IEEFA Europe: German lignite shows signs of stress from rising European carbon prices

LONDON — Germany’s dirtiest coal-fired power plants are showing signs of stress in response to an aggressive and sustained rise in European carbon prices, with the utility EnBW stating this week that its Lippendorf power plant unit is not economic at present power, fuel and emissions prices.

Lignite, a soft, brown form of coal, is the highest carbon-emitting source of power generation, but historically also one of the cheapest, as these power plants are located at the mine-mouth, usually allowing lower generation costs than power plants that burn imported hard coal.

However, European carbon prices have risen more than 63 percent in the past 12 months as a result of carbon market reforms intended to remove a glut of permits, increasing generation costs for coal-fired power plants, and lignite in particular. At the same time, German baseload power prices have fallen. That divergence reflects a number of factors, including the level of generating capacity in Germany, and falling gas prices.

The result has been falling margins for coal, and lignite in particular as the highest-carbon emitting source of power.

EnBW told S&P Global Platts this week that its Lippendorf unit had been in “standstill” since June 15 and may continue to be for a “longer time” as a result of market pressures, specifically carbon and power prices, as well as operating and fuel supply costs.

EnBW’s decision at Lippendorf may be a sign of things to come for Germany’s lignite power plants

It is too early to say lignite is about to suffer in general in Germany. Unlike most lignite power plant operators, EnBW does not have its own access to lignite, and so has less control over fuel prices. EnBW shares Lippendorf with LEAG, owned by the Czech energy firm, EPH. LEAG and EnBW each own one unit at Lippendorf. LEAG owns several lignite mines, and its Lippendorf unit continues to operate.

And there are other nuances: some lignite power plants have heating and other fuel supply contracts that might offset the deteriorating economics of electricity generation. And more modern, flexible lignite units have more scope to earn additional, potentially very lucrative revenues in Germany’s balancing mechanism, which has recently seen occasionally exorbitant prices for contracts to match demand shortfalls in real time.

Nevertheless, the EnBW statement, coupled with the recent divergence in carbon and German power prices is a cause for concern.

FOR ITS PART, EPH HAS FOLLOWED A BUSINESS MODEL OF ACQUIRING CHEAP COAL PLANTS ACROSS EUROPE, aiming to cash in on the increasing reluctance among some utilities to own and operate these highly polluting assets. EPH has no qualms about running such power plants for as long as possible.

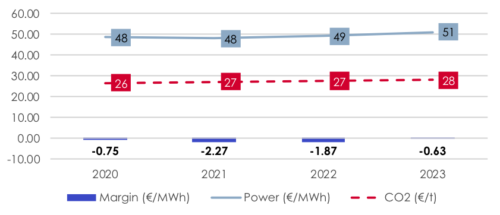

A straightforward view of the forward curve for German baseload power and carbon shows how lignite margins are now looking more vulnerable.

German utility RWE last year stated that its lignite power plants have full operating costs, excluding carbon, of €22 per megawatt hour (MWh), which we can assume is broadly representative of lignite in Germany.

More efficient lignite power plants emit about 1 tonne of carbon dioxide per MWh, implying carbon costs of €26/MWh at present carbon prices, and therefore full operating costs of €48/MWh, using the RWE estimate. Such costs are far greater than monthly German baseload power prices for August delivery, of €38/MWh, and are on the same level as the benchmark annual Cal-20 baseload contract, presently trading at €48/MWh.

The chart below illustrates the impact on lignite margins of forward prices for carbon and annual German baseload power, assuming a €22/MWh operating cost rising with inflation. The chart indicates zero profitability on wholesale generation sales going forward.

Such deteriorating lignite economics should draw the attention of German policymakers, presently considering compensating utilities for the mandated closure of lignite power plants to cut carbon emissions. Compensation will clearly be inappropriate if the power plants are already uneconomic.

And we should remember that in this discussion we have only referred to operating costs, excluding maintenance outages and one-off upgrade costs. The latter are relevant to German lignite power plants, some of which far exceed new oxides of sulphur (SOX) emissions limits, which apply from 2021, and which will require expensive retrofits.

Illustrative impact on German lignite generation margins of present forward

price curve (2020-23) for baseload power and carbon

Gerard Wynn ([email protected]) is an IEEFA finance consultant.

Related articles:

IEEFA update: European utilities at risk from Credit Agricole’s new 2030 coal exit stance

IEEFA Germany: RWE’s coal phaseout compensation demands defy market prices