Australia & Pacific

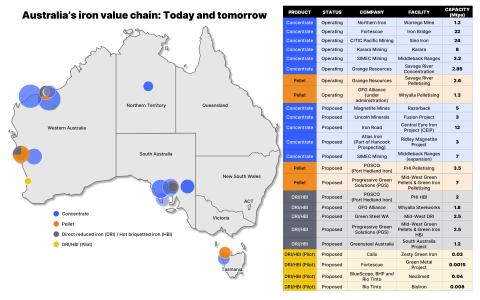

Australia is the largest exporter of metallurgical coal, the second largest exporter of thermal coal and one of the top three LNG exporters in the world. The vast majority of its fossil fuels exports go to Asia. Australia is also the world’s largest iron ore producer, and exports large volumes of other metal ores and rare earth elements.

Australia is fast transitioning away from a coal-dominated electricity system, with nearly 40% of electricity now coming from renewables. In particular, Australia has the highest per-capita uptake of rooftop solar globally.

Australia could combine its vast mineral resources with world-leading renewable advantages to become a renewable energy superpower, for example as a leading producer of green iron. IEEFA’s research covers both export and domestic energy markets in Australia and some areas of the Pacific.

Subscribe to the IEEFA Australia newsletter here and follow our IEEFA Australia page on LinkedIn.

Our Research Covers

Australian Electricity

Australia is nearly half-way to its 82% renewable energy target by 2030. Acceleration in renewable energy build-out is required to ensure that Australia can meet its target, and effective policies are needed to keep electricity bills as low as possible for consumers. Distributed energy resources – such as solar and battery systems – and flexible, efficient electrification can lower bills for households as well as reducing costs in the electricity system. In contrast, extensions to the life of coal power stations, proposals to deploy nuclear generation, and networks’ continued supernormal profits could increase costs for Australian consumers.

Areas we cover

- Distributed energy resources (such as rooftop solar and batteries)

- Efficient and flexible household electrification • Nuclear energy

- Coal and gas generation

- Renewable energy

- Energy networks’ supernormal profits

Australian Gas and LNG

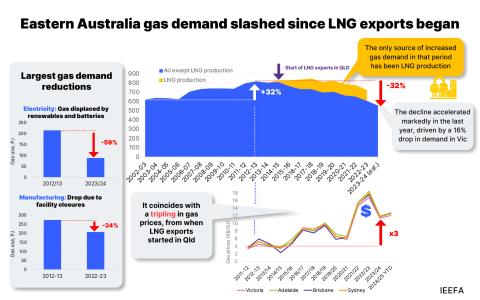

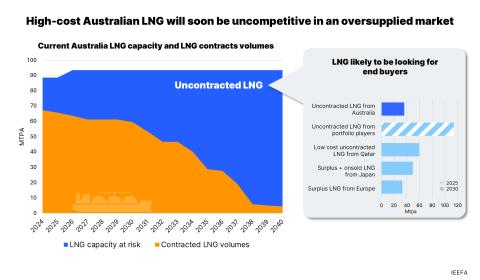

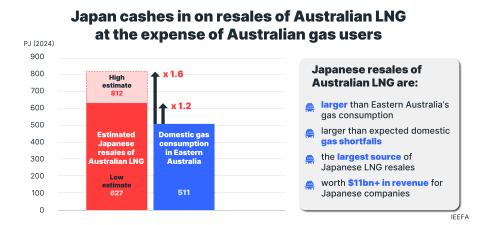

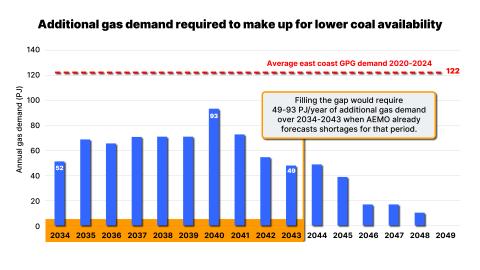

Australia is one of the largest exporters of liquefied natural gas (LNG) in the world. However, the industry faces headwinds as the world enters a period of large LNG oversupply in the coming years, compounded by Australian LNG’s relatively high cost of production. On the domestic front, Australia is now facing gas shortages on both its eastern and western coasts. Gas prices have tripled in eastern Australia since the start of LNG exports in 2015, driving domestic gas demand down. IEEFA has identified opportunities to redirect discretionary LNG exports and accelerate gas demand reduction to alleviate the risk of shortages and reduce costs for consumers.

Areas we cover:

- Global LNG markets and their implications for Australian producers

- Domestic gas demand trends and opportunities for gas demand reduction

- Carbon capture and storage performance and costs

- Analysis of gas projects

Australian Coal

Australia is the largest exporter of metallurgical coal, and the second largest exporter of thermal coal, mostly to Asian markets. Coal export market trends are shifting fast as the global steel transition accelerates and Asian countries progress on their decarbonisation journeys. Australian coal producers have seen costs of production skyrocket in recent years, amid increasing labour costs, rising prices for key inputs like diesel, and more frequent extreme weather events like floods. Miners are increasingly seeking to expand mine production as the process of applying for and financing greenfield developments becomes more difficult. This has implications for estimating rehabilitation risks and costs, and can result in worsening geological conditions and subsequent operations costs. Growing scrutiny of the methane emissions and water-related risks associated with coal mining operations in Australia are increasingly eroding their social licence to operate.

Areas we cover:

- Thermal coal market trends

- Metallurgical coal market trends

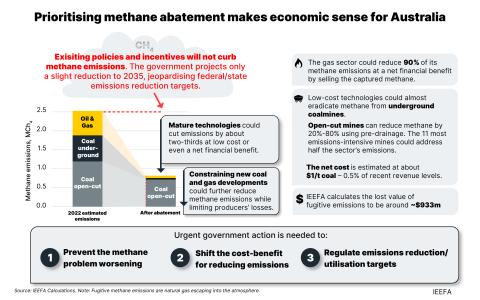

- Coal mine methane emissions

- Mine rehabilitation risks and cost estimations

- Water risks

- Project and company CBA and risk analyses

Australian Industry

Australia is one of the world’s largest resource producers in the world and is home to significant energy-intensive industrial facilities. It has many untapped opportunities to accelerate the shift from fossil fuels to renewable energy in its industrial sector, as well as to reduce its fugitive methane emissions. Australia also has the potential to become a world leader in renewable-powered heavy industry, such as green iron and other green metals, thanks to its vast renewable resources.

Areas we cover:

- Green iron opportunity

- Iron ore market risks and opportunities

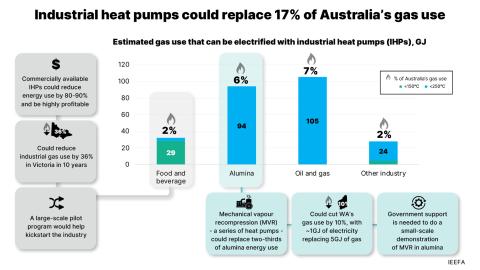

- Industrial gas demand reduction opportunities

- Fugitive methane emissions reductions

- Carbon capture and storage performance and costs

Australian Gas and LNG Tracker

IEEFA’s Australian Gas and LNG Tracker is an interactive data set to visualise Australia's LNG infrastructure, demand and capacity outlook, and export flows.

Prioritising methane abatement makes economic sense

Methane is jeopardising Australia’s emissions reduction targets; it is expected to account for 68%-95% of Australia’s targeted emissions by 2035, 78% of New South Wales’ and even exceed Queensland’s.