IEEFA Puerto Rico: FERC orders New Fortress Energy to explain lack of permission for San Juan LNG facility

June 22, 2020 (IEEFA U.S.) — Federal regulators have asked the operator of a scandal-plagued Puerto Rico energy project to explain why they didn’t seek permission to build and operate a liquid natural gas terminal (LNG) adjacent to the island’s first major power project since a 2017 hurricane devastated the island’s electrical grid.

June 22, 2020 (IEEFA U.S.) — Federal regulators have asked the operator of a scandal-plagued Puerto Rico energy project to explain why they didn’t seek permission to build and operate a liquid natural gas terminal (LNG) adjacent to the island’s first major power project since a 2017 hurricane devastated the island’s electrical grid.

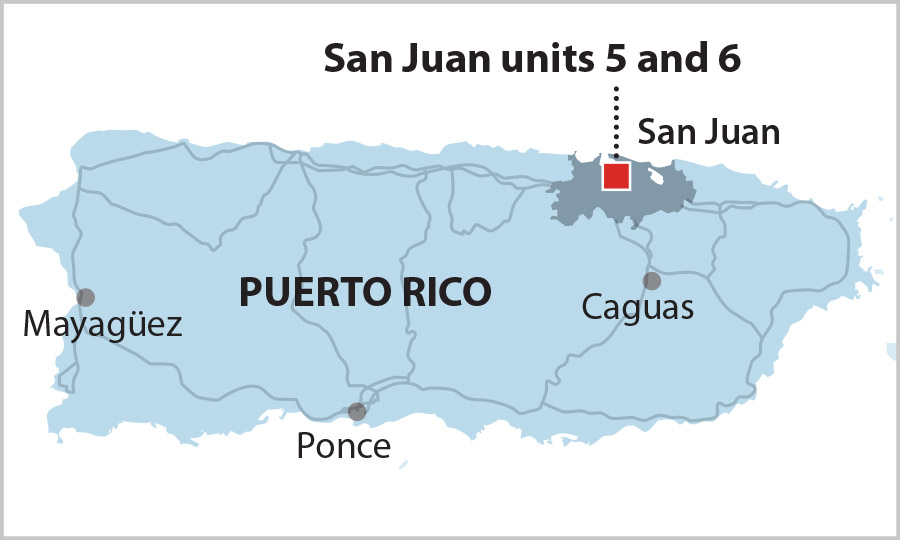

The Federal Energy Regulatory Commission (FERC) last week said New Fortress Energy (NFE) should have sought its approval before building the facility to fuel a $1.5 billion deal converting a pair of diesel-fired San Juan power stations.

A report released earlier this month by the Institute for Energy Economics and Financial Analysis (IEEFA) found that the contract process was plagued by irregularities that provided unfair advantage to New Fortress, which had limited experience in Puerto Rico.

“It appears that New Fortress Energy’s LNG import facilities located in San Juan are subject to the Commission’s jurisdiction, and New Fortress Energy is directed to show cause why its construction and operation of the subject facilities are not subject to the prior authorization requirements,” FERC Deputy Secretary Nathaniel J. Davis wrote in a June 18 order.

New Fortress has 30 days to explain its failure to seek FERC authorization.

The IEEFA report confirmed that NFE didn’t seek approval for its project. The Puerto Rico Electric Power Authority (PREPA), which awarded the contract, said it was told that New Fortress representatives met with FERC and agreed their facility didn’t need to be approved by the commission.

Tom Sanzillo, IEEFA Director of Finance, said New Fortress should have at least applied for an exemption from FERC approval before beginning work on the project. Although the initial request for proposal agreed that New Fortress would be responsible for interactions with regulators, authorities in Puerto Rico also should have exercised considerably more oversight, he said.

“It’s a very sketchy way to claim compliance in a contract process,” said Sanzillo, the co-author of the report. “There should be written letters of approval or adjudicated documents by FERC saying that such a waiver has been granted.”

The IEEFA report found multiple irregularities in the contract, including:

- After receiving an unsolicited proposal from New Fortress Energy (NFE), PREPA and its financial advisor, Filsinger Energy Partners (FEP), met repeatedly with NFE before the authority drafted its request for proposals (RFP) in April 2018.

- While the RFP was being drafted, PREPA and New Fortress Energy signed a confidentiality agreement that gave NFE advance information regarding the San Juan 5 and 6 power stations.

- PREPA failed to tell prospective bidders about New Fortress Energy’s lease of strategically important property for the project nor did the authority inform other bidders of NFE’s unsolicited proposal and of its numerous communications with the authority.

- The authority evaluated proposals with a committee that included FEP representatives who had talked regularly with New Fortress Energy, had reviewed their unsolicited proposal, and had assisted with evaluating its environmental permitting documents.

- PREPA used an outside counsel to negotiate the contract. The firm also represented entities owned by NFE’s parent company, Fortress Investment Group.

Author contact

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.