IEEFA Report: Advances in Solar Energy Accelerate Global Shift in Electricity Generation

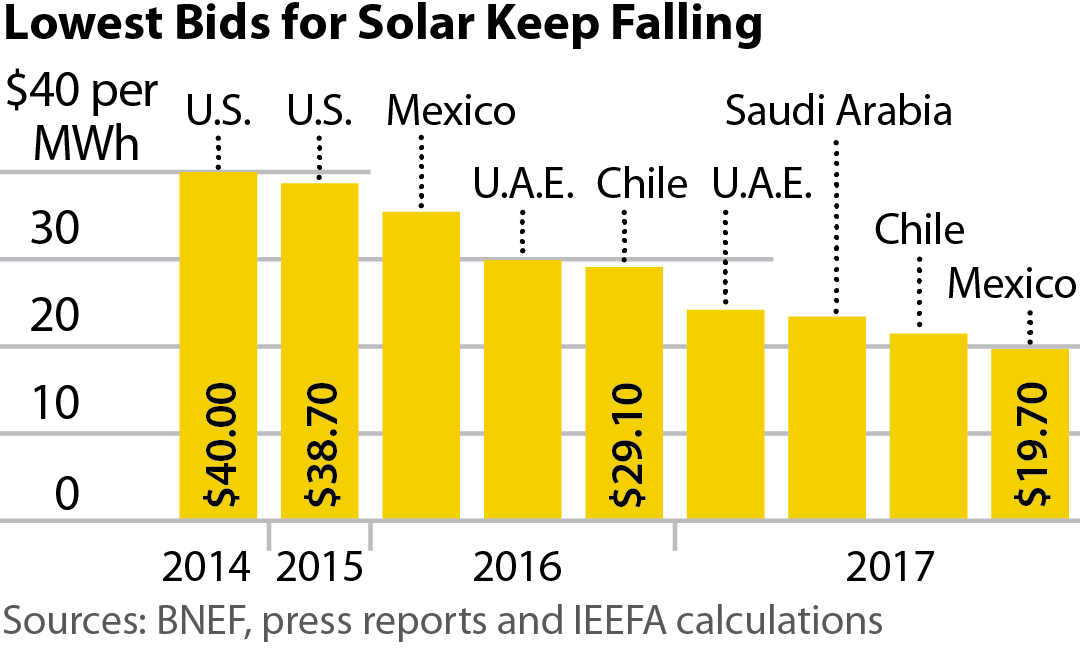

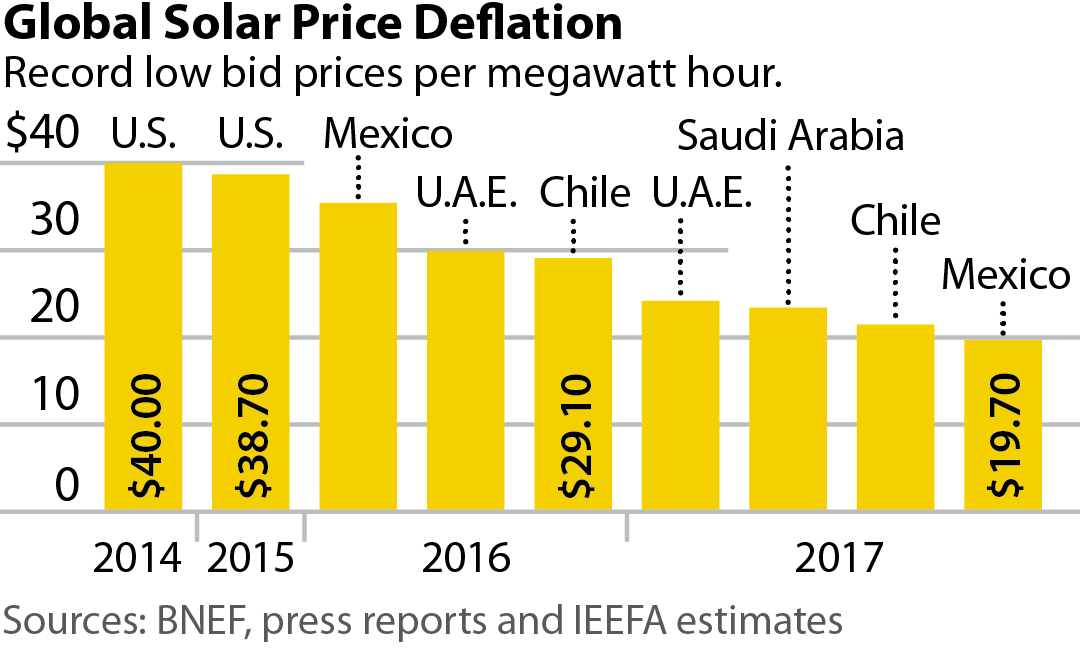

May 21, 2018 (IEEFA.org) – A report published today by the Institute for Energy Economics and Financial Analysis describes how solar energy is accelerating the transformation of the global electricity-generation sector through gains in technology innovation and price deflation.

