China

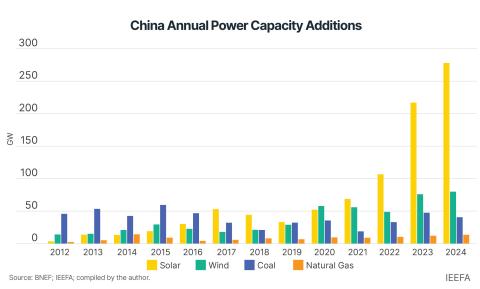

China is a unique and important player in the global decarbonization effort as the largest consumer of energy, source of greenhouse gas emissions, and both producer of and investor in clean energy capacity. The country is engaged in some of the largest and most extensive efforts to promote the transition to clean energy including storage, long-distance transmission, green energy finance, carbon pricing, distributed solar, and electric vehicles. Chinese efforts across the board will be important to monitor, as their scale and investment could provide new technologies and innovations that could be exportable to the rest of the world.

Latest China Research

See more >

Insights from China's current LNG trucking boom

June 10, 2025

Christopher Doleman

Fact Sheet

Mapping coal phaseouts in key Asian markets

June 02, 2025

Ghee Peh

Insights

Heavy trucking unlikely to materially increase China's LNG imports

May 08, 2025

Christopher Doleman

Report

Understanding the competitive landscape for China’s LNG market

April 10, 2025

Sam Reynolds

Briefing Note

Pakistan must rebuild Chinese investor confidence in its energy transition

March 05, 2025

Haneea Isaad, Mustafa Hyder Sayed

Insights

Canadian LNG will not boost Japan’s energy security or Asia’s decarbonization

October 08, 2024

Sam Reynolds, Christopher Doleman

Insights

Petrochemicals: Rising signs of a secular decline?

September 30, 2024

Tom Sanzillo, Suzanne Mattei, Abhishek Sinha...

Briefing Note

NSW coalmine approvals out of step

September 27, 2024

Andrew Gorringe

Insights

China’s falling iron ore demand is only half the story

September 12, 2024

Simon Nicholas

Insights

Energizing sustainable bond markets in Asia

August 30, 2024

Shu Xuan Tan, Ramnath N. Iyer

Briefing Note

LNG is not displacing coal in China's power mix

June 25, 2024

Sam Reynolds, Christopher Doleman, Ghee Peh...

Report

Fact Sheet: LNG is not a "bridge fuel" in China’s transition from coal to renewables

June 25, 2024

Sam Reynolds, Christopher Doleman, Ghee Peh...

Fact Sheet

Latest China Reports

See more >

Heavy trucking unlikely to materially increase China's LNG imports

May 08, 2025

Christopher Doleman

Report

LNG is not displacing coal in China's power mix

June 25, 2024

Sam Reynolds, Christopher Doleman, Ghee Peh...

Report

Carbon pricing: Governments increasingly make polluters pay for climate change

May 30, 2024

Andrew Reid

Report

Asia-Pacific lags global oil and gas industry in shift from carbon

June 01, 2023

Christina Ng, Gaurav Ahuja, Cameron Fairlie...

Report

European Pressurized Reactors (EPRs): Next-generation design suffers from old problems

February 02, 2023

Frank Bass

Report

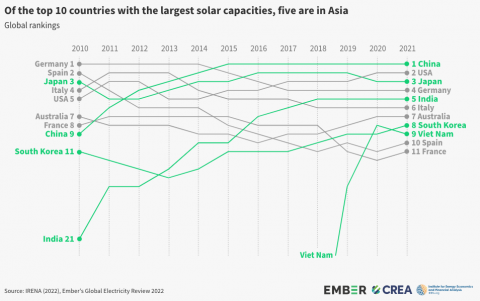

The sunny side of Asia

November 10, 2022

Norman Waite, Centre for Research on Energy and Clean Air (CREA), EMBER...

Report

Chinese offshore wind goes global

September 05, 2022

Norman Waite

Report

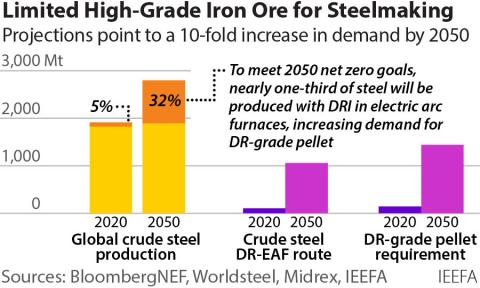

Iron ore quality a potential headwind to green steelmaking – Technology and mining options are available to hit net-zero steel targets

