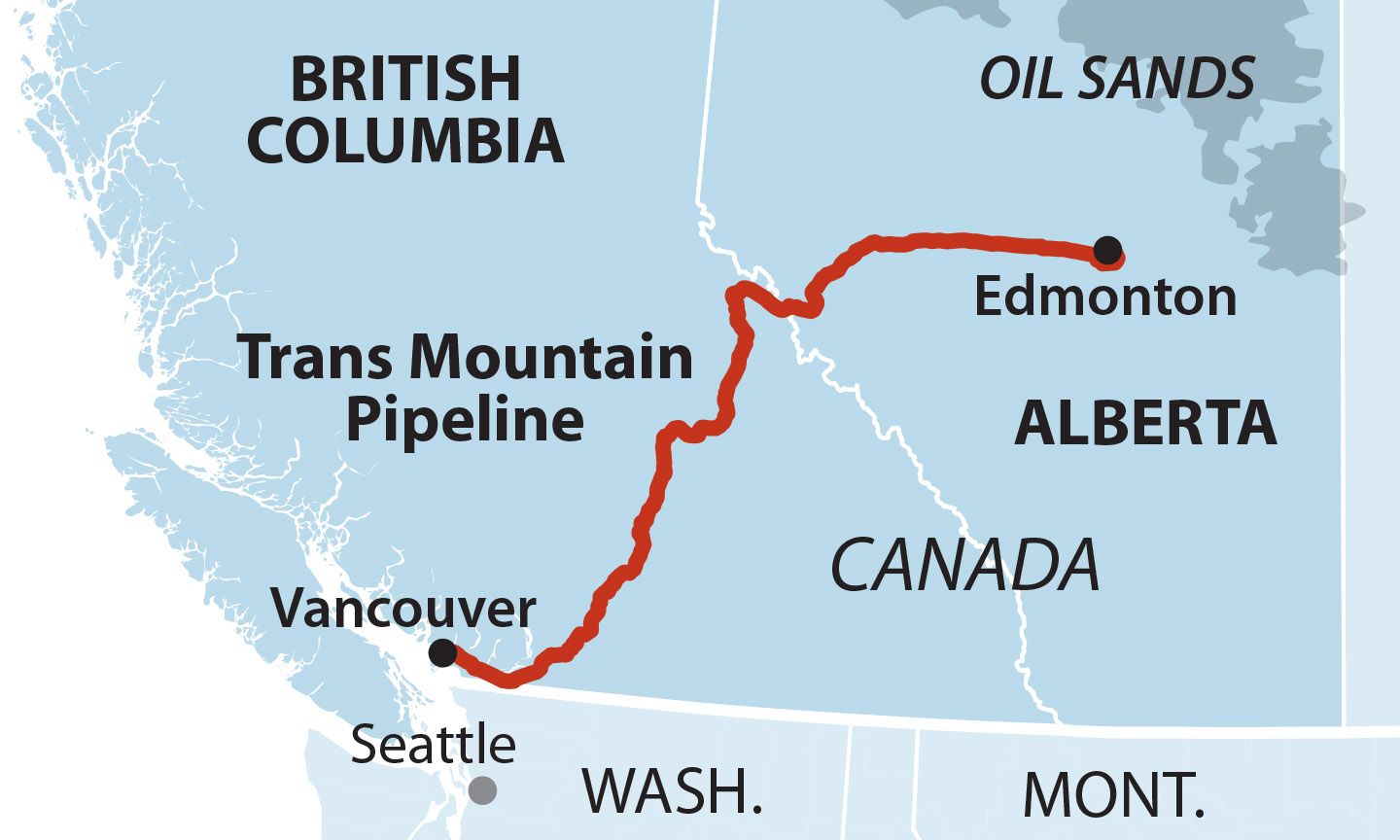

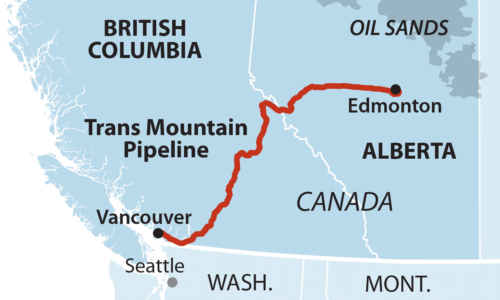

IEEFA report: ‘Canada’s Folly’ could drive national budget deficit 36% higher while ensuring Houston-based Kinder Morgan a 637% gain

June 26, 2018 (IEEFA)— Canada could see its budget deficit grow by more than a third with the national government’s purchase of the Trans Mountain Pipeline from Houston-based Kinder Morgan, according to a report published today by the Institute for Energy Economics and Financial Analysis.

The report —“Canada’s Folly: Government Purchase of Trans Mountain Pipeline Risks an Increase in National Budget Deficit by 36%, Ensures a 637% Gain by Kinder Morgan”— describes various fiscal and financial risks attached to the acquisition, which was announced in late May.

Among them: the probability that the government is facing at least C$11.6 billion in project-completion costs for a pipeline system that had stalled under Kinder Morgan for lack of market and political support.

“Canada is weakening its finances by taking on unlimited costs to buy an unneeded pipeline with an uncertain future and giving an unusual profit to a U.S. company,” said Tom Sanzillo, IEEFA’s director of finance and the former first deputy comptroller for New York State.

“Even though the government plans to sell the pipeline, such a deal would likely come at a loss given the unusual guarantees promised future buyers, weak market conditions, and the likelihood that the Canadian government would be selling the project under distressed conditions.”

‘Every indication that the Canadian government has bought the pipeline at a high price and is likely to resell it for far less than it will pay to build it.’

Excerpts from the report:

- “This transaction and the cost of further planning and construction could add a C$6.5 billion unplanned expenditure to Canada’s budget during FY 2019. This would increase Canada’s projected deficit of C$18.1 billion by 36%, to C$24.6 billion.”

- “The transaction risks an increase in Canada’s annual deficit in FY 2020, too, reversing a deficit reduction trend that supports Canada’s strong recovery, sound fiscal position and excellent credit rating.”

- “Kinder Morgan Inc. and its Canadian subsidiary, Kinder Morgan Canada Limited, will share a profit of C$3.89 billion from the sale of the pipeline to the Canadian government. IEEFA estimates that the return on outlay will total 637%.”

- “Kinder Morgan Canada Limited has identified C$1.1 billion in Trans Mountain pipeline project expenditures to date. IEEFA estimates, however, that the outlay by Kinder Morgan Inc. and its Canadian subsidiary has been approximately C$610 million.”

- “To date, both Kinder Morgan and the Canadian government have made only limited disclosures regarding the transaction. The August closing date leaves time open for further review.”

Sanzillo said the Canadian government owes its public a full explanation as to why it is buying the project, who benefits and how the price and other details of the deal were set.

“All of documents should be publicly disclosed now,” said Sanzillo. “There is every indication that the Canadian government has bought the pipeline at a high price and is likely to resell it for far less than it will pay to build it.”

“The Canadian government is taking open-ended responsibility to absorb all costs and ensure profits for any potential new owner of the pipeline. As a result, long-term cost increases for taxpayers are effectively uncapped, posing a significant, unquantifiable liability.”

The Trans Mountain Pipeline was meant to transport oil-sands reserves from central Alberta to West Coast ports but has proven financially and politically unviable.

Media contact:

Karl Cates [email protected] 917-439-8225 or

Sandy Buchanan [email protected] 216-688-3433

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.