Wind in the Wires, and More on the Way

Wind power is a rapidly growing source of electricity in the U.S., doubling its share of generation in just five years, to 4.9 percent in 2015. The declining cost of wind power, along with cheap natural gas, has put tremendous financial pressure on both coal-fired and nuclear power plants, and is changing the mix of fuels used for generation at regional and state levels.

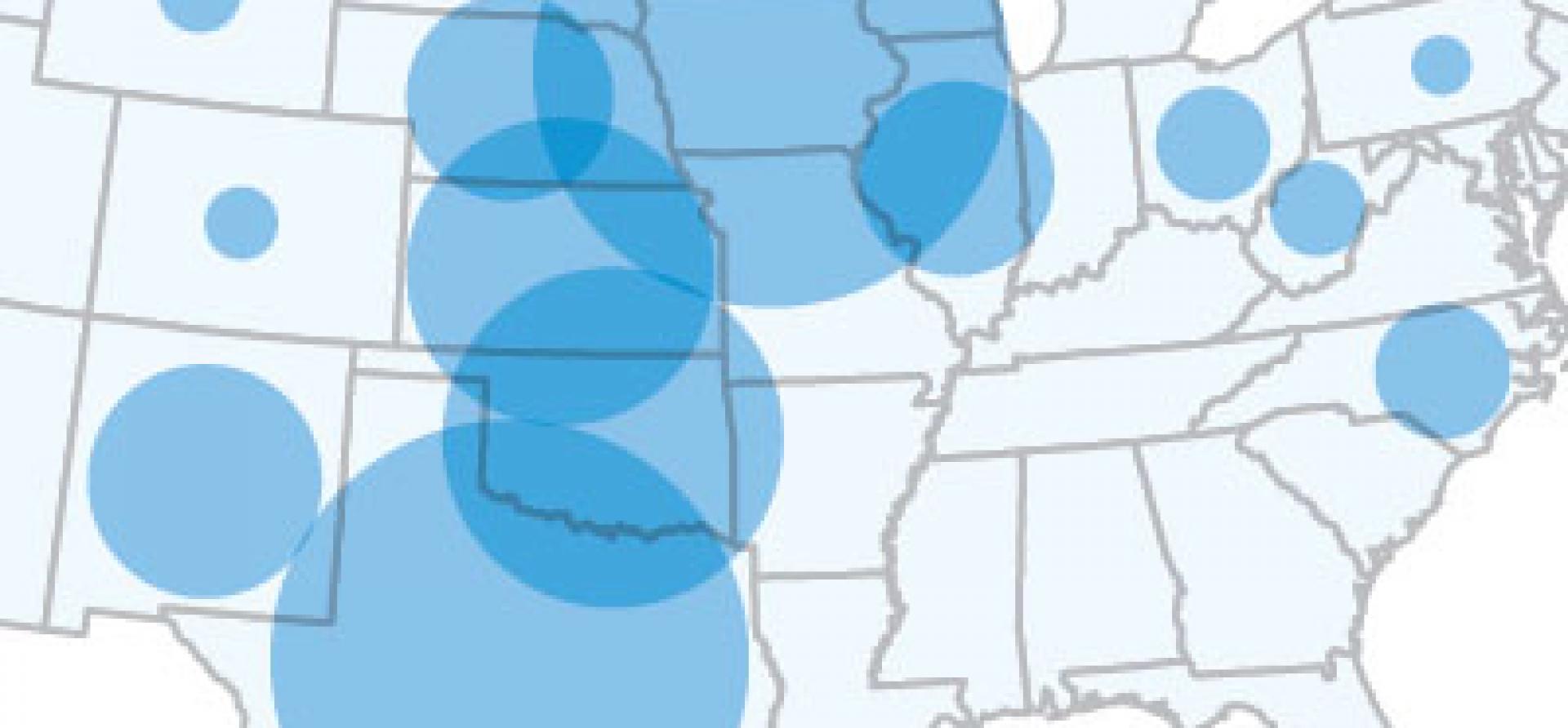

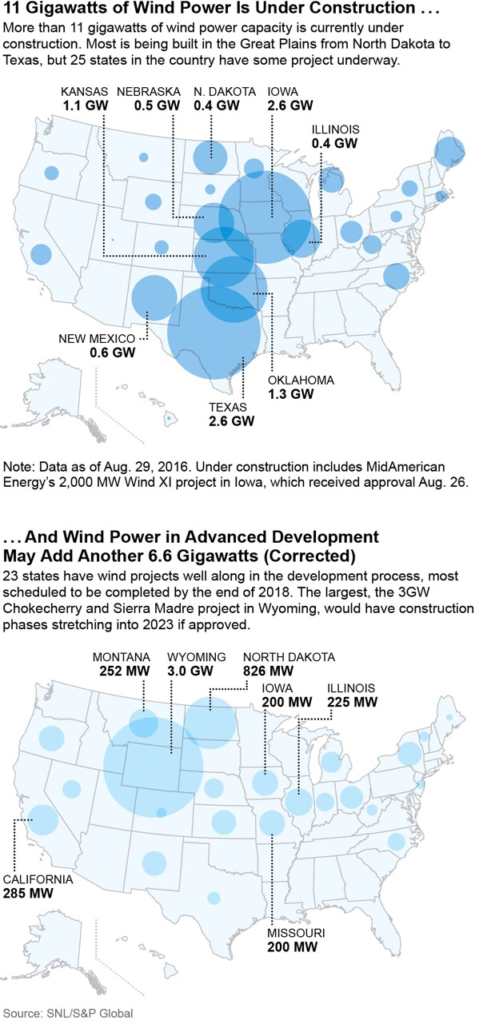

That trend is set to continue, with installed wind capacity growing 24 percent over the next few years, according to an analysis of electric power projects that are under construction or in advanced development. The data, maintained by SNL/S&P Global, shows that more than 11 gigawatts are currently under construction, with another 6.6 gigawatts well along in the development process. Installed wind power capacity was about 75 gigawatts in mid-2016, according to the American Wind Energy Association.

SNL/S&P Global defines “advanced development” as projects reaching at least two of five thresholds: necessary permits obtained; financing obtained; power-purchase agreement signed; an engineering, procurement, and construction (EPC) contractor signed; and turbines secured. Projects “under construction” are defined as having moved beyond site preparation and broken ground. The one exception to this is the inclusion of MidAmerican Energy’s 2 gigawatt, $3.6 billion Wind XI project as “under construction,” following final approval by the Iowa Utilities Board in late August, as ground-breaking could happen relatively soon for some locations that are set to come online in 2017.

The development of wind has been highly regional. Nearly two-thirds of the current U.S. capacity is in the Great Plains corridor, stretching from North Dakota to Texas and from Wyoming to Iowa. Texas alone, with 18 gigawatts, accounts for nearly a quarter of the total.

