In Powder River Basin debut, NTEC stumbles

Download Full Report

View Press Release

Key Findings

As part of the Cloud Peak acquisition process, NTEC is in talks with surety companies to underwrite about $407 million in reclamation and performance bond obligations at the mines in Montana and Wyoming.

NTEC appears to be making a bid to keep the original bonding in place to support its Powder River Basin adventure, a strategy—that if successful—could leave Navajo Nation at the mercy of the surety industry as the company pursues a “blank check” tribal-indemnification policy that would make Navajo Nation the backstop of last resort.

Executive Summary

An abrupt standoff between Montana regulators and the tribally owned company that is buying three coal mines out of bankruptcy in Montana and Wyoming adds to the already long odds against the success of Navajo Transitional Energy Company’s (NTEC) expansion into the Powder River Basin.

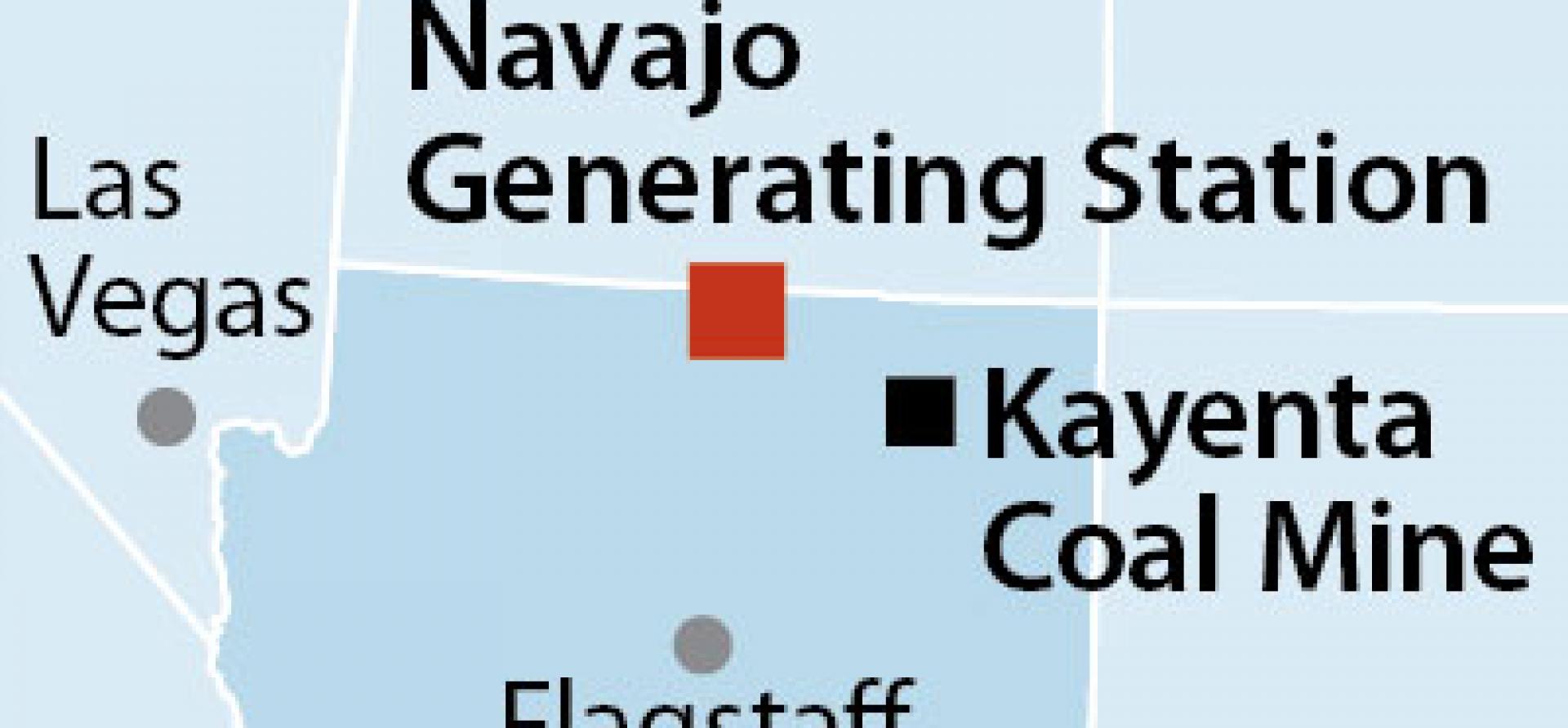

One day after NTEC was announcing this week that it had completed its acquisition of Cloud Peak Energy assets in the Powder River Basin (PRB), the Montana Department of Environmental Quality threw a wrench into the deal by raising questions about tribal-sovereignty issues. NTEC closed Spring Creek Mine on Thursday (Oct. 24), sending workers home and dealing NTEC a setback. Also at issue broadly in NTEC’s PRB acquisition is who will be held ultimately accountable for hundreds of millions of dollars in mine-cleanup costs.

If it is to resolve the latter problem, NTEC will very likely need Navajo Nation government backing, an unlikely possibility considering how the company all but ignored tribal leadership in the run-up to the acquisition, operating without government consultation and in direct conflict with Navajo energy-investment policy.

While NTEC has simultaneously touted its ownership by Navajo Nation as a liability buffer rooted in tribal sovereignty, Montana regulators are rejecting that construct, as well they should.

The Navajo Nation government this week moved wisely to distance itself from NTEC. Elected officials and government lawyers are seeking specifically to shield Navajo Nation finances from the liabilities in question, a strategy clearly in the Nation’s best interest.

