Taiwan’s policy to achieve a nuclear-free power sector by 2025 and lower coal-fired generation may lift LNG imports this decade.

Rather than importing more LNG, Japan’s LNG sales to other countries have almost tripled since 2018. Japanese companies aiming to re-sell LNG may be contributing to a looming oversupply of LNG rather than absorbing cargoes from the global market.

China

China reclaimed its position as the world’s largest LNG importer in 2023, but purchases have not fully recovered to levels before the Russian invasion of Ukraine and remain 10% below 2021 imports. Overall gas demand in 2023 is projected to rise almost 4% to 390 bcm after declining 1.2% in 2022.

Domestic gas production, pipeline gas imports and policies to bolster energy security will likely constrain China’s LNG imports. Natural gas’s share gas in the power generation mix has stagnated as unprecedented increases in renewable energy have outcompeted gas.

China’s role as a balancing buyer in global gas markets is set to increase in the coming years, clouding the outlook for LNG demand growth. If prices fall, LNG consumption could rise, but weaker-than-expected demand growth in the short term could leave buyers with a surplus of contracted volumes.

India, Bangladesh, and Pakistan

In South Asia, LNG imports fell by 16% in 2022, but rebounded in 2023 as global spot prices fell. However, two years of high prices and unreliable supplies triggered a political backlash, strengthening incentives to shift to cheaper alternative energy sources including renewables and domestic gas.

LNG price volatility may challenge sustained demand growth in price-sensitive South Asian countries, particularly during periods of heightened buying activity by other regions. Lower LNG prices may encourage some rebound of demand in the region, but persistent fiscal challenges could also limit near-term demand growth.

LNG’s role in power generation is likely to remain low. India has no plans to build more gas-fired power plants; Pakistan announced in 2023 it would no longer build LNG-fired plants; and in Bangladesh, new nuclear facilities and additional renewables may erode utilization of existing gas-fired plants.

Southeast Asia

Southeast Asia’s macroeconomic growth forecasts and declining gas production have fuelled industry expectations for LNG demand growth. However, infrastructure and financing challenges, as well as competition from alternative energy sources, may limit the region’s LNG growth potential.

Despite Vietnam’s completion of its first LNG terminal, demand growth faces significant hurdles. LNG-fired power plants have faced delays, LNG prices have been significantly higher than domestic gas, while renewable energy has cut the role of gas in Vietnam’s power mix. The Philippines also began importing LNG in 2023, but while LNG facilities are facing regulatory obstacles, the government is advancing policies to accelerate renewable energy deployment.

LNG imports in Thailand increased by 34% amid declining domestic gas production, lower pipeline imports and increased gas demand. However, the government plans to minimize LNG imports in 2024 and has emphasized the role of clean energy in mitigating economic crises. In Singapore, LNG imports rose 30% year-over-year through November 2023 to offset declining pipeline imports, but in the long term, gas price volatility and supply disruptions are prompting a search for alternative supplies.