June 28, 2022

Simon Nicholas, Soroush Basirat

Report

Central banking and climate action – China steers credit to decarbonize

March 01, 2022

Norman Waite

Report

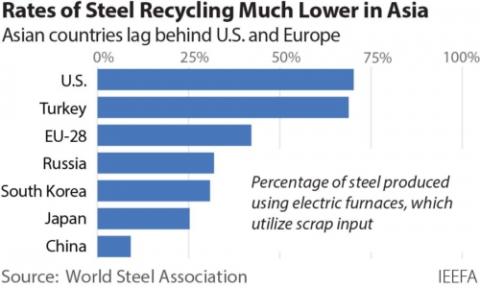

New from Old: The Global Potential for More Scrap Steel Recycling

December 01, 2021

Simon Nicholas

Report

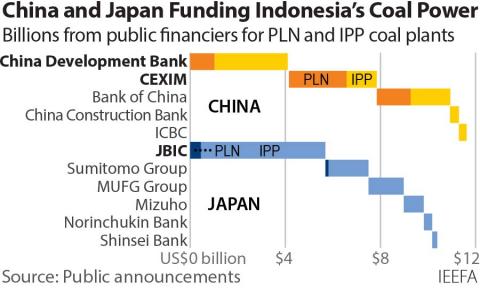

Indonesia Wants to go Greener but PLN is Stuck with Excess Capacity from Coal-Fired Power Plants

November 01, 2021

Elrika Hamdi, Putra Adhiguna

Report

Why external review of price-setting mechanism for plastic resins is warranted

October 01, 2021

Tom Sanzillo, Suzanne Mattei

Report

Guyana's tax giveaway: Guyana pays ExxonMobil, Hess and CNOOC's annual income taxes

September 28, 2021

Tom Sanzillo

Report

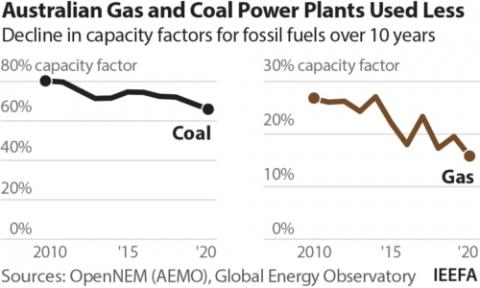

Australia's gas-fired recovery under scrutiny

June 24, 2021

Bruce Robertson, Milad Mousavian

Report

Carbon neutral bonds: has China set the bar too low?

June 01, 2021

Christina Ng

Report

Latest China Press Releases

See more >

China’s LNG trucking boom unlikely to pull LNG cargoes off the global market

May 08, 2025

Press Release

LNG is not displacing coal in China’s transition to renewable power

June 25, 2024

Press Release

APAC oil and gas firms risk financing challenges as they trail global peers in diversification

June 01, 2023

Press Release

European Pressurized Reactors: Nuclear power’s latest costly and delayed disappointments

February 02, 2023

Press Release

Solar generation helped avoid billions in costs for seven Asian countries

November 10, 2022

Press Release

China’s offshore wind industry giant stimulates global growth

September 05, 2022

Press Release

More high grade iron ore needed to accelerate steel decarbonisation

June 28, 2022

Press Release

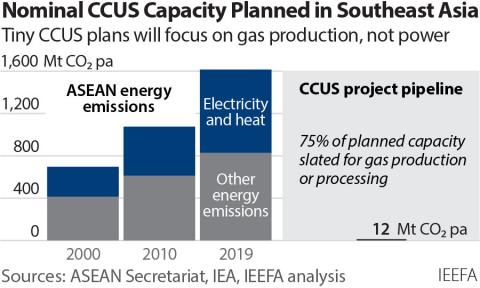

Widespread adoption of carbon capture, utilization and storage technologies in South East Asia remains highly unlikely

April 26, 2022

Press Release

China’s central bank is leading the way with bold green finance policies

March 31, 2022

Press Release

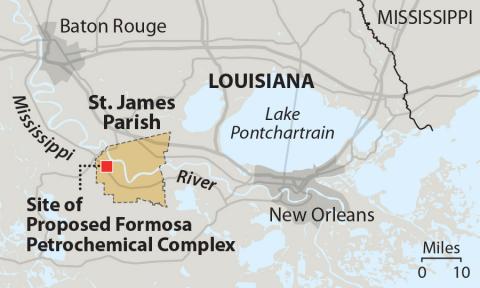

Problems have mounted over last year for proposed Formosa petrochemical plant

March 24, 2022

Press Release

IEEFA Europe: Zeebrugge terminal serves as hub for transport of Russian gas to non-European markets

March 21, 2022

Press Release

IEEFA: La expansión del gas de New Fortress Energy presenta mayores riesgos para los inversores

February 23, 2022

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.