NTEC surprised the Navajo government, the sole shareholder in the company, by announcing its intent to commit $200 million this past summer to buy the three PRB mines. The acquisition was approved by bankruptcy court, but serious questions remained unanswered regarding responsibility for some $407 million in reclamation and performance bonding requirements at the mines.

Local press reports this week detail an emerging Navajo government strategy aimed at protecting Navajo Nation on this front by isolating NTEC in a way that will require the company to stand or fall on its own—specifically without tribal indemnification on bonding obligations. The strategy is materializing through legislation before the Navajo Nation Council and in government officials’ concerns on signals from NTEC that its executives intend to use Navajo bonding authorizations created for other purposes years ago to backstop its future cleanup obligations in Montana and Wyoming.

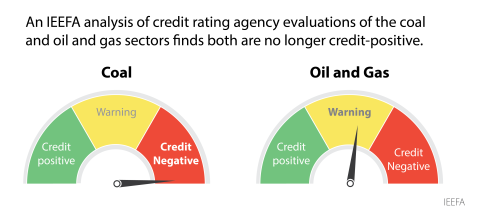

Navajo government officials correctly consider NTEC’s stance an overreach that violates the spirit in which the company was founded in 2013. Meanwhile, the business case for NTEC’s acquisition of the mines continues to deteriorate with the ongoing decline of the U.S. coal industry as utility companies transition to other resources to generate electricity.

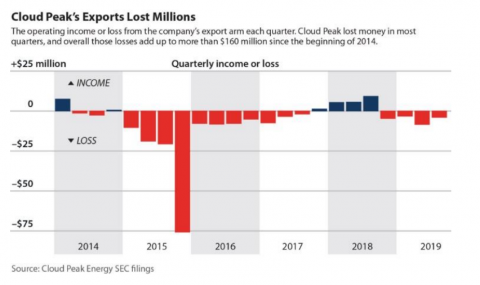

While NTEC has promoted the deal as a shrewd move in a down market, competition in the Powder River Basin has grown increasingly cutthroat and will remain so. The odds favor larger players like Peabody Energy and Arch Coal, which are consolidating their operations in the region in order to gain a competitive edge. NTEC’s contention that exports would be a big component of the deal’s future success is highly questionable, too, as suggested by the chart above.

Because of the core weaknesses in NTEC’s business model, because of the way company executives have comported themselves with tribal leaders and others, and because of unresolved mine-cleanup liabilities, the Navajo Nation would do well to follow through on its plans to distance itself as much as possible from NTEC.

Please view full report PDF for references and sources.

Press release: IEEFA report: Navajo company’s foray into Powder River Basin coal is off to a troubled start