The study—“Solar Is Driving a Global Shift in Energy Markets”—details some of the world’s biggest utility-scale and concentrated-solar-power (CSP) projects. It documents prime examples of large rooftop-solar expansions, floating-solar developments, and solar-with-battery-storage projects. It includes an overview of corporate renewable power purchase deals and a rundown of utilities that have taken a critical lead on the renewable energy front.

“Solar has finally come of age, as can be seen in the many rapid project developments across various technologies and in a broad array of business models,” said Tim Buckley, lead author of the report and IEEFA’s director of energy finance studies, Australasia. “These advances are occurring alongside gains in storage, wind, hydroelectricity and energy efficiency.”

“Global energy markets are changing, and fast.”

The report acknowledges recent research by Bloomberg New Energy Finance that puts total global solar installations in 2017 at 98 gigawatts (GW), a 31% increase over 2016. It notes that China was responsible for over half (53 GW) of that total, and that India installed 10 GW of solar in 2017, almost double its record in 2016. Crucially, India’s “Scheme for Development of Solar Parks” has proven successful at attracting foreign capital toward construction of the world’s largest ultra-mega solar parks.

“India and China are hardly alone, however, as electricity markets elsewhere accelerate their uptake of solar,” Buckley said. “Saudi Arabia’s latest announcement of its intentions to develop 200 GW of solar by 2030 through investments from Japanese tech giant Softbank is a great example of the scale at which solar power is likely to expand in the coming years.”

The report delineates important trends in corporate renewable Power Purchase Agreements (PPAs) in which tech giants like Amazon, Microsoft and Apple are relying more on solar and wind-energy plants and on rooftop solar capacities on their own facilities.

Manufacturing and logistics companies, airports, railways, and universities are following similar paths.

“As major corporations sign on to such deals, they continue to look to ‘green’ their entire supply chains, many of which sit in emerging markets,” Buckley said. “This activity helps expand access to international capital markets, which historically has been a key constraint.”

Buckley said that as countries grapple with ever-higher shares of variable renewable energy generation, demand for system balancing will require a multitude of technology solutions including improved international grid connectivity, better demand-response management, and more pumped hydro and battery storage. CSP technology, solar-wind hybrid generation, and solar-with-storage have become increasingly valuable for their ability to ensure solar reliability. India, in particular, is exploring a number of innovative initiatives in these areas to build capacity and “learning by doing.”

The report highlights a number of recent milestones:

- A 1,547-MW project at Tengger, China, setting the record for largest operational solar project.

- India’s push for development of “Industrial Solar Parks” driving construction on a number of the world’s largest utility-scale projects, including the nearly complete 2,225 MW Bhadla solar industrial park in Rajasthan and the State of Gujarat looking to beat that with an April 2018 announcement of intentions to build a 5,000 MW project.

- A step-change in the commercially deployed cost of CSP, with SolarReserve, the leading developer of such technology, establishing a pipeline of mega projects in the U.S., China, Australia, South Africa and Chile.

- Commissioning of the largest operational floating solar project (40 MW), in the Anhui district of China, amid signs of even larger floating solar plants to come as India, Japan, Indonesia, South Korea, Vietnam, and England take advantage of a model that maximises usage of dam reservoirs, wastewater-treatment facilities, fish farms and collapsed coal mines.

- Global residential plus commercial & industrial (C&I) rooftop solar installations totaling 28 GW in 2017, up 27% year on year from 22 GW in 2016.

- A record number of corporate PPAs, of which more and more are built around solar.

The report emphasises the role governments can play in expanding renewable electricity-generation momentum by constructively managing trade protectionism, domestic solar-module manufacturing, and transmission networks.

Full report: Solar Is Driving a Global Shift in Energy Markets

Contacts:

Tim Buckley, Australia [email protected] +61 408 102 127

Media – James Lorenz [email protected] +61 400 376 021

Media U.S. – Sandy Buchanan, [email protected], +1 216-688-3433

About IEEFA: The Cleveland-based Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

Tim Buckley, Director of Energy Finance Studies at IEEFA, based in Sydney, Australia, has 30 years of financial markets experience, including 17 years with Citigroup culminating in his role as Managing Director, Head of Australasian Equity Research. Tim has written broadly on the China and India’s energy transformation and the resulting stranded asset risks for thermal coal-exposed projects.