The data suggests this regional dominance will continue. Just six of those Plains states have over 8 gigawatts already under construction. Texas will continue to extend its leadership in wind power, completing most of the 2.6 gigawatts under construction there by next March. And the largest project in advanced development, by far, is in Wyoming, where the three gigawatt, 1,000-turbine Chokecherry and Sierra Madre Wind Energy farm is planned, to be built in phases stretching through 2023.

DEVELOPMENT IS HAPPENING MORE BROADLY ACROSS THE COUNTRY: 30 STATES HAVE GRID-CONNECTED WIND POWER PROJECTS either under construction today or in advanced development. Besides the plains, two other regions have invested substantially in wind. On the West Coast, California is slated to add over 400 megawatts and Oregon, over 250 megawatts. The other area, a band of north-central industrial states, are also set to add significant capacity. Together, Illinois, Indiana, Michigan, Ohio, Pennsylvania and New York have 900 megawatts under construction and another 785 in advanced development.

Today, 10 southern states from Louisiana to Florida and north to Virginia have no installed wind capacity, according to the American Wind Energy Association (AWEA). Only North Carolina, with 208 megawatts being built and 92 in advance planning, is likely to differentiate itself from that group in the foreseeable future (the state’s commitment to renewables also extends to solar, with over 2.6 gigawatts in advanced planning).

It is clear that the building boom in wind is set to continue well into the next decade. The enormous expansion in capacity in the Plains will go on, but projects are broadening out to include major additions across the industrial heartland into upstate New York.

Seth Feaster is an IEEFA data analyst.

RELATED POSTS:

IEEFA New England: Stirrings of Offshore Wind Development in the Northeast U.S.