Climate risk and the cost of capital in NSW

Download Full Report

Key Findings

Climate risk will materially impact the economic and fiscal outlook for New South Wales, Australia’s largest state, responsible for around a third of the nation’s economic output.

As Australia’s climate record comes under increasing scrutiny, global investors will look to proactively divest bonds in a high emitting, relatively insignificant global market.

Credit ratings agencies have warned that climate risks are starting to be incorporated in their forecasts, and sovereign downgrades are coming.

Australia’s failure to act on climate will impose a cost on future generations. For NSW, this could mean a debt boom.

Executive Summary

Australia’s failure to commit to national net zero targets or any credible climate policy is a growing economic threat to the country and its subnational governments.

International focus on climate is intensifying rapidly. As world leaders discuss means and methods to accelerate the race to zero, Australia has signalled it has no climate ambition and its economy will continue to be powered by fossil fuels, with government subsidies undermining the rapidly improving economics of decarbonisation.

Central banks, insurers, asset managers and investors are preparing for a lower emissions future. More than half of all global assets under management are now linked to net zero commitments; and central banks (notably the European Central Bank) have outlined measures to incorporate climate considerations into the purchasing of bonds.

Decarbonizing portfolios will inevitably mean shifting money away from assets with a high climate risk profile. Australian sovereign and sub-sovereign bonds will not fit within the international community’s low carbon goals.

Decarbonizing portfolios will mean shifting money away from assets with a high climate profile… like Australian sovereign and sub-sovereign bonds.

Notably, climate risk will materially impact the economic and fiscal outlook for the state of New South Wales, Australia’s largest state, responsible for around a third of the nation’s economic output. The state has relied heavily on offshore investors for its funding requirements. Access to foreign capital is likely to become increasingly challenging as investors shun assets with high carbon exposure.

Riksbank, Sweden’s central bank, has already divested its holdings in Queensland and Western Australian government bonds due to their climate profile.

As Australia’s climate record comes under increasing scrutiny, global investors will look to proactively divest bonds in a high emitting, relatively insignificant global market. Credit ratings agencies have also warned that climate risks are starting to be incorporated in their forecasts, and sovereign downgrades are coming.

For NSW, a one-notch downgrade from its ‘AA+ and AAA’ ratings would mean reduced capital access and higher borrowing costs, potentially preventing a large subset of investors from holding NSW semi-sovereign bonds.

As Federal Treasurer Josh Frydenberg stated (in a desperate plea for the Australian Government to set climate targets), “higher borrowing costs impact everything… from interest rates on home loans to the viability of large infrastructure projects”.

Australia’s failure to act on climate will impose a cost on future generations. For NSW, this could mean a debt boom as a result of the following impacts likely to materialise very soon:

- NSW Treasury expects the economic cost of natural disasters to NSW to treble to $16-17 billion per year by 2061.

- Deloitte Access Economics estimates that the economic losses of Australia doing nothing to mitigate climate will shrink Australia’s GDP by 6%.

- The combined loss of coal revenue and population growth will tip net debt to 100% of GSP by 2060.

- If climate mitigation efforts are not introduced until 2030, debt-to-GDP will increase to 156% by 2040, and Australia could default.

- Australia will see at least a 4-notch credit ratings downgrade by 2100 if it continues to ignore climate warnings; NSW ratings will be concurrently lowered.

- The bond market has reacted strongly to the NSW government’s recent economic recovery spending, with interest cost spreads rising ~30bps since June 2021. Increased debt resulting from the rising costs of environmental damage and climate mitigation will come at a greater cost to taxpayers in the form of interest expense.

Aside from these tangible costs, international investors’ perceptions of Australia and climate matter, and will inevitably have a material flow-on effect on the demand and liquidity of NSW Government bonds.

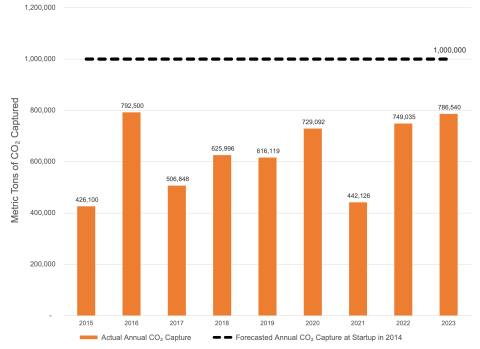

Press release: Emissions Reduction Fund change puts Australia’s 35% emission reduction forecast at risk unless taxpayers fork out

Please view full report PDF for references and sources.