Wind projects improve county bond ratings in Ohio

Ohio’s Paulding County experienced an upgrade in its municipal bond rating last year as a direct result of wind turbine projects installed throughout the county. The three current revenue‑generating projects installed were the Timber Road Wind Farms II and III opened in 2013 and 2018, respectively, and the Blue Creek Wind Farm opened in 2014. All together, these three farms comprise 188 turbines and 275MW of wind energy.

Municipal bond ratings have generally been ignored as a benefit when a community calculates the impact of a wind or solar farm project on its finances. Local elected and government budget professionals, environmental activists, public workers, local businesses, and community service providers should all take heed.

Why pay attention:

- The transition to a green economy is not just an abstract theory. It is an immensely practical pathway for communities that host renewable energy facilities. Revenues from wind energy installations can fund services, schools and health care, without new tax increases or municipal capital expenditure.

- Better reporting by rural communities will show that the distribution of benefits of renewable energy go beyond short-term construction jobs and can be a long-term part of a community’s financial stability.

- The benefits of an improved bond rating are not widely understood, but such upgrades help communities lower the cost of government and keep property and other taxes manageable. Wind farms are also important new members of Chambers of Commerce that make contributions across villages, towns, counties, and states.

The case study of Paulding County, Ohio, conducted by students of Bard’s MBA program over the past year, sheds light on how revenues from wind projects can positively impact financial windfalls from investment in renewable energy projects, and how improving municipal bond ratings can benefit counties.

Moody’s Investor Rating Improves from A1 to Aa3

In December 2018, Moody’s upgraded Paulding County’s general obligation unlimited tax (GOULT) debt rating from A1 to Aa3, bringing its rating from upper-medium investment grade to high investment grade. The structure of wind turbine contracts and their long-term reliability create a source of long-term, recurring revenue from PILOT and service fees for the useful life of the wind turbines, estimated at 20-25 years. New economic investments with a long-term stable revenue outlook allow local governments to demonstrate to bond analysts that new investments in quality of life can come without raising taxes, borrowing, or depleting cash reserves.

Municipal bonds (munis) receive upgrades to their ratings typically as a result of mainstay economic factors, three of which are the focus of Paulding County’s muni ratings.

These are:

- Steady growth in its tax base while not increasing general debt obligations or raising millage rates affecting property taxes,

- Upgrades to school district ratings,

- Increases in employment.

In Paulding County, 47% of taxable economic activity is through agricultural production that had remained a steady taxable base until 2012, during the first development of wind turbines in the county. Previous to these installations, Paulding County had limited means of stimulating economic growth without increasing its general debt obligations as well, due to constrained agricultural and manufacturing expansion in the local economy.

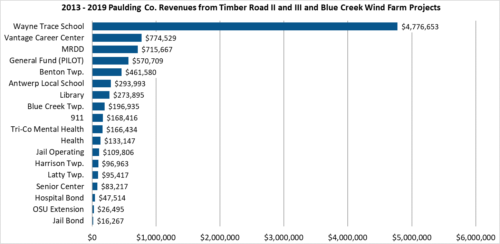

The turbines carry Payments in Lieu of Taxes (PILOTs) to the municipality based on megawatts (MW) produced per project. In 2013, Paulding County started receiving an influx of payments, averaging around $750,000 per year. In 2018, this amount rose to $950,000. To date, the local municipality has received close to $10 million in PILOT and service fee payments from Timber Roads II and III and the Blue Creek Wind Farm.

Improvements in the Wayne Trace School District

While the PILOT payments benefitted 18 different municipality services, including the library, a local mental health facility, 911 emergency services, and more, the bulk of these payments went directly to Paulding County’s primary school district, Wayne Trace. These payments were distributed similarly to the way in which property taxes are distributed in Ohio and have contributed to improved school district performance. There have been multiple signs of such improvements. The school district has:

- invested in building renovations, a new all-weather track and is seeking approval for new bleachers for the football field, which had never previously been compliant with the Americans with Disabilities Act (ADA).

- invested in specials needs teachers and teaching assistants, 18 in total, which has upgraded the special needs program at the Wayne Trace School District from an F rating to an A rating, according to the state-published school report card (see component grade).

- added teachers, classroom aides, tutoring, elementary guidance, and technology coordinator positions districtwide.

- improved the student:teacher ratio districtwide and were able to offer more attractive and competitive benefits packages to school employees.

- hired a full-time Drug Abuse Resistance Education (DARE) officer for the school district establishing a critical presence in the state’s response to the opioid crisis.

Wind Energy Investment Spurs Employment

Investment in wind energy across Paulding County spurred economic development throughout the community. In addition to the new positions in the Wayne Trace School District as a direct result of the PILOTs contributions and the presence of construction and maintenance workers ̶ many of them Ohioans ̶ at the turbine sites, a new restaurant has opened, a ready-mix cement plant began operations, the Paulding County courthouse increased staffing from 3 days per week to 5 days per week, and residents earned extra income by renting out rooms to temporary wind site workers.

The many economic opportunities experienced in Paulding County highlight the power of distributed, diffuse community benefits that can be generated through renewable energy investment.

Carolyn Pincus and Brian Liechti are graduate students of Bard’s MBA in Sustainability program.

Related items

IEEFA update: Unmistakable trends in American wind and solar