IEEFA Exxon: Questions, More Questions

Much will be written this week about the oil industry’s abandonment of key reserves in its oil sands holdings.

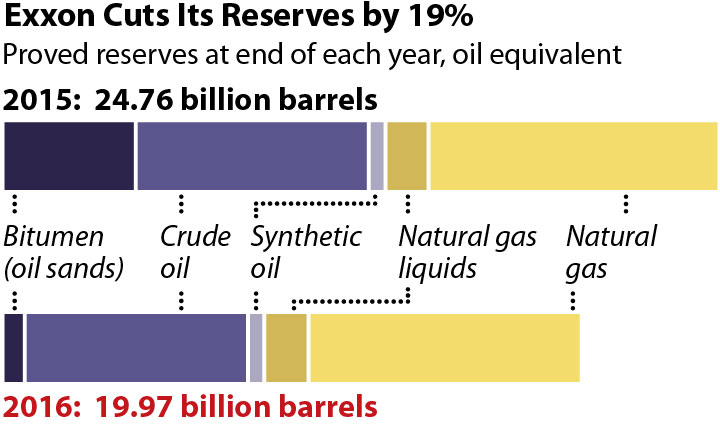

ExxonMobil is suddenly smaller than it was. So is Canada’s energy industry, and so are world oil markets. All said, the oil industry, globally speaking, has recently now lost about 10 percent of its proven and probable reserves.

This phenomenon is on vivid display in ExxonMobil’s acknowledgement that its total proven and probable oil reserves in 2015, 24.8 billion barrels, had shrunk by the end of 2016 by 19 percent, to 19.9 billion barrels.

Most of this reserve loss comes from the company’s oil sands holdings in Canada. We see a reduction there of 3.8 billion barrels.

Exxon’s write-down comes after similar actions by a long list of other companies over the past two years, most notably Royal Dutch Shell, Marathon, Petro China and Statoil.

While oil prices are the problem, they’re also a symptom—and they aren’t occurring in a vacuum.

First, the industry is seeing more and more competition from alternative sources of energy.

Second, many countries formerly dependent on the effective monopoly of oil companies have developed new strategies to protect national interests and to lower their exposure to oil market volatility.

Third, the impact of the Paris Agreement on climate change is unfolding as new energy policies work their way through state halls, investment banks, institutional investment firms, and international financial institutions.

It’s worth noting as well that the industry seems to have lost its ability to effectively manage prices. While it has recently marshaled a production cut, that cut produced only minor price gains, and those can only be sustained by further cuts.

PAGE 7 OF EXXON’S 10K FILING YESTERDAY IS WORTH A HARD LOOK as investors consider the future of the company—and the future of the oil industry, for that matter.

It says: “One of ExxonMobil’s requirements for reporting proved reserves is that management has made significant funding commitments toward the development of the reserves.”

Are we to assume, then, that if the company makes a “significant funding commitment” that those reserves will be developed?

It seems investors are being asked to accept that the company includes in its reserve calculations large amounts of oil that it will “develop” but not actually produce—which is to say these investments will not become revenue-generating assets.

And while Exxon executives make mollifying presentations on new exploration finds in Guyana, no dollar figure has yet been announced around these new assets. Investors can be forgiven if they view such disclosures will skepticism.

What ExxonMobil is leaving unsaid is what its turnaround plans are—assuming it has some. Its problems go to the fundamentals of the entire oil business, which is showing weak returns and exhibiting all the signs of a mature and declining sector—and one with a most decidedly negative outlook.

If ExxonMobil has a tradition of a departing chief executive leaving a letter on the desk for his replacement, we imagine the one from recently former CEO Rex Tillerson to Darren Woods might’ve consisted of one word: “Oops.”

Tom Sanzillo is IEEFA’s director of finances.

RELATED POSTS:

IEEFA Exxon: A Company in Need of More Accountability at the Top